Last updated: July 27, 2025

Introduction

ZYMAXID (Gatifloxacin ophthalmic solution), developed by Bausch + Lomb, is a broad-spectrum fluoroquinolone antibiotic primarily indicated for the treatment of bacterial conjunctivitis. Since its FDA approval in 2009, ZYMAXID has carved a significant niche within the ophthalmic antibiotics market. Understanding the evolving market dynamics and financial trajectory of ZYMAXID is crucial for stakeholders, including pharmaceutical companies, investors, and policymakers, as they navigate competitive pressures, regulatory landscapes, and commercialization strategies.

Market Landscape and Key Drivers

1. Rising Incidence of Bacterial Conjunctivitis

Bacterial conjunctivitis remains one of the most common ocular infections worldwide, driving the demand for effective antibiotics like ZYMAXID. Globally, frequent exposure to pathogens, increased urbanization, and rising pollution levels contribute to higher infection rates. Epidemiological data suggest that bacterial conjunctivitis affects over 24 million individuals annually in the United States alone [1], fueling sustained demand for targeted therapies.

2. Expanding Ophthalmic Drug Market

The global ophthalmic pharmaceuticals market is projected to reach USD 59 billion by 2025, growing at a CAGR of 4-6% [2]. Factors such as an aging population, increased prevalence of ocular surface diseases, and technological advancements underpin this growth. ZYMAXID benefits from this expanding market scope, as ophthalmic antibiotics remain essential in clinical practice.

3. Competitive Landscape

ZYMAXID faces competition from generic fluoroquinolones like Ciprofloxacin and Ofloxacin, as well as newer agents such as Besifloxacin. Its brand recognition and established efficacy lend it persistence in the market. However, patent challenges, pricing strategies, and formulary placements influence its market share trajectory.

4. Regulatory and Safety Considerations

Tightening regulatory scrutiny, especially regarding safety profiles such as rare adverse events, influences market access. Notably, ZYMAXID underwent FDA labeling updates pertaining to its potential for hypersensitivity and ocular side effects. These factors can impact prescribing behaviors and sales volumes [3].

Market Dynamics Influencing ZYMAXID's Financial Trajectory

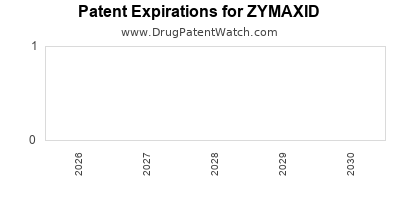

A. Patent Status and Generic Competition

Bausch + Lomb initially held patent exclusivity for ZYMAXID. However, patent expiration or challenges can accelerate generic entry, exerting downward pressure on prices and profit margins. The entry of generics such as gatifloxacin-based options typically results in substantial price erosion within the ophthalmic antibiotic segment. As of 2023, generic gatifloxacin products are widely available, influencing ZYMAXID’s market share.

B. Pricing Strategies and Reimbursement Environment

Reimbursement policies in key markets impact sales. In regions where insurance coverage is partial or where formulary restrictions favor generics, ZYMAXID's premium pricing may limit volume growth. Conversely, Bausch + Lomb's strategies, including bundle deals and physician incentives, help sustain revenue.

C. Strategic Marketing and Distribution

Strong distribution channels and targeted marketing efforts contribute to maintaining brand loyalty among ophthalmologists. Educational campaigns emphasizing ZYMAXID's efficacy and safety reinforce its position against alternatives, stabilizing sales even in the face of generic competition.

D. Innovation and Portfolio Diversification

While ZYMAXID remains a cornerstone product, diversification into newer formulations or combination therapies can influence revenue streams. Bausch + Lomb’s pipeline investments and licensing collaborations could shape future financial prospects.

E. Regulatory and Market Expansion

Efforts to expand indications or enter new geographic markets can bolster ZYMAXID’s revenue. For example, regulatory approvals in emerging markets like Asia and Latin America could open sizable new markets, although logistical and approval timelines pose challenges.

Financial Trajectory and Revenue Trends

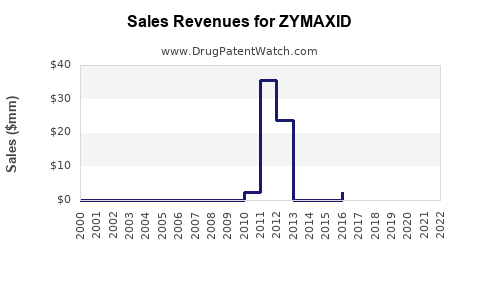

Historical Sales Performance

Post-launch in 2009, ZYMAXID saw rapid adoption driven by its broad-spectrum activity and favorable safety profile. According to Bausch + Lomb’s fiscal reports, annual sales peaked around USD 250 million in North America around 2015. Subsequent years experienced plateauing or modest declines due to generics and market saturation.

