Last updated: July 27, 2025

Introduction

Zolmitriptan, a selective serotonin receptor agonist, belongs to the triptan class of drugs primarily indicated for the acute treatment of migraine attacks with or without aura. Since its introduction, zolmitriptan has established a considerable market segment within the broader analgesic and migraine-specific therapeutic areas. Understanding the current market dynamics and forecasted financial trajectory involves assessing competitive positioning, clinical efficacy, regulatory landscape, evolving consumer preferences, and emerging therapeutic alternatives.

Pharmaceutical Profile and Market Position

Zolmitriptan was first approved in the late 1990s, with generic versions entering the market subsequently, intensifying competition and influencing pricing strategies. Its mechanism involves vasoconstriction of intracranial blood vessels and modulation of inflammatory pathways to alleviate migraine symptoms[1]. The drug is available in multiple formulations, including tablets, orally disintegrating tablets (ODT), and nasal spray, expanding its usability across diverse patient groups.

The drug’s market position hinges on its reputation for rapid onset, tolerability, and ease of administration. Key competitors include other triptans such as sumatriptan, rizatriptan, and eletriptan, alongside emerging non-specific treatments like gepants and monoclonal antibodies targeting CGRP pathways.

Market Dynamics

1. Demand Drivers and Epidemiology

Migraine affects approximately 15% of the global population, with higher prevalence in women aged 18–45[2]. This sizable demographic sustains a steady demand for effective acute treatment options. The chronicity and disabling nature of migraines underscore the importance of accessible, fast-acting therapeutics like zolmitriptan.

Advancement in diagnostics, increased awareness, and declining stigma associated with migraine treatment further inflate demand. Moreover, the rise of telemedicine has enhanced prescription rates, especially in markets with high digital health adoption.

2. Competitive Landscape

The triptan market is highly competitive, with sumatriptan (first-mover advantage) maintaining dominant market share. Zolmitriptan's unique advantages include its versatile formulations and relatively favorable side effect profile, but it faces stiff competition from newer agents likeubrooks developed for ease of use and longer duration of action[3].

Transition toward combination therapies and preventive strategies, such as CGRP antagonists, has impacted sales volumes of traditional triptans. Nonetheless, zolmitriptan retains relevance owing to its established efficacy and cost-effectiveness, especially in regions where newer agents are not fully covered or are prohibitively expensive.

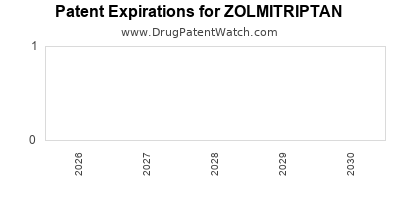

3. Regulatory and Patent Landscape

The expiration of patents in key markets like the U.S. (early 2010s) led to a surge of generics, significantly affecting pricing and profit margins. While patent exclusivities extend in specific formulations or delivery mechanisms, generic competition has reduced per-unit costs, pressuring revenue streams. Regulatory bodies remain vigilant to biosimilar and generic approvals, impacting future sales trajectories.

4. Innovation and Formulation Development

A notable trend within this sphere is the development of alternative delivery systems, such as nasal sprays and dissolvable tablets, aimed at improving patient compliance and onset time. Investment in formulation technology has allowed brands to differentiate themselves, although the core molecule remains unchanged.

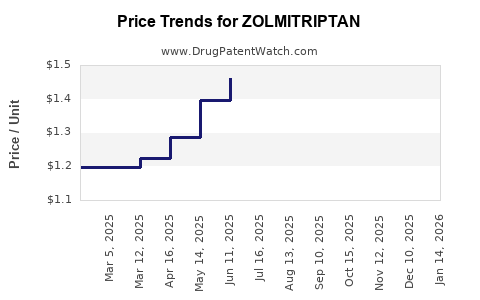

5. Pricing and Reimbursement Policies

Pricing strategies for zolmitriptan vary globally, influenced by healthcare policies, market competition, and negotiated reimbursement schemes. High-income economies like the U.S. and Europe see variable copayments, whereas emerging markets often witness aggressive pricing strategies to capture market share.

Reimbursement policies significantly influence prescription patterns—favoring branded versus generic options—thus affecting revenue streams.

