Last updated: July 30, 2025

Introduction

Alkermes plc stands as a prominent player in the biopharmaceutical sector, specializing in innovative therapies for central nervous system (CNS) disorders, oncology, and addiction. Its diversified portfolio, combined with a robust pipeline and strategic collaborations, positions Alkermes uniquely in a highly competitive industry. This analysis explores the company’s market positioning, core strengths, competitive advantages, and strategic initiatives aimed at consolidating its foothold amid evolving challenges and opportunities.

Market Position and Industry Context

Alkermes operates within a competitive landscape driven by unmet medical needs, technological innovation, and regulatory dynamics. The firm’s primary markets include the US, Europe, and select emerging economies. As of 2023, Alkermes’ revenue streams derive predominantly from commercialized products such as Vivitrol (naltrexone extended-release), used for opioid dependence and alcohol dependence, and Lybalvi (olanzapine and samidorphan), approved for schizophrenia and bipolar I disorder. These key assets generate recurring revenue streams, reinforcing its market presence[^1].

The company’s focus on CNS and addiction markets aligns with expanding societal efforts to combat opioid crises and mental health disorders—areas witnessing increasing regulatory attention and favorable reimbursement environments. Nonetheless, Alkermes faces stiff competition from large players like Johnson & Johnson, AbbVie, and Eli Lilly, which are advancing their pipelines in similar domains using novel delivery systems and biologics.

Market Position Highlights

-

Niche Leadership in Long-Acting Injectable Therapies: Alkermes maintains a leadership position in long-acting injectable formulations for CNS and addiction treatments. Its proprietary drug delivery platforms facilitate sustained-release mechanisms, providing competitive advantages[^2].

-

Diverse Portfolio: The combination of marketed products, development-stage candidates, and strategic collaborations enables Alkermes to mitigate risks associated with pipeline failures and market fluctuations.

-

Strategic Focus on Addiction Treatment: Vivitrol remains a flagship product, contributing significantly to revenue. Its approval for alcohol dependence in addition to opioid dependency broadens its market segmentation[^3].

-

Geographical Expansion Efforts: Alkermes continues to expand beyond North American markets, seeking regulatory approvals and establishing partnerships in Europe and Asia to diversify revenue sources.

Core Strengths and Competitive Advantages

1. Proprietary Drug Delivery Platforms

Alkermes leverages its patent-protected technologies, such as its microsphere and nanoparticle systems, that enable sustained drug release over weeks or months. These platforms improve patient adherence, reduce dosing frequency, and enhance therapeutic outcomes[^4]. Such innovation creates high entry barriers for competitors lacking equivalent delivery mechanisms.

2. Focused Therapeutic Portfolio

Specializing in CNS, addiction, and oncology provides Alkermes with a targeted approach, fostering expertise and reputation in these high-demand segments. Its emphasis on conditions with significant unmet needs enhances potential for regulatory approvals and reimbursement.

3. Established Commercial Infrastructure

Over years, Alkermes has built a direct sales force and distribution network capable of supporting complex injectable products. This infrastructure grants operational advantages over smaller or solely partnership-dependent competitors.

4. Strategic Collaborations and Licensing Agreements

Partnerships with major pharmaceutical companies and academic institutions accelerate R&D activities and market penetration. Notably, partnerships with Biogen and Johnson & Johnson enhance access to cutting-edge technologies and increase commercial reach[^5].

5. Commitment to R&D and Pipeline Development

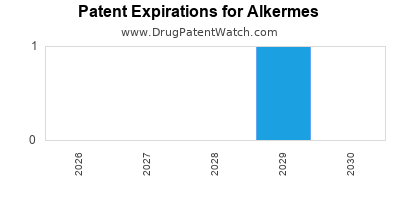

Alkermes maintains a substantial R&D pipeline extrapolated from its core platforms, including novel formulations for schizophrenia, depression, and other CNS indications. Continuous innovation mitigates risks associated with patent expiries and competitive product launches.

