tukysa Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Tukysa, and what generic alternatives are available?

Tukysa is a drug marketed by Seagen and is included in one NDA. There are eight patents protecting this drug.

This drug has two hundred and twenty-four patent family members in forty-six countries.

The generic ingredient in TUKYSA is tucatinib. One supplier is listed for this compound. Additional details are available on the tucatinib profile page.

DrugPatentWatch® Generic Entry Outlook for Tukysa

Tukysa was eligible for patent challenges on April 17, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be October 12, 2032. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for tukysa?

- What are the global sales for tukysa?

- What is Average Wholesale Price for tukysa?

Summary for tukysa

| International Patents: | 224 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 59 |

| Clinical Trials: | 17 |

| Patent Applications: | 1,312 |

| Drug Prices: | Drug price information for tukysa |

| What excipients (inactive ingredients) are in tukysa? | tukysa excipients list |

| DailyMed Link: | tukysa at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for tukysa

Generic Entry Date for tukysa*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for tukysa

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| RemeGen Co., Ltd. | Phase 1/Phase 2 |

| National Cancer Institute (NCI) | Phase 1 |

| Jonathan Riess | Phase 1 |

Pharmacology for tukysa

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Cytochrome P450 2C8 Inhibitors Cytochrome P450 3A Inhibitors P-Glycoprotein Inhibitors Tyrosine Kinase Inhibitors |

US Patents and Regulatory Information for tukysa

tukysa is protected by nine US patents and four FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of tukysa is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-001 | Apr 17, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-002 | Apr 17, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-002 | Apr 17, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-001 | Apr 17, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-001 | Apr 17, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

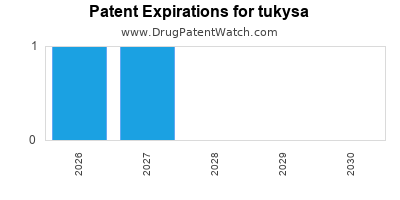

Expired US Patents for tukysa

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-001 | Apr 17, 2020 | ⤷ Get Started Free | ⤷ Get Started Free |

| Seagen | TUKYSA | tucatinib | TABLET;ORAL | 213411-002 | Apr 17, 2020 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for tukysa

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Seagen B.V. | Tukysa | tucatinib | EMEA/H/C/005263Tukysa is indicated in combination with trastuzumab and capecitabine for the treatment of adult patients with HER2‑positive locally advanced or metastatic breast cancer who have received at least 2 prior anti‑HER2 treatment regimens. | Authorised | no | no | no | 2021-02-11 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for tukysa

When does loss-of-exclusivity occur for tukysa?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 12322039

Patent: Solid dispersions of a Erb2 (HER2) inhibitor

Estimated Expiration: ⤷ Get Started Free

Patent: 17210499

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Patent: 19200243

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2014009092

Patent: dispersão sólida

Estimated Expiration: ⤷ Get Started Free

Patent: 2020010643

Patent: Dispersão sólida, composições farmacêuticas compreendendo a referida dispersão, usos das composições farmacêuticas e processo de preparação de uma dispersão sólida

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 52058

Patent: DISPERSION SOLIDE (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Patent: 14454

Patent: DISPERSION SOLIDE DE N4-(4-([1,2,4]TRIAZOLO[1,5-A]PYRIDIN-7-YLOXY)-3-METHYLPHENYL)-N6-(4,4-DIMETHYL-4,5-DIHYDROOXAZOL-2-YL)QUINAZOLINE-4,6-DIAMINE (A SOLID DISPERSION OF N4-(4-([1,2,4]TRIAZOLO[1,5-.ALPHA.]PYRIDIN-7-YLOXY)-3-METHYLPHENYL)-N6-(4,4-DIMETHYL-4,5-DIHYDROOXAZOL-2-YL)QUINAZOLINE-4,6-DIAMINE)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 14000930

Patent: Dispersion solida que comprende n4-(4-([1,2,4]triazolo-[1,5-a]piridina-7-iloxi)-3-metilfenil)-n6-(4,4-dimetil-4,5-dihidrooxazol-2-il)quinazolina-4,6-diamina y un polimero de dispersion; proceso de preparacion; composicion farmaceutica; uso en el tratamiento del cancer de mama, gastrico, colorectal, pancreatico, entre otros.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3998023

Patent: Solid dispersions of a ErbB2 (HER2) inhibitor

Estimated Expiration: ⤷ Get Started Free

Patent: 8498465

Patent: ErbB2(HER2)抑制剂的固态分散体 (Solid dispersions of a Erb2 (HER2) inhibitor)

Estimated Expiration: ⤷ Get Started Free

Patent: 4886853

Patent: ErbB2(HER2)抑制剂的固态分散体 (Solid dispersions of ErbB2 (HER2) inhibitors)