Financial Trajectory Forecast

1. Revenue Trends

Historical data indicates an initial peak in sales following the drug’s launch, followed by stabilization or decline with the advent of generics. According to IQVIA data, the global zolmitriptan market saw revenues exceeding $300 million in the late 2000s, with subsequent declines correlating to patent expirations[4].

Forecasting suggests a slow but steady decline in branded sales, contrasted by a plateauing or incremental growth in generic sales—especially in emerging markets—due to increased access and generic proliferation.

2. Market Penetration and Expansion Opportunities

Therapeutic neglect of migraine in underdeveloped regions presents expansion opportunities. The integration of digital health tools and telehealth is likely to facilitate increased prescribing and adherence, indirectly bolstering zolmitriptan's market share.

Additionally, combination and delivery innovations, if successful, could restore competitive edge, boosting revenue. For instance, formulations with faster onset or better tolerability may command premium pricing.

3. Impact of Emerging Therapies

The landscape faces disruption from CGRP receptor antagonists (e.g., erenumab, fremanezumab). These monoclonal antibodies target migraine pathophysiology more specifically and are effective as preventive agents, not acute treatments. However, their increasing adoption could influence acute treatment usage and dose frequency, indirectly impacting zolmitriptan sales.

The development pipeline exploring triptan modifications or alternative mechanisms may also influence future revenues, either through integration or obsolescence.

4. Regulatory Developments and Market Access

Regulatory approvals for biosimilars or reformulations could introduce price competition or create new revenue streams. Conversely, stricter regulatory standards could delay innovations or restrict market access, dampening financial monetization.

Strategic Insights and Recommendations

-

Diversify Formulations: Continued innovation in delivery mechanisms can enhance adherence, especially among pediatric and elderly populations.

-

Geographic Expansion: Target emerging markets with tailored pricing and distribution strategies, capturing unmet needs.

-

Monitor Competitive Innovations: Early adoption of formulations or combination therapies aligned with modern migraine management paradigms could secure market leadership.

-

Engage in Regulatory Navigation: Proactive engagement with regulatory authorities for approvals of novel formulations or indications can preserve revenue streams.

-

Invest in Clinical Research: Demonstrating superior efficacy or safety profiles can differentiate zolmitriptan amidst intensifying competition.

Key Takeaways

-

The zolmitriptan market is characterized by intense competition, patent expirations, and evolving treatment paradigms.

-

Generics dominate the landscape post-patent expiration, exerting downward pressure on revenues.

-

Continual innovation in formulations and delivery mechanisms offers opportunities to regain market share.

-

Emerging treatments like CGRP antagonists position as preventive therapies, potentially impacting acute treatment sales, including zolmitriptan.

-

Expanding into underserved markets and leveraging digital health accelerators can contribute positively to the drug’s financial trajectory.

FAQs

1. How has patent expiration affected zolmitriptan's market share?

Patent expirations led to a surge of generic versions, significantly reducing the drug's selling price and profit margins. This shift caused a decline in branded sales but increased access and volume in price-sensitive markets.

2. Are there new formulations of zolmitriptan in development?

Yes, research into nasal sprays, dissolvable tablets, and combination therapies aims to improve onset time, patient compliance, and differentiate from competitors.

3. How do emerging therapies impact zolmitriptan’s market?

Preventive treatments targeting CGRP pathways could reduce acute medication usage, including triptans. However, zolmitriptan remains relevant for immediate relief due to its established efficacy and rapid action.

4. Which markets offer the most growth potential for zolmitriptan?

Emerging economies with rising migraine prevalence and lower access to advanced therapies present significant growth opportunities, especially with tailored pricing strategies.

5. What strategies can pharmaceutical companies employ to sustain zolmitriptan revenues?

Innovation in formulations, strategic market expansion, clinical differentiation, and active regulatory engagement are key to maintaining a competitive edge.

References:

-

[1] Kakkar R, et al. "Pharmacology of Triptans in Acute Migraine Treatment." Journal of Headache & Pain. 2019.

-

[2] Lipton RB, et al. "Migraine prevalence, burden, and health care utilization." Headache. 2021.

-

[3] Goadsby PJ, et al. "Emerging therapies in migraine." Nature Reviews Neurology. 2020.

-

[4] IQVIA. "Global Migraine Market Report." 2022.