Strategic Challenges and Risks

Despite strengths, Alkermes faces notable challenges:

- Regulatory and Market Access Risks: Delays in approvals and pricing pressures could impact revenue growth.

- Pipeline Uncertainties: High attrition rates in clinical development threaten to diminish future product offerings.

- Intense Competition: Larger firms with extensive resources accelerate their CNS and addiction pipelines, potentially eroding Alkermes’ market share.

- Pricing and Reimbursement Pressures: Healthcare reforms aim to control drug prices, challenging premium-priced innovative therapies.

- Manufacturing and Supply Chain Constraints: Complex formulations necessitate stringent quality controls; disruptions could impair product availability.

Strategic Insights and Recommendations

1. Diversify Therapeutic Portfolio

Expanding into adjacent therapeutic areas, such as neurodegenerative diseases and rare disorders, can mitigate dependence on existing segments and unlock new revenue streams.

2. Accelerate Global Market Penetration

Focused strategies for regulatory approval in Europe, Asia, and emerging markets will diversify revenue and reduce reliance on North American markets.

3. Enhance R&D Efficiency

Investing in biomarker-guided clinical trials and digital health solutions can improve R&D success rates, shorten development timelines, and inform patient stratification.

4. Leverage Digital and Digital-Health Technologies

Integrating digital health tools for patient adherence and real-world evidence collection can strengthen value proposition and market access negotiations.

5. Pursue Strategic M&A Opportunities

Targeted acquisitions of smaller biotech firms with complementary platforms or pipelines can accelerate therapeutic innovation and expand technological capabilities.

Conclusion

Alkermes’ strategic positioning in CNS and addiction therapeutics, underpinned by proprietary technology and a focused portfolio, allows it to carve out a significant niche. While competitive and regulatory challenges persist, the company’s innovation-focused approach, strategic collaborations, and geographic expansion initiatives suggest a trajectory poised for resilient growth. Executing these strategies effectively while navigating systemic industry risks will be crucial for Alkermes to sustain and enhance its market presence.

Key Takeaways

- Alkermes commands a strategic advantage via its proprietary delivery technologies and focused therapeutic segments.

- The company’s leadership in long-acting injectable formulations positions it uniquely amidst a competitive landscape.

- Diversification—through pipeline expansion and global market penetration—is essential to sustaining growth.

- Strategic partnerships bolster innovation and market reach but require careful management.

- Ongoing challenges include regulatory hurdles, pipeline risks, and pricing pressures; proactive strategic planning is vital.

FAQs

1. How does Alkermes differentiate itself from competitors in CNS therapeutics?

Alkermes employs proprietary sustained-release delivery platforms that enhance drug efficacy and patient adherence, providing a competitive edge over companies relying on traditional formulations.

2. What are the primary revenue-generating products of Alkermes?

Vivitrol (naltrexone extended-release) is the flagship product, used for opioid and alcohol dependence. Lybalvi (olanzapine and samidorphan) is another significant contributor, treating schizophrenia and bipolar disorder.

3. What strategic initiatives are Alkermes pursuing to expand its market footprint?

The company is focusing on international regulatory approvals, pipeline diversification, technological innovation, and strategic collaborations to enhance global presence.

4. What are the main risks facing Alkermes’ growth prospects?

Regulatory delays, pipeline failures, aggressive competition, reimbursement pressures, and manufacturing issues pose significant risks.

5. How can Alkermes maintain its competitive edge in a rapidly evolving industry?

By investing in R&D, exploring emerging therapeutic areas, leveraging digital health, expanding globally, and pursuing strategic acquisitions, Alkermes can sustain innovation and market relevance.

Sources

[^1]: Alkermes Annual Report 2022.

[^2]: MarketWatch, Alkermes Long-Acting Formulations Overview.

[^3]: FDA Approvals and Label Updates.

[^4]: Patent Office Data on Delivery Platforms.

[^5]: Strategic Partnerships Announcements, 2022.