Impact of Patent Expiry and Generic Entry

The patent cliff around 2018-2020 led to increased generic availability, significantly reducing ZYMAXID’s ASP (Average Selling Price) and curbing revenue growth. Nonetheless, brand loyalty and prescriber preference sustained a residual revenue stream estimated at USD 50-80 million annually in North America.

Current Financial Outlook

Despite competitive pressures, ZYMAXID continues to generate stable cash flows. Market analysts project a gradual decline in earnings through 2025, barring strategic repositioning or extension of indications. The product’s mature status implies reliance more on market maintenance than growth, emphasizing the importance of lifecycle management strategies.

Future Outlook and Growth Opportunities

1. Formulation Innovations

Developing preservative-free or sustained-release formulations could enhance patient adherence and expand therapeutic applications. These innovations may command premium pricing and reinforce market position.

2. Geographic Expansion

Targeted entry into underserved regions, with tailored regulatory strategies, could create new revenue pathways. Countries in Asia-Pacific and Latin America, with rising ophthalmic disease burdens, represent viable growth corridors.

3. Combination Therapies and Adjunct Uses

Research into combining ZYMAXID with corticosteroids or anti-inflammatory agents may open new indications in postoperative care or complex infections, broadening revenue streams.

4. Leveraging Pharmacovigilance and Safety Data

Proactive safety communication and data-driven positioning can sustain prescriber confidence, especially as safety concerns evolve with market competition.

Key Takeaways

- Market fundamentals, driven by increasing bacterial conjunctivitis cases and expanding ophthalmic markets, support stable demand for ZYMAXID despite growth challenges.

- Patent expirations and subsequent generic competition have exerted downward pricing pressure, shifting revenues toward mature, stable cash flows rather than growth.

- Competitive dynamics necessitate continuous investment in formulation innovation, geographic expansion, and strategic marketing to sustain profitability.

- Regulatory and safety considerations influence prescriber preferences, with ongoing data dissemination critical for market retention.

- Future growth focuses on pipeline enhancements, new indications, and entering emerging markets, albeit with inherent regulatory and logistical challenges.

Conclusion

ZYMAXID’s financial trajectory reflects a product in its maturity phase in the ophthalmic antibiotic realm. While facing inevitable generic competition and pricing pressures, its entrenched market presence and strategic initiatives position it as a steady revenue contributor within Bausch + Lomb’s portfolio. Anticipated innovations and market expansion efforts will be critical in offsetting revenue erosion and unlocking new growth avenues.

FAQs

1. How has patent expiration impacted ZYMAXID’s market share?

Patent expiration led to the influx of generic gatifloxacin products, intensifying price competition and reducing ZYMAXID’s market share and revenue, which now primarily derives from brand loyalty and physician preference.

2. What are the primary competitors to ZYMAXID?

Generic fluoroquinolones such as Ciprofloxacin and Ofloxacin dominate the market, while newer agents like Besifloxacin provide alternative options, creating a highly competitive environment.

3. Are there ongoing efforts to expand ZYMAXID’s indications?

Currently, ZYMAXID’s approved indications are limited to bacterial conjunctivitis. Future efforts may involve pursuing additional ocular infections or postoperative applications, contingent on clinical trial outcomes and regulatory approvals.

4. How does pricing strategy influence ZYMAXID’s revenues?

Pricing competitiveness is vital; while brand premiums persist, widespread generic alternatives exert pressure that influences strategic pricing, reimbursement negotiations, and overall revenue stability.

5. What growth opportunities exist for ZYMAXID in emerging markets?

Emerging markets present untapped potential due to rising ocular infection burdens and increased healthcare access. However, challenges include regulatory hurdles, distribution infrastructure, and local competition.

Sources

[1] American Optometric Association, “Conjunctivitis: Epidemiology and Prevalence,” 2022.

[2] ResearchandMarkets, “Global Ophthalmic Pharmaceuticals Market Forecast (2020-2025),” 2021.

[3] U.S. FDA, “ZYMAXID (Gatifloxacin Ophthalmic Solution) Label Updates,” 2012.