Last updated: July 27, 2025

Introduction

Xenical (orlistat) stands as a flagship pharmaceutical in the realm of weight management and obesity treatment. Since its initial approval, Xenical's market dynamics and financial trajectory have reflected evolving healthcare trends, regulatory landscapes, and competitive pressures. This analysis delineates the key factors driving its market performance, revenue streams, challenges, and opportunities shaping its future.

Historical Context and Product Overview

Developed by Roche, Xenical (generic name: orlistat) was approved by the FDA in 1999 as a prescription anti-obesity drug. It operates primarily through gastrointestinal lipase inhibition, reducing fat absorption and thereby contributing to weight loss. As an anti-obesity agent, it has targeted a significant global health concern, given rising obesity prevalence, which, per WHO estimates, affected over 650 million adults worldwide as of 2016[1].

Xenical's status as a pioneer anti-obesity drug delayed the entry of newer pharmacotherapies but also established a robust market presence, especially within prescription drug sectors.

Market Dynamics

Global Obesity Crisis Fueling Demand

The expanding obesity epidemic has driven demand for pharmacological interventions like Xenical. In 2020, obesity prevalence increased in many nations, with the U.S. reporting over 42% of adults classified as obese[2]. This trend sustains the need for effective weight management drugs, directly influencing Xenical's sales volume.

Regulatory Landscape and Market Penetration

Regulatory approvals shape market access. Xenical maintains approval in multiple regions, strengthening its global footprint. However, regulatory bodies like the European Medicines Agency (EMA) have introduced restrictions and guidelines emphasizing lifestyle modifications combined with pharmacotherapy, influencing prescribing practices[3].

Market penetration varies by geography; developed markets with higher healthcare expenditure and obesity awareness exhibit higher prescription rates, contrasting with emerging economies where affordability and healthcare access limit sales.

Competitive Environment

Xenical faces competition from newer drugs such as Qsymia (phentermine/topiramate), Saxenda (liraglutide), and Wegovy (semaglutide), which offer enhanced efficacy or different mechanisms. Additionally, over-the-counter availability of orlistat in some markets (e.g., Alli in the U.S., lower-dose version of Xenical) expands accessibility but compresses premium pricing opportunities.

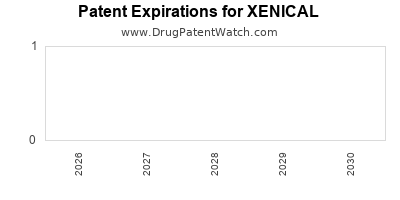

The competitive landscape pressures Xenical to innovate or reposition, especially considering patent expirations and the entrance of generic equivalents.

Reimbursement and Pricing Pressures

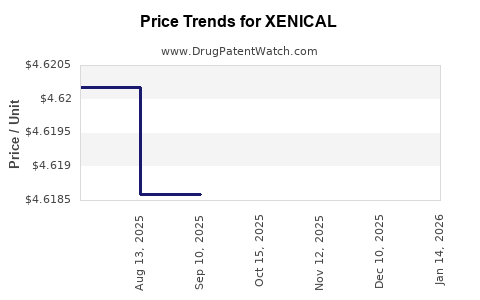

Reimbursement policies significantly influence sales trajectories. Many health insurers require prior authorization and evidence of failure with lifestyle interventions for coverage, tempering immediate demand. Pricing pressures, driven by cost-containment imperatives, have led to negotiations, discounts, and increased generic competition, impacting profit margins.

Financial Trajectory

Revenue Trends

Xenical's revenues peaked during early 2000s owing to its market monopoly as the leading anti-obesity drug. However, subsequent patent expiry, generic penetration, and the ascent of newer therapies have caused a decline in sales.

According to IQVIA data, Roche’s global sales of Xenical declined from over $400 million annually in the early 2010s to approximately $150 million in recent years[4]. The emergence of over-the-counter orlistat products further segments the market, reducing brands' control over distribution channels.

