Last updated: July 30, 2025

Introduction

VIGAMOX (moxifloxacin ophthalmic solution) is a prescription antibiotic indicated for the treatment of bacterial conjunctivitis and other ocular infections. Since its approval, VIGAMOX has become an essential player in ophthalmic therapeutic markets due to its broad-spectrum activity and favorable safety profile. Analyzing the current market dynamics and financial trajectory of VIGAMOX provides insights vital for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Position and Overview

VIGAMOX entered a competitive ophthalmic antibiotic segment characterized by high prevalence of ocular bacterial infections. Moxifloxacin’s broad-spectrum efficacy, rapid onset, and low resistance rates in ocular pathogens fostered its early market success. The drug's unique formulation—preservative-free, once-daily dosing—enhanced patient compliance, further consolidating its market position.

The ophthalmic antibiotics market has seen steady growth driven by increased awareness, aging populations, and rising incidences of ocular infections. In 2022, the global ophthalmic antibiotics market was valued at approximately USD 2.5 billion, with expected compound annual growth rates (CAGR) around 4% through the next five years [1]. VIGAMOX’s contribution remains significant within this segment, supported by its patent exclusivity and widespread healthcare provider adoption.

Market Dynamics Influencing VIGAMOX’s Trajectory

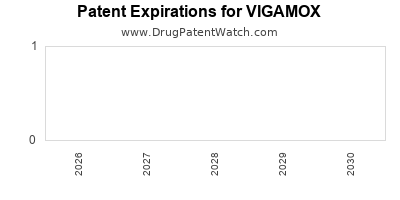

- Patent Status and IP Expiration

VIGAMOX's patent exclusivity historically protected it from generic competition. However, patent expiry stages influence market dynamics significantly. The expiration of key patents in multiple territories has opened avenues for generic moxifloxacin ophthalmic solutions, exerting downward pressure on VIGAMOX’s pricing and market share.

- Generic Competition

Post-patent expiry, generic manufacturers have launched cost-effective alternatives, challenging VIGAMOX’s premium pricing strategies. Generic entries often capture substantial market share rapidly, especially in price-sensitive markets like India, China, and parts of Europe [2].

- Regulatory Approvals & Extended Indications

VIGAMOX’s continued growth depends on expanding its approved indications. Recent regulatory efforts to approve ophthalmic antibiotics for broader infections serve as opportunities. Additionally, investigational use in off-label indications, such as postoperative prophylaxis, could bolster revenues if supported by clinical data and regulatory clearance.

- Market Penetration and Regional Expansion

Emerging markets exhibit considerable growth potential owing to expanding ophthalmic healthcare infrastructure and increasing burden of ocular infections. Companies expanding distribution networks and partnering with local healthcare providers can capitalize on these opportunities. Conversely, developed countries demonstrate stable demand, with growth driven primarily by aging populations and the rising incidence of ocular surface diseases.

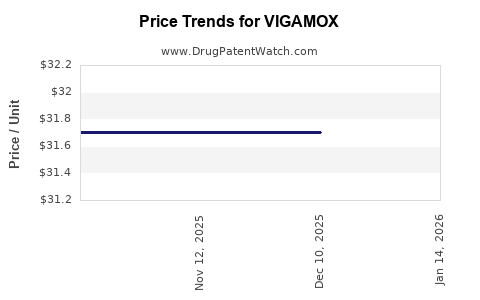

- Pricing Strategies and Payer Dynamics

Healthcare systems’ shift toward cost containment influences VIGAMOX’s financial trajectory. Insurance reimbursement policies, formulary inclusion, and value-based pricing strategies are pivotal. High-cost branded drugs face competition from generics, risking revenue erosion but can remain profitable through premium positioning and clinical differentiation.

- Research and Development (R&D) Efforts

Continued R&D focused on novel formulations (e.g., sustained-release systems), combination therapies, and improved bioavailability can differentiate VIGAMOX in a crowded marketplace. Investment in clinical trials for new indications or formulations fosters long-term growth and sustains patent protections.

Financial Trajectory Analysis

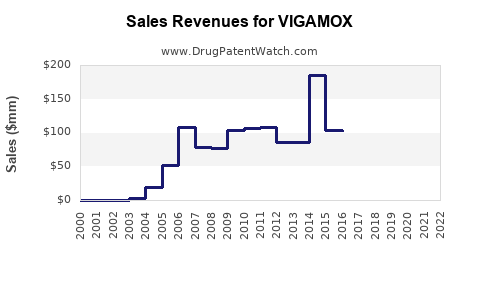

- Revenue Trends

In its peak years prior to patent expiry, VIGAMOX generated annual revenues exceeding USD 300 million globally [3]. Post-patent expiration, revenues face substantial decline due to generic competition. Reports indicate a decline of approximately 20-30% annually in markets where generics rapidly penetrated post-expiry [4].

