Last updated: July 30, 2025

Introduction

FIBRICOR, a proprietary pharmaceutical formulation, is fundamentally designed to address lipid disorders, primarily hypertriglyceridemia. As a potentially innovative addition to the cardiovascular care market, FIBRICOR's market trajectory hinges upon an evolving landscape marked by regulatory adjustments, clinical efficacy, competitive forces, and broader healthcare trends. This analysis explores the key factors shaping its market dynamics and provides a financial outlook based on current data and industry patterns.

Pharmaceutical Overview of FIBRICOR

FIBRICOR is a fibrate-based oral medication, likely aimed at reducing triglycerides and improving HDL cholesterol levels. Fibrates, including agents such as fenofibrate and gemfibrozil, have historically occupied a niche within lipid management, especially for patients with severe hypertriglyceridemia at risk for pancreatitis or cardiovascular events—conditions with high morbidity and mortality rates. The innovative positioning of FIBRICOR may involve novel formulations, enhanced bioavailability, or targeted delivery, which could influence its market acceptance and pricing strategy.

Market Dynamics Influencing FIBRICOR

1. Growing Cardiovascular Disease Burden

The global burden of cardiovascular diseases (CVD) continues to escalate, driven by lifestyle changes, aging populations, and increasing prevalence of metabolic syndromes. Hypertriglyceridemia is recognized as an independent risk factor for atherosclerosis and pancreatitis, prompting heightened interest in targeted lipid therapies. The World Health Organization estimates that CVD accounts for over 17 million deaths annually, creating a substantial market for lipid-modulating therapeutics (WHO, 2021).

2. Competitive Landscape

FIBRICOR enters a competitive marketplace dominated by several established fibrates, including fenofibrate (Tricor), gemfibrozil, and newer agents like Pemafibrate, which offer improved efficacy and safety profiles. Additionally, statins and PCSK9 inhibitors indirectly influence lipid management strategies, necessitating FIBRICOR to establish distinct clinical benefits or cost advantages to gain market share.

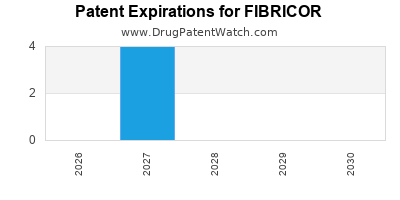

The advent of combination therapies and emerging therapies targeting lipid subfractions further complicates its market positioning. The pharmaceutical industry’s tendency toward innovation, coupled with patent expiration of leading fibrates, offers opportunities for novel entrants like FIBRICOR to acquire market share through differentiation.

3. Regulatory Environment and Approvals

Regulatory pathways profoundly impact commercialization timing and market entry. FIBRICOR’s success depends on securing FDA or EMA approval based on favorable clinical trial results demonstrating superior safety or efficacy profiles. The regulatory landscape is also increasingly scrutinizing cardiovascular outcome data, emphasizing the need for robust Phase III trials.

Regulatory trends favor targeted therapies with clear endpoints, affecting FIBRICOR’s developmental timeline and market entry strategy. Additionally, new regulations encouraging formulary inclusion and reimbursement are critical for commercial success.

4. Pharmacoeconomic Considerations

Healthcare systems globally are emphasizing cost-effectiveness; thus, FIBRICOR's economic value will influence its uptake. If clinical data demonstrate improved outcomes at comparable or lower costs, payers will be more inclined to favor FIBRICOR, boosting sales. Conversely, high pricing without significant added benefit could impede market penetration.

5. Patient and Physician Adoption Dynamics

Physician familiarity with existing fibrates, along with prescriber concerns about side effects—particularly in comorbid populations—are factors influencing adoption. Key differentiators such as improved tolerability, dosing convenience, and demonstrated reduction in cardiovascular events will accelerate market acceptance.

Patient adherence also depends on side effect profiles, dosing frequency, and ease of access, directly impacting FIBRICOR’s financial trajectory.

6. Technological and Innovation Trends

Advances in personalized medicine and lipidomics are guiding targeted therapy selection. FIBRICOR’s ability to integrate into these evolving paradigms through biomarkers or genetic profiling could enhance its market relevance. Moreover, digital health tools supporting adherence and real-time monitoring could serve as additional growth catalysts.

Financial Trajectory and Revenue Predictions

1. Market Size Estimation

The global market for lipid-modulating therapies was valued at approximately USD 12 billion in 2022, with a compound annual growth rate (CAGR) of around 5%. Fibrates accounted for an estimated USD 4 billion of this segment, reflecting both prevalence and therapy penetration. The hypertriglyceridemia subset, targeted specifically by FIBRICOR, is projected to represent a growing niche within this total.

