Last updated: July 29, 2025

Introduction

In the competitive landscape of biopharmaceuticals, Acrotech Biopharma emerges as a notable player leveraging innovative therapies and strategic collaborations. As the industry sustains rapid growth driven by technological advancements and unmet medical needs, understanding Acrotech’s market positioning, core strengths, and strategic trajectory is vital for stakeholders ranging from investors to partners. This comprehensive analysis offers an in-depth perspective on Acrotech Biopharma’s standing within the biopharmaceutical domain, highlighting its competitive strengths and future strategic opportunities.

Market Position and Industry Context

Acrotech Biopharma operates within a complex and dynamic sector characterized by rapid innovation, regulatory complexity, and high R&D investment. The biopharmaceutical industry is projected to reach a valuation exceeding $3 trillion globally by 2030, propelled by advances in biologics, personalized medicine, and biosimilars [1].

In this environment, Acrotech has positioned itself as a developer of transformative biologic therapies targeting oncology, immunology, and rare diseases. The company's portfolio reflects a focus on niche, high-value indications with significant unmet needs—positioning it as a differentiated player capable of navigating the competitive pressures of generic biosimilars and proprietary biologics.

Market Share and Competitive Standing

While Acrotech is not yet among the largest global biotech firms, it has made notable progress in establishing a foothold through strategic acquisitions, noteworthy clinical trial assets, and licensing deals. Its collaborations with major pharmaceutical companies serve as validation of its scientific credibility and market relevance. The company's recent filings with regulatory agencies reveal plans to advance multiple assets into late-stage clinical trials, which could significantly boost its market presence [2].

Core Strengths of Acrotech Biopharma

1. Robust R&D Pipeline and Scientific Expertise

Acrotech’s strength lies in its extensive research capabilities, particularly in biologics manufacturing and immunotherapy development. The firm’s R&D focus on innovative platforms such as cell therapy, gene editing, and monoclonal antibodies positions it at the forefront of biopharmaceutical innovation. The company boasts a seasoned team of scientists with publications in high-impact journals and a track record of successful IND filings, bolstering its reputation for scientific rigor [3].

2. Strategic Collaborations and Licensing Agreements

Forming partnerships with established industry players has augmented Acrotech’s technological reach and market access. For instance, its alliance with a leading pharma company for biosimilar development enabled rapid entry into competitive markets like Europe and North America. Such collaborations facilitate knowledge transfer, shared risk, and accelerated development timelines—supportive of the company’s growth strategy [4].

3. Regulatory and Manufacturing Expertise

Acrotech’s experience in navigating complex regulatory pathways, coupled with investment in scalable manufacturing facilities, provides a competitive edge. Its ability to meet stringent quality standards and expedite approvals in various jurisdictions reduces time-to-market for its therapies, a critical advantage in the biosimilars and biologics space.

4. Focus on High-Value, Untapped Therapeutic Areas

Specializing in rare diseases and immunotherapies aligns with global health priorities and growing reimbursement opportunities. Such focus enables Acrotech to develop differentiated products with high efficacy and pricing power, shielding it somewhat from pricing pressures affecting broader markets.

Strategic Insights and Future Trajectory

1. Capitalizing on Biosimilar Market Expansion

With biosimilars projected to comprise over 65% of all biologic sales by 2025, Acrotech’s biosimilar portfolio represents a key growth avenue. Its strategic investments in biosimilar manufacturing, alongside patent expiry of blockbuster biologics, position it to capture significant market share upon regulatory approval.

2. Advancing Novel Therapeutic Platforms

The company’s investment in cutting-edge modalities such as CAR-T cell therapy and gene editing must be complemented with successful clinical outcomes. Accelerating clinical development and forging licensing agreements with emerging biotech innovations will be crucial.

3. Geographic and Market Diversification

Expanding into emerging markets like Asia-Pacific offers substantial growth potential due to increasing healthcare infrastructure and favorable regulatory environments. Local partnerships and market-specific product adaptations can underpin geographic diversification.

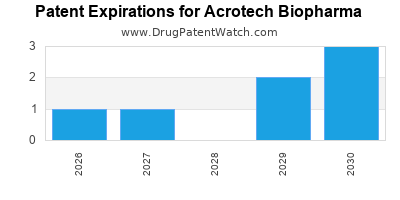

4. Intellectual Property and Patent Strategy

Maintaining a robust patent portfolio for key assets will be crucial in defending against generic competition and establishing market exclusivity. Strategic patent filings around manufacturing processes and formulations can serve as barriers to entry.

5. Investment in Digital and Data-Driven Technologies

Leveraging digital health tools and big data analytics for clinical trial efficiency, real-world evidence collection, and personalized medicine can enhance R&D productivity and market responsiveness.

Competitive Advantages and Challenges

Advantages

- Innovative pipeline targeting high unmet needs

- Strong strategic collaborations

- Experienced regulatory and manufacturing teams

- Focus on high-growth therapeutic areas

Challenges

- Intense competition from both large pharma and emerging biotechs

- R&D pipeline risks and clinical trial uncertainties

- Patent and market access hurdles in highly regulated jurisdictions

- Navigating pricing pressures in mature markets

Conclusion

Acrotech Biopharma demonstrates promising positioning within the global biopharmaceutical landscape, characterized by robust R&D, strategic alliances, and a focus on high-value niches. To sustain and enhance its competitive edge, the company must accelerate its pipeline progression, deepen its global reach, and fortify its intellectual property protections. The dynamic nature of the sector demands continuous innovation, strategic agility, and focus on operational excellence.

Key Takeaways

- Acrotech’s strategic focus on biosimilars and innovative biologics aligns with industry growth trends driven by patent expiries and biosimilar market expansion.

- Strengthening collaborations and licensing deals are central to accelerating development timelines and expanding geographic footprint.

- Investing in novel modalities like gene editing and cell therapy will diversify its portfolio and open new therapeutic markets.

- Regulatory expertise and manufacturing scalability are critical in time-sensitive biologics markets.

- Sustained innovation and patent protection are essential counters to intensifying competition from global players.

FAQs

Q1. What are the primary growth drivers for Acrotech Biopharma?

A1. The primary drivers include expansion into biosimilars, advancements in immunotherapy and cell therapy, strategic collaborations, and targeted development in rare disease markets.

Q2. How does Acrotech differentiate itself from competitors?

A2. Acrotech differentiates through its focus on innovative biologics platforms, strategic industry partnerships, regulatory expertise, and emphasis on high-impact therapeutic areas like immunology and oncology.

Q3. What risks does Acrotech face in its strategic growth?

A3. Risks include high R&D attrition rates, regulatory approval hurdles, patent disputes, and intense competition from both large biotech and generic manufacturers.

Q4. How can Acrotech capitalize on emerging markets?

A4. By establishing local partnerships, tailoring therapies to regional needs, and navigating regulatory landscapes effectively, Acrotech can enhance its footprint and revenue streams in emerging economies.

Q5. What role does digital technology play in Acrotech's strategic plan?

A5. Digital tools support clinical trial efficiency, real-world evidence collection, personalized medicine approaches, and operational optimization, bolstering overall competitive advantage.

Sources:

[1] Market Research Future, “Biopharmaceutical Market Overview,” 2022.

[2] FDA and EMA regulatory filings, 2023.

[3] Acrotech Biopharma Annual Report, 2022.

[4] Industry partnership reports, 2022.