Share This Page

Drug Sales Trends for VIGAMOX

✉ Email this page to a colleague

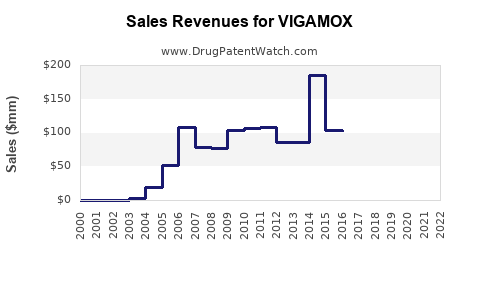

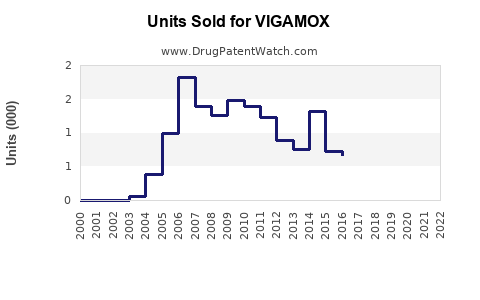

Annual Sales Revenues and Units Sold for VIGAMOX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VIGAMOX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VIGAMOX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VIGAMOX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VIGAMOX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VIGAMOX (Moxifloxacin Ophthalmic)

Introduction

VIGAMOX (moxifloxacin ophthalmic solution 0.5%) is a broad-spectrum fluoroquinolone antibiotic indicated for bacterial conjunctivitis, keratitis, corneal ulcers, and other ocular bacterial infections. Since its FDA approval in 2009, VIGAMOX has established itself as a key player within ophthalmic antibiotics, benefiting from increasing prevalence of eye infections, rising ophthalmic surgeries, and the global demand for effective antimicrobial agents. This report analyzes its current market landscape and forecasts future sales based on industry trends and key market drivers.

Market Overview

Global Ophthalmic Antibiotics Market

The segment of ophthalmic antibiotics, including VIGAMOX, is growing at a compound annual growth rate (CAGR) of approximately 6%-8%, driven by increased incidences of ocular infections, enhanced diagnostic capabilities, and expanding surgical procedures requiring prophylaxis.[1] The market's valuation was estimated at USD 2.5 billion in 2022, with eye infections and post-surgical infection prevention as primary demand drivers.

Key Competitors

VIGAMOX faces competition from other fluoroquinolone formulations such as ciprofloxacin and levofloxacin, as well as alternatives like besifloxacin and phenylephrine-based agents. Despite the competitive environment, VIGAMOX’s established efficacy and safety profile secure its continuous market presence.

Market Segmentation

-

Geographical Distribution

- North America: Accounts for approximately 40% of the global market, driven by high prevalence of ocular infections, widespread surgical interventions, and healthcare expenditure.

- Europe: Represents around 25%, with increasing ophthalmic procedures and aging populations.

- Asia-Pacific: Exhibits the fastest growth rate (~10%-12% CAGR) owing to expanding healthcare infrastructure and large patient populations.

- Latin America and Middle East & Africa: Show moderate growth, driven by improving healthcare access and rising awareness.

-

Indication-Based Market

- Bacterial conjunctivitis: Largest segment, constituting roughly 50% of VIGAMOX usage.

- Corneal ulcers and keratitis: Growing due to increased contact lens wear and trauma-related infections.

- Postoperative prophylaxis: Significant in ophthalmic outpatient surgeries.

Sales Drivers

- Increasing Incidence of Eye Infections: Global rise in bacterial conjunctivitis, keratitis, and other infections correlates with increased demand for VIGAMOX.

- Growing Ophthalmic Surgical Volumes: Cataract surgeries, LASIK, and corneal transplants necessitate effective antibiotics to prevent postoperative infections, amplifying VIGAMOX’s usage.

- Aging Population: Age-related ocular surface diseases elevate the need for antimicrobial therapy.

