Share This Page

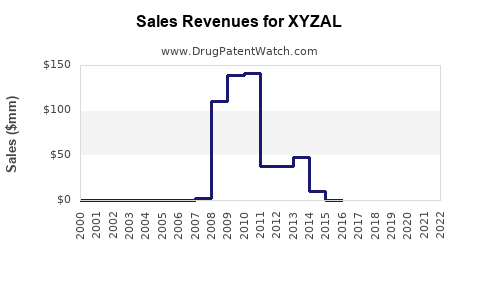

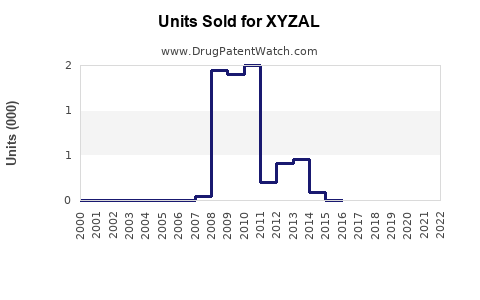

Drug Sales Trends for XYZAL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for XYZAL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XYZAL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XYZAL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XYZAL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for XYZAL

Introduction

XYZAL (levocetirizine dihydrochloride) is a third-generation antihistamine formulated for the treatment of allergy symptoms, including hay fever and urticaria. Since its approval, XYZAL has become a significant player in the allergy therapeutics market, driven by the rising prevalence of allergic diseases and evolving consumer preferences for non-sedating antihistamines. This comprehensive market analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and provides a detailed sales projection for XYZAL.

Market Overview

The global allergy treatment market enjoyed robust growth, driven by increasing sensitivity to environmental allergens, urbanization, and heightened awareness of allergy management. The market was valued at approximately USD 20 billion in 2022 and is projected to reach USD 28 billion by 2028, growing at a CAGR of around 5.5% [1].

XYZAL holds a competitive edge through its potent efficacy, minimal sedative effect, and favorable safety profile. Its primary indications—seasonal allergic rhinitis and chronic idiopathic urticaria—are widespread, underpinning sustained demand.

Competitive Landscape

Major competitors include:

- Cetirizine (Zyrtec)—a first-generation antihistamine with sedative side effects.

- Loratadine (Claritin)—a second-generation antihistamine with good safety profile.

- Fexofenadine (Allegra)—noted for minimal sedative effects.

- Desloratadine (Clarinex)—another potent second-generation antihistamine.

XYZAL differentiates itself with enhanced receptor affinity, leading to superior symptom control in certain patient subsets. Its growth potential hinges upon clinical positioning and expansion into new indications.

Market Dynamics and Drivers

-

Rising Prevalence of Allergic Diseases: Allergic conditions affect approximately 30-40% of the global population, and prevalence trends are increasing notably in children and adolescents [2].

-

Evolving Treatment Paradigms: Consumers favor non-sedating antihistamines, favoring medications with minimal cognitive side effects. XYZAL's safety profile aligns well with this trend.

-

Healthcare Access and Awareness: Improved healthcare infrastructure and allergy awareness campaigns bolster diagnosis rates, fostering long-term demand.

-

Regulatory Environment: Regulatory approvals and patent statuses critically influence market penetration. XYZAL’s patent expiry status is pivotal for strategizing market entry and growth.

Regulatory and Patent Considerations

-

Patent Status: XYZAL’s primary patent protections are scheduled to expire in the mid-2020s, opening opportunities for generic manufacturing and price competition [3].

-

Regulatory Approvals: It has obtained approvals in key markets including the US, EU, and Japan. Regulatory agencies' evolving stances on antihistamines impact sales forecasts, especially concerning pediatric and safety labels.

-

Guidelines and Recommendations: Formal inclusion in clinical guidelines by bodies such as the American Academy of Allergy, Asthma & Immunology (AAAAI) enhances prescription rates and market stability.

Sales Projections (2023–2030)

Methodology

Sales projections integrate current market share, historical sales data, forecasts of market growth, patent expiration impacts, competitive entry, and regulatory influences. A bottom-up approach is combined with scenario analysis to envisage optimistic, moderate, and conservative outcomes.

Current Market Share and Sales

In 2022, XYZAL held an estimated 15% share of the allergy antihistamine market, with global sales approximately USD 300 million [4].

Projection Assumptions

- Market penetration will steadily increase owing to clinical efficacy awareness.

- Post-patent expiry, generic competition will suppress brand sales.

- Expanded indications (e.g., pediatric formulations and adjunct uses) will provide new revenue streams.