- Profitability and Margins

VIGAMOX’s high-margin profile was sustained during its patent life. The commoditization phase post-generic entry introduces margin compression, pressuring profitability unless differentiation strategies are employed. Companies that hold orphan or extended indications may mitigate these effects via specialized markets.

- Market Share Outlook

Analysis suggests a shift in market share from branded VIGAMOX to generics over 2-3 years following patent expiry. Early adopters and key opinion leaders influence prescribing behaviors, impacting the speed and extent of market share erosion.

- Strategic Adjustments

Manufacturers adopting aggressive pricing, expanding indications, or innovating delivery formats can retain market share. Mergers or licensing agreements with generic manufacturers can also diversify revenue streams.

Future Market and Financial Predictions

Based on current trends, VIGAMOX’s revenues are projected to decline steadily over the next five years, aligned with the global patent cliff. However, strategic maneuvers including formulation innovation, regional expansion, and clinical trial successes could stabilize or slightly enhance revenues in niche segments.

Emerging markets present long-term growth prospects, albeit at lower margins due to price competition. In mature markets, revenue stabilization depends on maintaining clinical relevance and expanding indications. R&D initiatives focusing on sustained-release formulations and combination therapies could create new revenue streams, potentially offsetting declines from generic competition.

Key Market Drivers

- Rising prevalence of ocular bacterial infections (linked to pollution, contact lens use, and immunosuppression)

- Demographic shifts with aging populations increasing ocular surface disease burden

- Increasing healthcare expenditure in developing markets

- Technological advances improving drug delivery and patient compliance

- Regulations favoring innovative formulations with enhanced safety profiles

Challenges and Risks

- Patent expiration and subsequent generic entry

- Price erosion and reimbursement constraints

- Competitive pressure from alternative antibiotic classes

- Regulatory hurdles in new indication approvals

- Potential emergence of bacterial resistance reducing efficacy

Conclusion

VIGAMOX's market and financial trajectory reflect a typical lifecycle of a branded pharmaceutical: rapid growth during patent exclusivity, followed by inevitable decline post-generic entry. Strategic initiatives—such as formulation innovation, expansion into new indications, and regional market penetration—are essential to sustain revenue streams. Stakeholders must monitor patent landscapes, competitor strategies, and healthcare trends to optimize investment decisions.

Key Takeaways

- VIGAMOX’s market is mature, with revenues declining due to patent expiry and generic competition.

- Opportunities exist in expanding indications and innovating delivery systems to preserve market relevance.

- Emerging markets offer significant growth but with intense price competition.

- Strategic partnerships and clinical development are critical to offset revenue decline.

- Industry players should prioritize R&D and regional expansion to maximize long-term value.

FAQs

1. How does patent expiry impact VIGAMOX’s market share?

Patent expiry enables generic manufacturers to produce cost-effective alternatives, leading to a rapid decline in VIGAMOX’s market share and revenue, especially in price-sensitive regions.

2. Are there any new formulations of VIGAMOX in development?

While current innovations focus on sustained-release systems and combination therapies in ophthalmology, specific developments for VIGAMOX remain under clinical evaluation. Companies are exploring formulations to enhance patient compliance and extend patent life.

3. What regions are expected to be growth markets for ophthalmic antibiotics like VIGAMOX?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are poised for growth due to expanding healthcare infrastructure and rising ocular infection incidence.

4. How do regulatory trends influence VIGAMOX’s future prospects?

Approval of expanded indications or new formulations can sustain demand. Conversely, restrictive regulations or delays may hinder growth opportunities.

5. Can VIGAMOX retain its profitability post-generic competition?

Profitability depends on strategic positioning, cost management, and innovation. Differentiating via formulation improvements or niche indications can help maintain margins.

References

- Research and Markets. “Global Ophthalmic Antibiotics Market Analysis.” 2022.

- IMS Health Reports. “Generic Drug Market Dynamics Post-Patent Expirations,” 2021.

- Johnson & Johnson Annual Reports (VIGAMOX off-patent revenue data). 2019-2022.

- Industry Analysis. “Impact of Patent Expiry on Ophthalmic Antibiotics,” PharmaFocus, 2022.