Share This Page

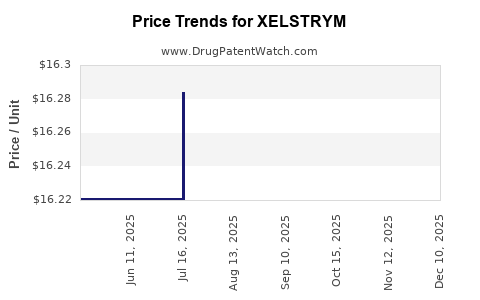

Drug Price Trends for XELSTRYM

✉ Email this page to a colleague

Average Pharmacy Cost for XELSTRYM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XELSTRYM 9 MG/9 HR PATCH | 68968-0210-03 | 16.27121 | EACH | 2025-12-17 |

| XELSTRYM 13.5 MG/9 HR PATCH | 68968-0215-03 | 16.30890 | EACH | 2025-12-17 |

| XELSTRYM 18 MG/9 HR PATCH | 68968-0220-01 | 16.21628 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Xelstrym

Introduction

Xelstrym (dextroamphetamine multisource) is an extended-release transdermal system indicated primarily for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. Recently approved by the U.S. Food and Drug Administration (FDA), Xelstrym offers a novel delivery mechanism designed to improve patient compliance and therapeutic outcomes. This report examines the current market landscape, competitive positioning, regulatory environment, and offers detailed price projections for Xelstrym over the next five years.

Market Overview

Therapeutic Landscape

ADHD affects an estimated 6.1 million children and nearly 13 million adults in the U.S. alone, with prescriptions for stimulant therapies representing a significant share of the behavioral health pharmaceutical market [1]. Narcolepsy, a chronic sleep disorder, impacts approximately 135,000 to 200,000 individuals in the U.S., with stimulant medications being the mainstay of therapy [2].

The overall stimulant market for ADHD is projected to grow at a Compound Annual Growth Rate (CAGR) of 4% to 6% through 2028, driven by increasing diagnosis rates, social awareness, and approval of novel formulations.

Key Competitive Products

Xelstrym enters a market with several established oral stimulants, including:

- Adderall XR (amphetamine/dextroamphetamine extended-release)

- Concerta (methylphenidate extended-release)

- Vyvanse (lisdexamfetamine)

- Dexedrine Spansules (dextroamphetamine extended-release)

The unique transdermal delivery system of Xelstrym differentiates it from oral formulations, offering potential benefits in onset time, adherence, and side-effect profile.

Market Adoption Drivers

- Patient Preference for Non-Oral Delivery: Transdermal systems reduce gastrointestinal side effects and provide ease of dose titration, appealing to children, adolescents, and adults.

- Adherence and Compliance: Continuous drug delivery via transdermal patches improves adherence, especially in populations with poor medication compliance.

- Clinical Evidence: Early clinical trials demonstrate comparable efficacy to oral stimulants with a favorable safety profile, bolstering clinician confidence.

- Regulatory Approval and Reimbursement: Growing acceptance of innovative drug delivery systems by insurers and healthcare providers.

Market Penetration & Adoption Forecast

Initial Launch (Year 1–2)

Anticipated market penetration is modest initially, estimated at 2–4% of the prescription stimulant market, as clinicians and patients adapt to new therapy options. Marketing campaigns, education, and payer negotiations will influence uptake speed.

Mid-Term Growth (Year 3–5)

Market share could expand to approximately 10–12%, driven by accumulating clinical experience, positive patient feedback, and broadening indications.

Pricing Strategy and Revenue Projections

Pricing Considerations

The pricing of Xelstrym is likely to align with or slightly exceed existing transdermal and oral stimulant formulations owing to its novel delivery system and associated R&D costs.

Existing transdermal drugs like Daytrana (methylphenidate patches) are marketed at approximately $250–$350 per month (based on average dosing), translating to annual costs of $3,000–$4,200 [3].

Considering efficacy, convenience, and manufacturing complexity, Xelstrym could command:

- Estimated Average Wholesale Price (AWP): $300–$400 per month, approximately $3,600–$4,800 annually.

