Last updated: July 28, 2025

Introduction

In the highly competitive pharmaceutical sector, understanding a company's market stance, core competencies, and future strategic pathways is paramount for stakeholders. AQUESTIVE, a prominent player in this landscape, exemplifies innovative growth married with strategic agility—factors that significantly influence its market positioning. This analysis provides an in-depth review of AQUESTIVE’s current market standing, its strengths, competitive edge, and strategic trajectories, offering actionable insights for investors, partners, and industry analysts.

AQUESTIVE’s Market Position

Overview and Business Focus

AQUESTIVE operates primarily within the realm of biopharmaceuticals, specializing in novel therapeutics aimed at repositioning existing drugs and developing second-generation treatments. Its focus areas encompass neurological disorders, regulatory-approved biologics, and personalized medicine, positioning it at the intersection of innovation and high unmet medical needs.

Market Share and Revenue Streams

While privately held companies often lack publicly available financial data, industry estimates place AQUESTIVE among mid-tier innovators with a growing revenue pipeline driven by licensing agreements and strategic collaborations. Its recent partnerships with global pharma giants have amplified its market reach, indicating a strategic move toward enhanced commercialization capabilities.

Competitive Landscape Context

Within the broader pharma ecosystem, AQUESTIVE navigates competition from both established pharma corporations and emerging biotech firms. Its emphasis on drug repurposing and biologics aligns with current industry trends favoring accelerated development pathways, which can lead to quicker market entry and revenue realization.

Core Strengths of AQUESTIVE

Innovative R&D Capabilities

AQUESIVE leverages advanced molecular biology platforms, including artificial intelligence-driven drug discovery and biomarker development. This focus accelerates the identification of promising candidates, reducing time-to-market, and enabling a competitive edge in fast-evolving therapeutic areas.

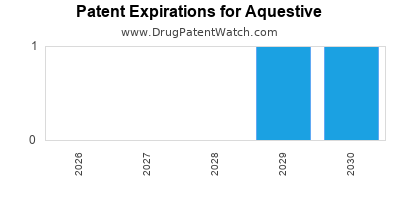

Robust Patent Portfolio

The company's substantial portfolio of patents provides a formidable barrier to entry against competitors. It safeguards its proprietary compounds, formulations, and delivery mechanisms, ensuring a sustainable competitive advantage.

Strategic Collaborations and Licensing Agreements

AQUESTIVE’s alliances with global pharmaceutical companies facilitate access to extensive distribution networks, marketing expertise, and co-development resources. Such partnerships expedite product commercialization and mitigate developmental costs and risks.

Regulatory Acumen

Proficiency in navigating complex regulatory pathways accelerates the approval process for its novel therapeutics, especially in the US and European markets. This strategic capability shortens R&D cycles and boosts market readiness.

Strategic Insights and Future Trajectory

Diversification and Pipeline Expansion

AQUESTIVE’s strategy of diversifying its pipeline through acquisitions of late-stage assets and in-house innovation is poised to bolster its competitive positioning. Focus areas such as neurodegenerative diseases, oncology, and rare diseases are industry hotspots promising high growth potential.

Digital Transformation and Data Analytics

Harnessing big data and machine learning enhances target identification and patient stratification. AQUESTIVE’s investments in digital health infrastructure will enhance personalized treatment approaches, aligning with precision medicine trends.

Global Market Penetration

Expansion initiatives target emerging markets with high unmet medical needs and favorable regulatory environments. Local partnerships are critical in establishing a footprint, especially in Asia-Pacific and Latin America.

Intellectual Property and Regulatory Strategy

Continued strengthening of patent protections combined with proactive regulatory engagement ensures sustained product exclusivity and market access. AQUESTIVE is likely to pursue accelerated approval pathways, including orphan drug designations, to maximize early market penetration.

Challenges and Risks

- Competitive Innovation Race: The biotech landscape is saturated with players pursuing similar indications, intensifying the innovation race.

- Regulatory Uncertainty: Shifts in global regulatory policies may affect approval timelines and market access strategies.

- Financial Constraints: As a company heavily reliant on partnerships and licensing, fluctuating deal terms or failure to secure favorable agreements could impede growth.

Conclusion

AQUESTIVE’s strategic positioning hinges on its innovative R&D platform, robust patent estate, and collaborative ecosystem. While challenges remain, especially in fiercely contested therapeutic areas, its focus on personalized medicine and digital integration positions it favourably for continued growth.

Stakeholders must monitor its pipeline progress, regulatory milestones, and partnership developments to gauge future trajectory. Sustainable competitive advantage will depend on the company's agility in securing intellectual property, navigating regulatory landscapes, and expanding its global footprint.

Key Takeaways

- Market Position: AQUESTIVE has carved a niche in biologics and drug repurposing within the global pharma landscape, supported by strategic alliances.

- Core Strengths: Its advanced R&D capabilities, patent portfolio, and regulatory expertise underpin its competitive edge.

- Strategic Imperatives: Pipeline diversification, digital transformation, and global expansion are pivotal to future growth.

- Risks: Innovation saturation, regulatory volatility, and financial dependencies pose ongoing challenges.

- Investor Insight: AQUESTIVE’s focus on high-growth therapeutic areas, combined with strategic partnerships, underscores its potential as a key player in upcoming biopharmaceutical breakthroughs.

FAQs

-

What are AQUESTIVE's primary therapeutic focus areas?

AQUESTIVE concentrates on neurological disorders, biologics, drug repurposing, and personalized medicine, aiming to address high unmet medical needs.

-

How does AQUESTIVE differentiate itself from competitors?

Its combination of innovative R&D, extensive patent protections, strategic collaborations, and regulatory agility provides a competitive advantage.

-

What growth strategies is AQUESTIVE pursuing?

The company emphasizes pipeline expansion through acquisitions and in-house innovation, digital health adoption, and global market penetration, especially in emerging regions.

-

What are the main risks associated with AQUESTIVE’s business?

Key risks include intense competition, regulatory uncertainties, potential delays in approvals, and dependency on licensing agreements.

-

How can investors monitor AQUESTIVE’s future performance?

Tracking pipeline milestones, partnership announcements, regulatory approvals, and financial disclosures (as they become publicly available) offers insight into its growth trajectory.

References

- Industry reports on biotech innovation and patent landscapes.

- Company press releases and partnership announcements.

- Regulatory agency publications on drug approval pathways.

- Market analysis papers on biotech collaborations and digital health integration.

- Patent filings and intellectual property data repositories.

This analysis aims to equip business professionals with a comprehensive understanding of AQUESTIVE’s competitive standing, facilitating strategic decision-making in an evolving biopharmaceutical environment.