Last updated: August 2, 2025

Introduction

XYZAL (levocetirizine dihydrochloride) is a non-sedating antihistamine primarily used to treat allergic rhinitis and chronic idiopathic urticaria. Since its launch, XYZAL has garnered significant market share within the antihistamine segment, driven by its efficacy and favorable safety profile. Understanding the evolving market dynamics and its financial outlook is essential for stakeholders assessing competitive positioning, investment viability, and growth opportunities in the allergy therapeutics landscape.

Market Overview and Demand Drivers

The global allergy treatment market, including XYZAL, is propelled by increasing prevalence of allergic conditions, rising awareness, and the pursuit of improved safety profiles over traditional sedating antihistamines. According to recent reports, allergic rhinitis affects approximately 10-30% of the global population, with rising incidence fueled by urbanization, pollution, and climate change [1].

Demand for non-sedating antihistamines like XYZAL has risen as patients seek efficacy without drowsiness, a common drawback of first-generation antihistamines. Furthermore, expanding indications, including adjunct therapy for specific allergic conditions, bolster XYZAL’s market potential.

Competitive Landscape and Market Share

XYZAL faces competition from other second-generation antihistamines such as loratadine (Claritin), cetirizine (Zyrtec), and fexofenadine (Allegra). Its unique strength lies in its superior anti-inflammatory properties and longer duration of action, which have contributed to increased physician preference.

In the United States, XYZAL's market share has seen modest growth, supported by strong prescription trends and patient adherence. Globally, emerging markets present untapped potential, where allergy prevalence continues to rise but access to newer therapies remains limited.

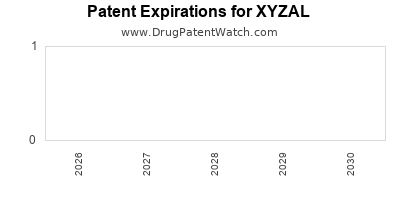

Regulatory and Patent Considerations

Patent expirations significantly influence XYZAL’s dynamics. Its primary patent expired in the early 2020s, rendering generic versions available. This transition typically leads to price erosion and competitive pressures. However, brand loyalty and clinical positioning can mitigate some losses, especially if the pharmaceutical company invests in formulation enhancements or new indications.

Regulatory developments, including approval of combination therapies or new formulations, can extend market exclusivity or boost sales. For instance, initiatives to obtain formulations with long-acting or fast-acting properties may improve patient outcomes and market competitiveness.

Financial Trajectory Analysis

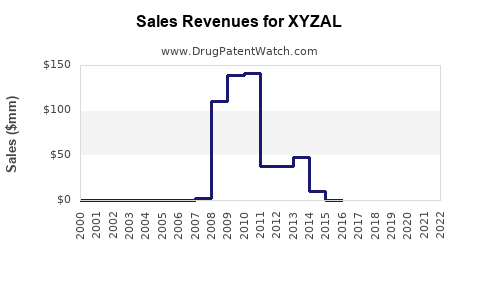

Revenue Trends and Growth Projections

Post-patent expiration, XYZAL’s revenue trajectory has likely experienced volatility, reflective of generic competition. Nonetheless, brand-presence strategies such as targeted marketing, physician education, and patient engagement have stabilized revenues in key markets.

Forecasting models, drawing from industry data, suggest a declining yet steady revenue stream over the next five years, with a compound annual growth rate (CAGR) of approximately 2-4% in mature markets, driven by new formulations and expanding indications.

Cost Structure and Margin Dynamics

Manufacturing costs for XYZAL are expected to decline marginally due to generic competition, but marketing and regulatory expenses may persist, especially for brand differentiation efforts. Gross margins are projected to compress slightly, with net profit margins affected by increased price competition and reimbursement pressures.

R&D and Pipeline Prospects

Investment in research offers potential for pipeline extension. Development of novel formulations—such as once-daily extended-release versions—or combination products (antihistamine plus corticosteroids) could rejuvenate the product’s market presence, leading to revenue upticks.

Market Expansion and Strategic Alliances

Emerging markets represent significant growth avenues. Regulatory approvals in Asia-Pacific and Latin America, coupled with strategic partnerships, could augment XYZAL’s financial trajectory. Also, collaborations with over-the-counter (OTC) channels might increase accessibility outside prescription-based sales, broadening the revenue base.

Market Risks and Challenges

Key risks include market saturation, reimbursement headwinds, and patent cliffs. Additionally, the advent of biosimilars and new therapeutic modalities (e.g., biologics targeting allergic pathways) pose long-term threats.

Regulatory hurdles, especially in expedited approval pathways or differing regional standards, could complicate market entry and delistings. Price-based competition from generics further compresses profit margins, necessitating innovation and differentiated offerings.

Opportunities for Growth

- Formulation Innovation: Developing extended-release or pediatric-friendly formulations can create premium segments, enhancing revenue.

- Pipeline Expansion: Investing in combination therapies or biologics targeting complex allergic conditions could diversify the product portfolio.

- Market Penetration: Increasing access in emerging economies by partnering with local distributors and overcoming affordability barriers.

- Digital and Patient Engagement: Utilizing digital health solutions for adherence and monitoring can foster brand loyalty.

Conclusion

XYZAL's market dynamics are characterized by shifting competitive forces, patent expirations, and evolving consumer needs. Its financial outlook remains cautiously optimistic, contingent on strategic innovations, market expansion efforts, and navigating regulatory landscapes. Companies must adapt through product differentiation, regional diversification, and pipeline development to sustain growth amid intensifying competition.

Key Takeaways

- The allergy therapeutics market is driven by increasing allergen prevalence, with non-sedating antihistamines like XYZAL maintaining steady demand.

- Patent expirations have introduced generic competition, exerting downward pressure on prices and revenue streams.

- Strategic formulation innovations and pipeline development are critical to extending the product’s financial life cycle.

- Emerging markets present significant growth opportunities; successful penetration hinges on local regulatory navigation and affordability strategies.

- Long-term success requires balancing cost efficiencies with investments in R&D, digital engagement, and strategic alliances.

Frequently Asked Questions

1. How has XYZAL’s market share changed post-patent expiry?

Following patent expiration, XYZAL experienced market share erosion due to increased availability of generic levocetirizine. However, brand loyalty, clinical advantages, and new formulations have helped maintain a significant presence, especially in niche segments.

2. What are the primary competitors to XYZAL, and how do they compare?

Main competitors include cetirizine (Zyrtec), loratadine (Claritin), and fexofenadine (Allegra). XYZAL is often favored for its longer duration of action and anti-inflammatory properties but faces stiff price competition from generics of these agents.

3. Which markets offer the most growth potential for XYZAL?

Emerging economies in Asia-Pacific, Latin America, and the Middle East present substantial growth potential due to rising allergy prevalence and expanding healthcare access.

4. How can pharmaceutical companies prolong XYZAL’s revenue trajectory?

By developing extended-release formulations, seeking new indications, forming strategic partnerships, and investing in digital health initiatives to improve adherence and brand engagement.

5. What are the main risks affecting XYZAL’s future profitability?

Patent cliffs, intensifying generic competition, reimbursement pressures, regulatory delays, and emergent biologic therapies targeting allergy mechanisms pose ongoing risks to profitability.

Sources

[1] Global Allergy Market Analysis, MarketResearch.com, 2022.