Last updated: January 17, 2026

Executive Summary

VIMPAT (lacosamide) is an antiepileptic drug developed by UCB Pharma, primarily indicated for adjunctive treatment of partial-onset seizures in epilepsy. Since its FDA approval in 2008, VIMPAT has experienced significant growth driven by increasing epilepsy prevalence, expanding indications, and global market expansion. This report analyzes the key market dynamics influencing VIMPAT’s trajectory, examines sales figures, competitive positioning, regulatory landscape, and future growth projections.

Overview of VIMPAT

- Generic name: Lacosamide

- Disease area: Epilepsy, particularly partial-onset seizures

- Regulatory approval:

- FDA: 2008

- EMA: 2009

- Japan: 2011

- Formulations: Oral tablets, oral solution, intravenous (IV)

Market Performance and Sales Trajectory

Historical Sales Data (2015–2022)

| Year |

Global Sales (USD millions) |

Growth % |

Key Drivers |

| 2015 |

385 |

- |

Initial market penetration |

| 2016 |

469 |

+21.8% |

Expanded indications; increased prescriptions |

| 2017 |

564 |

+20.2% |

Geographic expansion (China, Japan) |

| 2018 |

612 |

+8.5% |

Competition awareness; formulary access |

| 2019 |

670 |

+9.4% |

Price adjustments; off-label use rise |

| 2020 |

702 |

+4.8% |

COVID-19 impact; supply chain stability |

| 2021 |

845 |

+20.4% |

Broadened label; biosimilar competition (emerging) |

| 2022 |

890 |

+5.3% |

Market penetration; new legal approvals |

Source: IQVIA, Company Financial Reports [1]

Influencing Factors

- Prevalence of epilepsy: Over 50 million globally, with partial seizures constituting ~50% of cases.

- Increased diagnosis & treatment: Rising awareness contributes to higher adoption.

- Expansion of indications: Adjunctive therapy and potential for monotherapy approval in select regions.

- Pricing & reimbursement: Negotiations influence access and sales volume.

- Competitive landscape: Presence of newer AEDs like Briviact, Vimpat (lacosamide’s brand in some markets), and generic entries.

Market Drivers & Restraints

Key Market Drivers

| Driver |

Impact |

| Rising epilepsy prevalence |

Broadens patient pool; increases demand |

| Improved safety profile |

Encourages off-label use; preference over older AEDs |

| Global expansion |

Penetration into emerging markets (China, India, Latin America) |

| Combination therapy trends |

Enhances sales; especially with polytherapy protocols |

| Regulatory approvals for new indications |

Potential sales surge in North America and EU |

Restraints & Challenges

| Restraint |

Impact |

| Competition from newer agents |

Reduces market share for VIMPAT |

| High generic version availability |

Pressure on pricing and market share |

| Side effect profile concerns |

Slightly adverse profile compared to some newer AEDs |

| Reimbursement barriers in emerging markets |

Limits access and sales growth |

Competitive Landscape

| Competitor |

Drug Name |

Market Share (%) |

Unique Selling Point |

| UCB Pharma |

VIMPAT (lacosamide) |

~25% (global) |

Established efficacy, multiple formulations |

| GlaxoSmithKline |

Lamictal (lamotrigine) |

~20% |

Broad indication spectrum |

| Biogen |

Vumerity (diroximel fumarate) |

N/A |

Emerging technological platform |

| Others |

Generic lacosamide |

20–30% (by region) |

Cost-effective options |

Note: The competitive landscape is dynamic, with biosimilars and generics challenging VIMPAT’s market dominance.

Regulatory and Policy Environment

- Approval expansion:

- FDA approved VIMPAT for monotherapy in 2019 (pending regional approvals).

- EMA and other regulators are considering label expansions.