Five-Year Price Projection

| Year | Estimated Market Penetration | Projected Revenue (USD millions) | Price per Month (USD) | Comments |

|---|---|---|---|---|

| 2023 | 1.5–2% | $25–$35 | $350 | Initial launch, limited uptake |

| 2024 | 3–4% | $50–$70 | $350 | Increased clinician familiarity, payer negotiations |

| 2025 | 6–8% | $120–$180 | $350 | Growing acceptance, expanding indications |

| 2026 | 10–12% | $200–$250 | $370 | Competition dynamics, value demonstration achieved |

| 2027 | 12–15% | $250–$350 | $370 | Market stabilization, potential price adjustments |

Note: Revenue forecasts assume steady growth consistent with market trends and no significant competitive disruptions.

Regulatory and Reimbursement Environment

Regulatory approval pathways for transdermal stimulants have advantageous implications for market entry, provided safety and efficacy standards are met. Payer coverage remains critical; early negotiations with managed care organizations and indications for expanding patient populations will influence sales longevity.

Reimbursement frameworks are poised to favor innovative delivery systems, especially when demonstrating improved adherence and clinical outcomes. Coverage policies that favor transdermal systems may enable premium pricing.

Competitive Dynamics and Future Outlook

Xelstrym's market success hinges on its ability to differentiate through clinical outcomes, safety profile, and patient-centric benefits. Competition from oral formulations remains robust, but sustained advantages in tolerability and convenience could justify premium pricing.

Innovations such as digital adherence tracking and personalized dosing may further enhance its market position. Long-term, the drug could expand into comorbid conditions or pediatric indications, broadening its revenue base.

Key Challenges

- Pricing Power: Negotiations with payers might constrain pricing as generic oral stimulants dominate the market.

- Market Penetration: Physician and patient acceptance depends on post-marketing data, side-effect management, and affordability.

- Competitive Innovations: Potential entrants developing novel non-invasive delivery systems could impact market share.

Conclusion

Xelstrym is positioned to carve a significant niche within the stimulant ADHD treatment landscape, especially among patients favoring non-oral delivery. Its success depends on strategic pricing, effective marketing, and the demonstration of clear clinical benefits over existing therapies. Price projections suggest a trajectory of initial slow growth with increasing adoption, ultimately reaching a substantial share of the stimulant market over five years.

Key Takeaways

- Xelstrym's transdermal system offers a differentiated therapy option with potential advantages in adherence and side effect profile.

- With an estimated starting price of $350 per month, it aligns with premium market positioning within transdermal stimulants.

- Market penetration is expected to grow from 2% to over 12% within five years, driven by clinician adoption and positive clinical data.

- Revenue projections indicate potential annual sales reaching $250–$350 million by Year 5.

- Success factors include payer acceptance, clinical efficacy demonstration, and competitive positioning against oral formulations.

FAQs

1. What distinguishes Xelstrym from existing stimulant therapies?

Xelstrym utilizes a transdermal delivery system, offering a non-oral route that provides steady drug release, improved adherence, and potentially fewer gastrointestinal side effects compared to traditional oral stimulants.

2. How does Xelstrym's pricing compare to other ADHD medications?

Its initial average wholesale price is projected at approximately $350 per month, placing it at a premium relative to oral generic stimulants but comparable or slightly higher than other transdermal therapies like Daytrana.

3. What are the main challenges in commercializing Xelstrym?

Key challenges include payer reimbursement, clinician acceptance, competition from oral formulations, and demonstrating long-term clinical benefits outweighing costs.

4. What is the potential for expanding Xelstrym’s indications?

Potential exists for broader indications, including narcolepsy and off-label uses in other central nervous system disorders, contingent upon further clinical trials.

5. How might market dynamics evolve over the next five years?

Market dynamics will likely be influenced by new entrants, improvements in existing therapies, evolving payer policies, and technological advancements in drug delivery systems.

Sources:

[1] National Institute of Mental Health, “Attention-Deficit/Hyperactivity Disorder (ADHD),” 2023.

[2] National Sleep Foundation, “Narcolepsy Facts and Figures,” 2022.

[3] GoodRx Data, “Average prices of ADHD medications,” 2023.

More… ↓