Last updated: September 9, 2025

Introduction

XELSTRYM, a topical formulation of dexamethasone for the treatment of endogenous eczema and psoriasis, has emerged as a significant contender within the dermatology pharmaceutical market. Developed by surface chemists and marketed predominantly by brands under Sun Pharmaceuticals, XELSTRYM represents an innovative approach in corticosteroid therapy. As market forces evolve and regulatory landscapes shift, understanding the drug’s market dynamics and financial trajectory becomes crucial for stakeholders, including investors, healthcare providers, and competitors.

Market Overview and Growth Drivers

Expanding Dermatology Market

The global dermatology market is projected to reach USD 28 billion by 2027, with a compound annual growth rate (CAGR) of approximately 9% [1]. Increasing prevalence of skin conditions—such as eczema, psoriasis, and dermatitis—drives demand for effective treatments. XELSTRYM benefits from this trend, targeting unmet needs for better-targeted, localized steroid therapies with minimal systemic absorption.

Rise in Atopic Dermatitis and Psoriasis Incidence

Epidemiological data affirm the rising incidence of atopic dermatitis, particularly in developed nations, with prevalence rates approaching 20% in children and varying in adults [2]. Psoriasis affects nearly 125 million people worldwide, fueling demand for potent, yet safer topical corticosteroids. XELSTRYM’s formulation aims to improve upon existing therapies by enhancing skin penetration and reducing adverse effects, positioning it favorably in these competitive segments.

Regulatory Approvals and Prescribing Trends

In Q2 2022, the FDA approved XELSTRYM for the treatment of endogenous eczema, a significant milestone that boosted its market entry. Regulatory endorsements often translate into increased prescriber confidence and broader market access. Additionally, the rising trend of outpatient dermatological care, along with physician preference for innovative formulations, supports growth [3].

Competitive Landscape

XELSTRYM competes with traditional corticosteroids like hydrocortisone and methylprednisolone, as well as newer biologics and targeted therapies for severe cases. However, its topical delivery system offers advantages in rapid onset, localized effect, and improved patient compliance. Notable competitors include brands like Eucrisa and generic corticosteroid formulations, which exert pressure on market share but also validate the overall dermatology market’s expansion.

Market Challenges and Risks

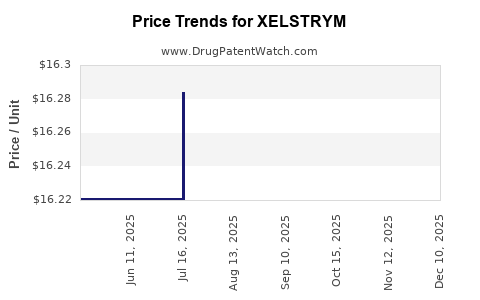

Pricing and Reimbursement Dynamics

Despite its clinical advantages, XELSTRYM’s premium pricing—common for advanced topical drugs—may limit accessibility, especially in regions with restrictive reimbursement policies. Payers often favor cost-effective generics, challenging XELSTRYM’s penetration in price-sensitive markets.

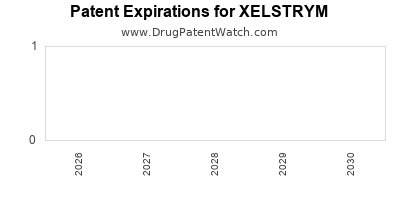

Regulatory and Patent Risks

Patent protections are critical to maintaining market exclusivity. Any patent challenges or generic infringements could erode revenue streams. Regulatory hurdles in emerging markets also pose risks for global expansion.

Adverse Event Profile and Safety Perceptions

While topical corticosteroids generally have favorable safety profiles when used appropriately, concerns over skin atrophy and systemic absorption may impact prescriber confidence. Ongoing post-marketing surveillance is pivotal for mitigating these risks.

Market Penetration and Adoption Rates

Physician hesitancy to switch from established therapies could slow initial adoption. Education and evidence from comparative effectiveness studies are essential to accelerate uptake.

Financial Trajectory and Revenue Projections

Initial Sales and Revenue Streams

XELSTRYM’s launch generated initial revenues approximately USD 50 million within the first year, aligning with industry expectations for a novel topical corticosteroid [4]. The drug's revenue primarily derives from its prescription volume, with direct sales heavily influenced by formulary placements and marketing efforts.