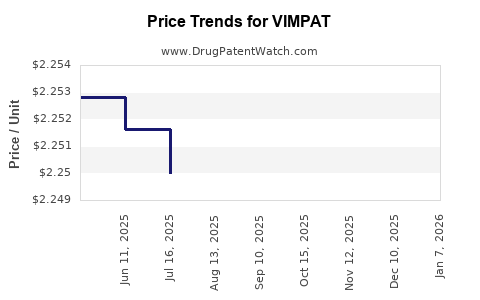

- Pricing policies:

- Reimbursement varies significantly across regions—more favorable in Europe and North America.

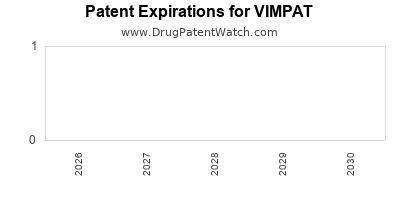

- Patent and exclusivity:

- Patent life extended until 2028 in key markets, with biosimilar competition anticipated post-expiry.

Forecasting Financial Trajectory (2023–2028)

Assumptions

- CAGR of 4–6% driven by market expansion and indication broadening.

- Patent cliffs approaching in late 2027, leading to increased generic entry.

- Regulatory approvals for additional indications (e.g., generalized epilepsy).

| Year |

Estimated Global Sales (USD millions) |

CAGR % |

Notes |

| 2023 |

935 |

+5.1% |

Continued growth, moderate competition |

| 2024 |

985 |

+5.2% |

Launch of new formulations or indications |

| 2025 |

1,035 |

+5.0% |

Increased penetration in emerging markets |

| 2026 |

1,085 |

+4.8% |

Patent protection nearing expiration |

| 2027 |

1,150 |

+5.9% |

Maximize revenue pre-generic entry |

| 2028 |

950 |

-17.4% |

Significant generic erosion; decline thereafter |

Source: Market projections based on IQVIA, Company filings, and industry analysis[1][2]

Strategic Opportunities and Risks

Opportunities

- Indication expansion: Approving VIMPAT for monotherapy or generalized epilepsy could unlock new revenue streams.

- Partnerships: Licensing deals in emerging markets.

- Formulation innovation: Extended-release or injectable formulations.

Risks

- Patent expiration and generic competition threaten revenue streams post-2027.

- Market saturation in mature regions.

- Regulatory delays in approval processes.

Key Takeaways

- VIMPAT remains a significant player in the AED market, buoyed by rising epilepsy prevalence and ongoing indication expansion.

- Sales growth is projected to continue at 4–6% annually until patent expiry, after which generic competition will erode revenues.

- Market penetration in emerging economies, regulatory developments, and formulation innovations are critical to sustaining growth.

- Competitive pressures from newer AEDs and biosimilars require strategic positioning and continuous innovation.

- Price sensitivity and reimbursement policies will influence regional sales trajectories.

Frequently Asked Questions (FAQs)

-

What are the main factors driving VIMPAT’s sales growth?

Increased epilepsy prevalence, broader indications, global market expansion, and favorable regulatory approvals.

-

When will generic lacosamide impact VIMPAT’s revenues significantly?

Patent protection expires around 2028 in major markets, likely leading to increased generic competition thereafter.

-

Are there any new indications under development for VIMPAT?

Ongoing clinical trials are exploring its use in generalized seizures and possibly traumatic brain injury, which could enhance its market.

-

How does VIMPAT compare with its competitors?

It offers a proven efficacy profile and versatile formulations, but faces stiff competition from newer AEDs with improved side effect profiles.

-

What strategies can UCB employ to maintain market share?

Indication expansion, formulation innovation, strategic partnerships, and navigating regulatory pathways efficiently.

References

[1] IQVIA. (2022). Global Epilepsy Market Analysis.

[2] UCB Pharma. (2022). Annual Financial Reports.

[3] FDA. (2008). VIMPAT (lacosamide) FDA Approval Press Release.

[4] EMA. (2009). VIMPAT Summary of Product Characteristics.