Assuming FIBRICOR’s differentiation allows for a conservative market share capture of 2-5% over five years, revenue potential ranges between USD 100 million to USD 600 million annually in mature markets such as the U.S., EU, and Japan.

2. Revenue Drivers

- Pricing Strategy: Premium pricing could be justified by superior efficacy or safety. Alternatively, competitive pricing may be necessary in cost-sensitive markets.

- Market Penetration: Adoption depends on clinical acceptance, payer coverage, and positioning within treatment guidelines.

- Sales and Distribution: Strategic partnerships with large pharmaceutical distributors and direct sales force deployment influence reach and revenue.

3. Cost Structure and Profit Margins

Development costs, including clinical trials and regulatory submission, typically range from USD 250 million to USD 500 million per novel drug. Post-approval, manufacturing costs for fibrates are relatively modest, enabling profitable margins if market penetration is achieved early.

4. Break-even and Growth Timeline

Given standard industry timelines, FIBRICOR could reach breakeven within 5-7 years post-launch, assuming successful clinical outcomes and regulatory approval. Revenue growth is expected to be incremental initially, with acceleration as market acceptance broadens, reaching peak sales within a decade.

5. Risk Factors

Potential regulatory hurdles, competitive entry of biosimilars or new classes, side effect profiles, and payer negotiation strategies could delay or reduce revenue realization. Also, shifts in clinical guidelines favoring alternative or combination therapies could impact long-term sales.

Market Entry Strategies

In pursuing market growth, FIBRICOR developers should focus on demonstrating clinical superiority through outcome-based trials, engaging key opinion leaders, and aligning with cardiovascular care guidelines. Payer engagement early in the process, emphasizing cost-effectiveness, will be crucial for reimbursement success.

Key Takeaways

- The expanding global burden of CVD and hypertriglyceridemia presents a growing market opportunity for FIBRICOR.

- Competitive differentiation—through enhanced efficacy, safety, or convenience—is vital for capturing market share.

- Regulatory approval hinges on robust clinical data; early engagement with authorities can streamline approval processes.

- Pricing and pharmacoeconomic value will influence payer acceptance and patient access, directly impacting revenue.

- Strategic collaborations and targeted marketing will accelerate adoption and realize revenue potential.

Conclusion

FIBRICOR's future hinges on navigating a complex interplay of market dynamics, clinical validation, regulatory pathways, and competitive positioning. While it faces formidable competition from established fibrates and emerging therapies, its prospects improve with demonstrable clinical benefits and favorable economic evaluations. Companies that effectively align innovation with market needs can anticipate a trajectory toward significant financial success within the evolving landscape of lipid management therapeutics.

FAQs

1. What differentiates FIBRICOR from existing fibrate therapies?

FIBRICOR aims to offer improved safety, efficacy, or dosing convenience over existing fibrates, potentially through innovative formulations or delivery systems. Its differentiation strategies are vital for physician and payer acceptance.

2. How does regulatory strategy impact FIBRICOR's market entry?

Securing timely approval depends on comprehensive clinical trial data demonstrating safety and efficacy. Early engagement with regulators can address potential concerns and shape the approval pathway, influencing market launch timing.

3. What factors influence FIBRICOR's pricing and reimbursement prospects?

Demonstrated clinical benefits, cost-effectiveness, and alignment with healthcare guidelines improve reimbursement potential. The ability to reduce long-term cardiovascular events or hospitalization costs will be key.

4. Who are the primary competitors of FIBRICOR?

Established drugs like fenofibrate and gemfibrozil dominate the fibrate segment. Emerging therapies, including Pemafibrate, present additional competition with potentially enhanced profiles.

5. What is the outlook for FIBRICOR’s revenue growth?

Assuming successful approval and market acceptance, revenues could reach hundreds of millions annually within a decade, with growth driven by expanding indications, geographic penetration, and formulary inclusion.

Sources

- WHO. (2021). Cardiovascular Diseases (CVDs). World Health Organization.

- MarketWatch. (2022). Lipid Management Therapeutics Market Size, Share, Trends & Forecast.

- ClinicalTrials.gov. (Accessed 2023). FIBRICOR Clinical Trial Data and Progress.

- GlobalData. (2023). Cardiovascular Drugs and Market Analysis.

- Food and Drug Administration. (2022). Guidance for Industry: Cardiovascular Outcome Trials.