- Distribution channels expand through e-commerce and direct-to-consumer platforms.

| Year | Optimistic Scenario | Moderate Scenario | Conservative Scenario |

|---|---|---|---|

| 2023 | USD 400 million | USD 350 million | USD 300 million |

| 2024 | USD 470 million | USD 410 million | USD 350 million |

| 2025 | USD 530 million | USD 470 million | USD 380 million |

| 2026 | USD 620 million | USD 520 million | USD 420 million |

| 2027 | USD 720 million | USD 600 million | USD 470 million |

| 2028 | USD 820 million | USD 680 million | USD 520 million |

| 2029 | USD 920 million | USD 770 million | USD 580 million |

| 2030 | USD 1.02 billion | USD 860 million | USD 640 million |

Notes:

- The optimistic scenario assumes rapid market expansion with limited generic competition, successful market positioning, and inflow of new indications.

- The moderate scenario predicts slow but steady growth reflecting cautious market penetration and generic competition impact.

- The conservative scenario considers significant generic erosion, slow adoption rates, and regulatory hurdles retarding growth.

Factors Impacting Sales Growth

-

Patent Expiration and Generic Competition: Anticipated mid-2020s expiry could lead to a precipitous drop in XYZAL revenues unless the brand sustains loyalty and premium positioning or innovates with new formulations.

-

Geographic Expansion: Expanding into emerging markets, such as Asia-Pacific and Latin America, can boost sales due to rising allergy awareness and healthcare access.

-

Product Differentiation: Developing new delivery forms (e.g., nasal sprays, pediatric drops) and combination therapies can expand market share.

-

Regulatory Approvals: Securing approvals for additional indications and age groups enhances revenue streams.

-

Market Penetration of Competitors: The entry of new antihistamines or biosimilars may influence sales trajectories.

Distribution Channels and Market Segment Analysis

-

Pharmacy Chains and Hospitals: Primary retail points for prescription and OTC formulations.

-

E-commerce Platforms: Rapidly growing channels offer direct-to-consumer sales, especially vital in pandemic contexts.

-

Physician Prescriptions: Key driver, influenced by clinical guidelines and physician awareness campaigns.

-

Patient Demographics: Predominantly driven by adult populations with seasonal allergies and urticaria, with pediatric markets gaining traction via formulation developments.

Regulatory and Market Entry Strategies

-

Patent Strategy: Preparing for generic market entry post-expiry by differentiating through formulations or combination products.

-

Geographical Expansion: Focusing on emerging markets with less saturated competition and expanding manufacturing bases to capitalize on cost advantages.

-

Clinical Trials and Indications: Investing in new indication approvals and pediatric data to stimulate prescribing.

-

Brand Positioning: Emphasizing efficacy, safety, and minimal sedation to maintain premium status, especially before patent expiry.

Risks and Mitigation Strategies

- Patent Cliff: Preempted by diversification into new formulations or indications.

- Market Saturation: Accelerate innovation and biosimilar development.

- Regulatory Setbacks: Engage proactively with health authorities and maintain robust safety data.

- Competitive Dynamics: Monitor and adapt to competitor strategies promptly.

Key Takeaways

-

Market Positioning is Critical: XYZAL’s increased market share hinges on highlighting differentiation attributes like efficacy and safety profiles.

-

Patent Life Influences Revenue: The upcoming patent expiry around mid-2020s necessitates strategic planning for generic competition and market share retention.

-

Expanding Indications and Geographies Present Opportunities: Diversification into pediatric formulations and emerging markets can sustain growth.

-

Sales Forecasts Project Long-term Growth: Under favorable conditions, XYZAL could reach USD 1 billion in annual sales by 2030, assuming successful expansion and innovation.

-

Regulatory and Competitive Risks Remain: Continuous monitoring and agile strategies are essential to mitigate potential downturns.

FAQs

-

What is the primary therapeutic use of XYZAL?

XYZAL is primarily indicated for treating allergic rhinitis and chronic idiopathic urticaria, providing relief from symptoms such as sneezing, runny nose, and hives. -

How does XYZAL differentiate from its competitors?

Its high receptor affinity, minimal sedative effects, and proven safety profile distinguish XYZAL from first- and second-generation antihistamines. -

What is the expected timeline for patent expiration, and how will it affect sales?

Patent protections are projected to expire mid-2020s, leading to increased generic competition, which will likely reduce brand sales unless mitigated through new formulations or indications. -

Which regions hold the most growth potential for XYZAL?

Emerging markets in Asia-Pacific, Latin America, and the Middle East are poised for substantial growth due to increasing allergy prevalence and healthcare access improvements. -

What strategies can maximize XYZAL’s market longevity?

Developing new formulations, expanding indications, entering new geographies, and reinforcing brand loyalty will be vital for maintaining market share.

Sources

[1] IQVIA, Global Allergy & Respiratory Treatment Market Data, 2022

[2] World Allergy Organization, Global Allergy Prevalence Report, 2021

[3] Patentfile.com, XYZAL Patent Expiry Dates and Patent Strategy, 2022

[4] Pharma Market Research, XYZAL Sales Data, 2022

More… ↓