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 60547

Patent: Dispersión sólida de un inhibidor erb2 (her2)

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 140228

Patent: DISPERSIÓN SÓLIDA

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0171578

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19837

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 65990

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 65990

Patent: DISPERSION SOLIDE (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 35247

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 2103

Patent: דיספרסיה מוצקה המכילה 4n-)4-([4.2.1]טריאזולו[a5,1]פירידין-7-אילאוקסי-3-מתילפניל)-n6 - (4,4-דימתיל-5,4-דיהידרוקסואוקסאזול-2-איל)קיוונאזולין-6,4-דיאמין ופולימר מבדר, תהליך להכנתה ותכשיר רוקחות המכיל אותה (Solid dispersions of a erb2 (her2) inhibitor)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 44514

Estimated Expiration: ⤷ Get Started Free

Patent: 14528484

Patent: 固体分散体

Estimated Expiration: ⤷ Get Started Free

Patent: 16027062

Patent: 固体分散体 (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 65990

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 9072

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3970

Patent: DISPERSION SOLIDA. (SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR.)

Estimated Expiration: ⤷ Get Started Free

Patent: 14004551

Patent: DISPERSION SOLIDA. (SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR.)

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 913

Patent: ČVRSTA DISPERZIJA (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4942

Patent: Solid dispersions of a erb2 (her2) inhibitor

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 21029

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 014500799

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 65990

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 65990

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 48448

Patent: ТВЕРДАЯ ДИСПЕРСИЯ (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Patent: 14119283

Patent: ТВЕРДАЯ ДИСПЕРСИЯ

Estimated Expiration: ⤷ Get Started Free

Patent: 18107710

Patent: ТВЕРДАЯ ДИСПЕРСИЯ

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01700499

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 608

Patent: ČVRSTA DISPERZIJA (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201401459Y

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 65990

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1606123

Patent: PHARMACEUTICAL COMPOSITIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2000312

Estimated Expiration: ⤷ Get Started Free

Patent: 140075798

Patent: SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 50608

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 94769

Estimated Expiration: ⤷ Get Started Free

Patent: 22189

Estimated Expiration: ⤷ Get Started Free

Patent: 88733

Estimated Expiration: ⤷ Get Started Free

Patent: 1330876

Patent: Solid dispersion

Estimated Expiration: ⤷ Get Started Free

Patent: 1728323

Patent: Solid dispersion

Estimated Expiration: ⤷ Get Started Free

Patent: 2131902

Patent: Solid dispersion

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 1383

Patent: ТВЕРДА ДИСПЕРСІЯ (SOLID DISPERSION)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering tukysa around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 20060064630 | QUINAZOLINE ANALOGS AS RECEPTOR TYROSINE KINASE INHIBITORS | ⤷ Get Started Free |

| Australia | 2017272232 | ⤷ Get Started Free | |

| Russian Federation | 2350605 | АНАЛОГИ ХИНАЗОЛИНА В КАЧЕСТВЕ ИНГИБИТОРОВ РЕЦЕПТОРНЫХ ТИРОЗИНКИНАЗ (ANALOGUES OF QUINAZOLINE AS INHIBITORS OF RECEPTOR TYROSINE KINASES) | ⤷ Get Started Free |

| Japan | 2010270154 | METHOD FOR PRODUCING N4-PHENYL-QUINAZOLINE-4-AMINE DERIVATIVE, AND INTERMEDIATE THEREOF | ⤷ Get Started Free |

| Australia | 2019200243 | SOLID DISPERSIONS OF A ERB2 (HER2) INHIBITOR | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for tukysa

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1971601 | 770 | Finland | ⤷ Get Started Free | |

| 1971601 | SPC/GB21/042 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: TUCATINIB, OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT OR SOLVATE; REGISTERED: UK EU/1/20/1526(FOR NI) 20210212; UK FURTHER MAS ON IPSUM 20210212 |

| 1971601 | 132021000000128 | Italy | ⤷ Get Started Free | PRODUCT NAME: TUCATINIB OPZIONALMENTE NELLA FORMA DI UN SALE O SOLVATO FARMACEUTICAMENTE ACCETTABILE(TUKYSA); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/20/1526, 20210212 |

| 1971601 | CR 2021 00025 | Denmark | ⤷ Get Started Free | PRODUCT NAME: TUCATINIB, EVENTUELT I FORM AF ET FARMACEUTISK ACCEPTABELT SALT ELLER SOLVAT DERAF; REG. NO/DATE: EU/1/20/1526 20210212 |

| 1971601 | LUC00217 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: TUCATINIB EVENTUELLEMENT SOUS FORME D'UN SEL OU SOLVATE PHARMACEUTIQUEMENT ACCEPTABLE; AUTHORISATION NUMBER AND DATE: EU/1/20/1526 20210212 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TUKYSA (Tucatinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.