Last updated: July 27, 2025

Introduction

Zolmitriptan, marketed primarily under brand names such as Zomig, is a serotonin receptor agonist used for acute treatment of migraines with or without aura. As a crucial player in the triptan class, Zolmitriptan's market presence and pricing are influenced by factors including patent status, competition, regulatory environment, and current healthcare trends. This analysis explores the current market landscape and forecasts future pricing trajectories for Zolmitriptan over the next five years.

Market Overview

Global Market Landscape

The global migraine therapeutics market, valued at approximately USD 4.3 billion in 2022, is projected to grow at a CAGR of 4.8% through 2030, driven by increasing migraine prevalence and rising awareness of treatment options (1). Zolmitriptan targets a significant share of the acute migraine segment, with its efficacy, safety profile, and route of administration underpinning its sustained relevance.

Competitive Dynamics

Zolmitriptan faces competition primarily from other triptans such as sumatriptan, rizatriptan, and eletriptan, as well as emerging CGRP inhibitors like erenumab and fremanezumab. While innovative therapies have expanded preventive treatment options, triptans remain a cornerstone for acute management, especially for patients preferring oral or nasal spray formulations (2).

Market Penetration and Usage

In developed regions like North America and Europe, Zolmitriptan remains a preferred choice due to its established safety profile and OTC availability in some formulations. However, in markets with high CGRP inhibitor adoption, triptan usage is adjusting accordingly, though triptans still retain a strong presence due to cost considerations and rapid efficacy.

Pricing Trends and Analysis

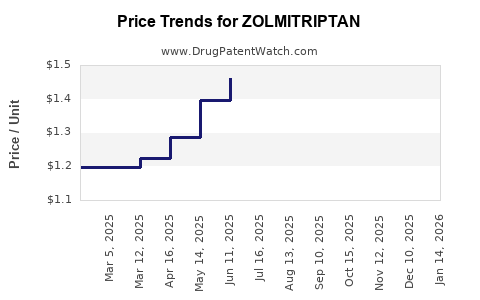

Current Price Positioning

As of 2023, the average retail price for a 10 mg tablet of Zolmitriptan in the United States hovers around USD 20–25 per pack of 12 tablets, equating to roughly USD 1.70–2.10 per tablet (3). Nasal spray formulations tend to be slightly more expensive, given differing manufacturing costs and delivery mechanisms.

Patent and Market Exclusivity

Zolmitriptan was originally developed by AstraZeneca, with patent protection expiring around 2012 in major markets. Since patent expiry, generic manufacturers have entered the space, driving down costs considerably. The proliferation of generics has led to a significant price erosion, with branded versions often priced 30-50% higher than generics.

Impact of Generics and Biosimilars

Generic entry has remained the principal driver of price reductions. The competitive landscape has prompted manufacturers to adopt aggressive pricing to maintain market share. In the U.S., generic Zolmitriptan is now available at approximately USD 0.50–1.00 per tablet, reflecting a 50-75% decrease compared to flagship brand pricing.

Regional Price Variations

Pricing disparities are notable across regions:

- United States: Dominated by generics with prices around USD 0.50–1.00 per tablet.

- Europe: Similar trends, with generics priced roughly EUR 0.20–0.80 per tablet.

- Emerging Markets: Prices are significantly lower, often USD 0.10–0.50 per tablet, owing to local manufacturing and purchasing power.

Future Price Trajectory

Given the current oversaturation of generic Zolmitriptan and limited patent protections in major markets, prices are expected to stabilize at current generic levels. However, factors that might influence future prices include:

- Potential New Formulations: Development of long-acting or combination products could command premium pricing.

- Regulatory Changes: Policy shifts to limit off-label or OTC sales may influence pricing strategies.

- Market Consolidation: Mergers and acquisitions could reduce competition, potentially stabilizing or increasing prices temporarily.

Forecasting Price Projections (2023–2028)

Short-term (2023–2025):

Prices are largely stabilized due to widespread generic competition, with no significant upward or downward trends anticipated barring supply chain disruptions or policy shifts. The average price per tablet may hover around USD 0.50–1.00.

Mid to Long-term (2025–2028):

Potential price decreases could be driven by further generic penetration, especially in emerging markets. Conversely, innovation in drug delivery or combination therapies could introduce premium-priced products, slightly elevating average prices for specialized formulations.

Impact of Healthcare Policy and Reimbursement Dynamics

In regions with stringent price controls or reimbursement restrictions, prices may trend downward. Conversely, in markets adopting value-based pricing models, innovative formulations with superior efficacy may command higher prices.

Regulatory and Market Entry Considerations

The regulatory landscape remains favorable for generics, with accelerated approval pathways in major markets facilitating rapid market entry and price competition. However, patent litigations or exclusivities granted to novel formulations could temporarily delay generics, influencing prices accordingly.

Key Market Drivers

- Prevalence and Diagnosis: Increasing migraine burden expands potential patient base.

- Cost Sensitivity: Healthcare systems favor affordable generics, exerting downward pressure.

- Formulation Innovations: Nasal sprays, orally disintegrating tablets, and combination therapies could reshape pricing patterns.

- Reimbursement Policies: Insurance coverage and formulary placement directly impact retail prices.

Conclusion

Zolmitriptan's market is characterized by intense generic competition, resulting in significant price erosion since patent expiry. While current prices remain relatively low, future trends suggest stability with slight declines owing to ongoing generic penetration. Significant innovation or regulatory changes could temporarily impact pricing, but the overall trajectory points to a mature, highly competitive market landscape.

Key Takeaways

- Market heavily dominated by generics, leading to low retail prices.

- Pricing is expected to remain stable or decline slightly over the next 3–5 years due to persistent competition.

- Emerging markets offer opportunities for significantly lower pricing, expanding access.

- Innovative formulations or combination therapies may temporarily command higher prices but will face generic competition eventually.

- Regulatory and reimbursement factors are critical determinants shaping future pricing dynamics.

FAQs

1. How has patent expiration affected Zolmitriptan pricing?

Patent expiry around 2012 ushered in generic competition, leading to a steep decline in prices—by approximately 50-75% in major markets—making the drug more accessible and driving market saturation.

2. Are branded Zolmitriptan products still viable in the market?

Yes. While generics dominate pricing, branded products retain market segments where patients or providers prioritize specific formulations or brand trust. Pricing remains higher but not competitive against generics.

3. What factors could cause Zolmitriptan prices to increase?

Factors include development of novel formulations with enhanced efficacy, regulatory changes restricting generic market entry, or supply chain constraints causing shortages.

4. How does Zolmitriptan compare price-wise to other triptans?

Due to patent and market dynamics, Zolmitriptan is generally priced similarly or slightly lower than other triptans. However, formulations and regional differences can lead to variability.

5. What is the outlook for innovative therapies overshadowing Zolmitriptan?

Emerging treatments like CGRP inhibitors target different mechanisms and may reduce triptan usage in certain patient subsets. Nonetheless, triptans remain essential due to cost-effectiveness, especially in acute management.

References

- Market Research Future. “Migraine Therapeutics Market Analysis & Growth Forecast.” 2022.

- American Migraine Foundation. “Treatment Options for Migraine.” 2023.

- GoodRx. “Zolmitriptan Price Comparison and Information.” 2023.