Profitability and Cost Structure

The cost structure for Xenical includes R&D, manufacturing, regulatory compliance, and marketing. Post-patent expiry, generic manufacturers offer orlistat at lower prices, compressing profit margins for brand-name producers. Roche has shifted focus onto newer pipeline drugs and biosimilars to sustain revenue flows.

Emerging Trends and Future Outlook

Market Expansion and Biosimilars

Although biosimilars are less relevant for small-molecule drugs like Xenical, adjacent trends include combination therapies and personalized medicine approaches that could supplement anti-obesity treatments. Developing countries exhibit growth potential owing to escalating obesity rates and increasing healthcare expenditure.

Regulatory & Clinical Pipeline Developments

Future market growth hinges on regulatory approvals for expanded indications and evidence from clinical trials demonstrating superior efficacy or safety profiles. Xenical’s positioning may be affected by emerging therapies demonstrating weight loss advantages with fewer side effects.

Digital Health Integration and Patient Engagement

Incorporating digital therapeutics could enhance adherence, efficacy, and monitoring, creating new value propositions for established drugs like Xenical. However, competition from app-based interventions and lifestyle modifications remains intense.

Challenges Faced by Xenical

- Patent expirations and generic competition: Lowering prices and constraining margins (e.g., Abbott’s Alli).

- Adverse effect profile: Gastrointestinal discomfort can impact patient compliance.

- Limited efficacy and safety concerns: Compared to newer agents with more favorable profiles.

- Market saturation: Especially in mature markets.

Opportunities and Strategic Directions

- Repositioning in combination therapies: Partnering with other agents to enhance efficacy.

- Expanding indications: Exploring obesity-related comorbidities such as diabetes or metabolic syndrome.

- Market expansion in emerging economies: Leveraging increasing obesity prevalence.

- Patient-centric innovations: Digital adherence tools and personalized dosing.

Key Takeaways

- The global obesity epidemic remains a primary driver for weight-loss pharmacotherapy demand, sustaining a baseline market for drugs like Xenical.

- Patent expiry and the rise of generics have markedly reduced revenue, compounded by competition from newer therapeutics offering superior efficacy and safety.

- Market penetration varies globally, with developed nations maintaining higher sales due to reimbursement mechanisms and healthcare infrastructure.

- Future growth hinges on strategic repositioning, leveraging regulatory approvals, and integrating innovative delivery methods.

- Roche’s focus appears to shifting toward emerging therapies, potentially relegating Xenical to a declining or niche segment unless significant repositioning strategies are implemented.

FAQs

-

What are the main clinical indications for Xenical?

Xenical is primarily indicated for weight management in obese or overweight adults when used alongside a reduced-calorie diet and exercise.

-

How does the competition impact Xenical’s market share?

Competition from newer agents like liraglutide and semaglutide, which demonstrate greater weight loss efficacy, has eroded Xenical’s market share, especially in markets where newer drugs are reimbursed.

-

Are there any upcoming regulatory changes that could affect Xenical?

Evolving guidelines emphasizing comprehensive lifestyle management and new obesity pharmacotherapies may influence prescribing patterns, though Xenical's existing approvals remain stable in many regions.

-

What strategies could extend Xenical’s market life?

Repositioning through combination therapies, expanding indications, leveraging digital health tools, and targeting underserved markets could prolong its relevance.

-

Is over-the-counter orlistat a significant threat to prescription Xenical?

Yes; lower-cost OTC versions (e.g., Alli) increase market accessibility, reducing prescription revenues but also expanding overall use.

References

[1] World Health Organization. Obesity and Overweight. Fact Sheet. 2016.

[2] CDC. Adult Obesity Prevalence Maps. 2020.

[3] EMA. Guideline on Obesity Management. 2020.

[4] IQVIA. Global Prescription Sales Data. 2022.