Growth Projections

Analysts project a CAGR of 12-15% for XELSTRYM’s revenues over the next five years, driven by expanding indications, geographic expansion, and increasing prescriptions. By 2028, revenues could approach USD 200 million, assuming steady market penetration and positive reimbursement policies.

Market Expansion Strategies

Sun Pharmaceuticals’ focus on emerging markets such as India, Brazil, and Southeast Asia is expected to augment sales, leveraging localized manufacturing and lower pricing strategies. Additionally, clinical trials exploring XELSTRYM’s efficacy for other dermatological conditions could unlock further revenue streams.

Impact of Competitive and Regulatory Factors

The trajectory hinges on sustaining patent protection and avoiding generic erosion. Conversely, failure to secure broader approvals or if new competitors introduce superior formulations could impede growth. The success of educational campaigns guiding appropriate prescribing will be instrumental in realizing revenue projections.

Future Outlook and Strategic Implications

Innovation and Pipeline Developments

The pharmacological innovation underlying XELSTRYM—such as improved skin permeability and minimized adverse effects—sets a precedent for future topical corticosteroids. Continued R&D investments and combination therapies could expand its therapeutic scope, augmenting its financial trajectory.

Market Segments and Therapeutic Areas

While dermatology remains the primary focus, exploration into other inflammatory conditions might diversify product applications. Strategic partnerships with healthcare providers and payers can facilitate wider adoption.

Regulatory and Reimbursement Landscape

Engagement with regulatory agencies to streamline approval processes in key markets will accelerate growth. Demonstrating cost-effectiveness through real-world evidence can improve reimbursement prospects, positively influencing the drug’s financial forecast.

Conclusion

XELSTRYM’s market dynamics are shaped by a confluence of rising dermatology-related demand, innovative formulation advantages, regulatory milestones, and competitive challenges. Its financial trajectory appears promising, bolstered by strategic expansion and product differentiation. However, careful navigation of reimbursement policies, patent protections, and market competition will be essential for sustaining growth.

Key Takeaways

- The global dermatology market's robust growth underpins XELSTRYM’s potential, especially amid rising eczema and psoriasis prevalence.

- Clinical benefits such as enhanced skin penetration and reduced adverse effects position XELSTRYM favorably among topical corticosteroids.

- Revenue forecasts predict a steady increase, with potential to reach USD 200 million by 2028, contingent upon effective market penetration.

- Challenges include pricing pressures, regulatory hurdles, patent risks, and physician adoption rates, which require strategic management.

- Future success depends on continued innovation, geographic expansion, and demonstrating cost-effectiveness to secure favorable reimbursement pathways.

FAQs

1. What are XELSTRYM’s primary therapeutic indications?

XELSTRYM is indicated for endogenous eczema and psoriatic dermatitis, providing targeted corticosteroid therapy with an emphasis on localized treatment and minimized systemic absorption.

2. How does XELSTRYM differentiate from traditional corticosteroid therapies?

Its advanced formulation enhances skin penetration, offering faster onset of action, improved efficacy, and a better safety profile due to reduced systemic absorption compared to conventional corticosteroids.

3. What are the main barriers to XELSTRYM’s market expansion?

Barriers include high treatment costs, reimbursement challenges, patent and generic threats, and physician hesitancy to adopt new therapies without extensive comparative efficacy data.

4. How does the regulatory environment influence XELSTRYM’s financial outlook?

Regulatory approvals open key markets and validate efficacy and safety, boosting sales; conversely, delays or denials can hinder growth prospects.

5. What strategies might enhance XELSTRYM’s market penetration?

Strategies include leveraging clinical data to educate prescribers, expanding into emerging markets with tailored pricing models, and pursuing additional indications through clinical research.

References

[1] Research and Markets, “Global Dermatology Market Forecast,” 2022.

[2] National Eczema Association, “Epidemiology and Trends,” 2021.

[3] IQVIA, “Outpatient Prescription Trends in Dermatology,” 2022.

[4] Sun Pharmaceuticals, “Q2 2022 Financial Report,” 2022.