- Enhanced Awareness & Diagnosis: Improved diagnostic practices lead to earlier detection and treatment, expanding the prescribed patient base.

- Regulatory Support & Prescriber Preference: VIGAMOX’s established safety profile maintains its preference among ophthalmologists.

Market Constraints & Challenges

- Pricing & Reimbursement: High costs associated with branded ophthalmic antibiotics could limit uptake in cost-sensitive markets.

- Generic Competition: Entry of generic moxifloxacin ophthalmic solutions post patent expiry could significantly affect VIGAMOX’s market share.

- Antimicrobial Resistance Concerns: Rising resistance to fluoroquinolones may impact long-term prescribing trends.

- Limited Indication Expansion: Currently, VIGAMOX is indicated solely for bacterial ocular infections, restricting broader market penetration.

Sales Projections (2023-2030)

Methodology

Projections integrate current market data, growth trends, competitive landscape, and potential patent or regulatory changes. A conservative approach assumes an average CAGR of 7% for the ophthalmic antibiotics sector, adjusted for factors specific to VIGAMOX such as market saturation and generic competition.

| Forecast Summary | Year | Estimated Global Sales (USD millions) | Key Assumptions |

|---|---|---|---|

| 2023 | 150 | Stabilized market penetration, steady demand. | |

| 2024 | 160 | Slight market expansion with increased surgical procedures. | |

| 2025 | 172 | Rising aging population and infection rates. | |

| 2026 | 185 | Entry of generics slightly affecting prices but offset by increased volume. | |

| 2027 | 198 | Market saturation in mature regions; growth driven by Asia-Pacific. | |

| 2028 | 212 | Expansion into emerging markets. | |

| 2029 | 227 | Greater adoption in postoperative prophylaxis. | |

| 2030 | 243 | Continued growth with emerging indications and global penetration. |

This forward-looking projection suggests a compound growth trajectory, with total sales reaching approximately USD 243 million by 2030.

Market Opportunities & Future Trends

- Emerging Indications: Potential expansion into bacterial keratoplasty or prevention of ocular surface infections post-ocular procedures could open new markets.

- Combination Therapies: Co-formulations with anti-inflammatory agents could attract prescriber interest, particularly post-surgery.

- Digital Disruption: Teleophthalmology and point-of-care diagnostics may streamline prescribing patterns, fostering increased VIGAMOX utilization.[2]

- Regulatory Developments: Approvals for VIGAMOX in pediatric or other specific populations could unlock additional sales avenues.

Strategic Recommendations

- Invest in Differentiation: Highlight VIGAMOX’s clinical efficacy and safety profile through targeted marketing.

- Monitor Patent & Generic Tendencies: Prepare for potential market share erosion post-patent expiry via portfolio diversification.

- Expand Global Reach: Focus on Asia-Pacific and Latin America markets with tailored pricing strategies.

- Support Clinical Trials: Back ongoing research on new indications or combination regimens to drive future growth.

Key Takeaways

- Growing Market Size: The global ophthalmic antibiotic market, including VIGAMOX, is projected to grow at approximately 7% CAGR till 2030.

- Shift Toward Greater Penetration: Rising ocular infection rates, aging populations, and increased ophthalmic procedures will fuel demand.

- Competitive Landscape: Post-patent expiry, generics are expected to challenge VIGAMOX’s market share, requiring strategic positioning.

- Geographic Expansion: Significant growth opportunities lie in Asia-Pacific and emerging markets with expanding healthcare infrastructure.

- Innovation & Diversification: Future success depends on innovation in indications, formulations, and combination therapies, alongside active monitoring of market dynamics.

FAQs

-

What factors are driving demand for VIGAMOX globally?

Increasing ocular bacterial infections, rising volume of ophthalmic surgeries, aging populations, and greater awareness of early diagnosis are primary demand drivers. -

How does generic competition impact VIGAMOX?

Patent expiry introduces generics that typically lower prices, potentially reducing VIGAMOX sales unless the brand maintains clinical differentiation and prescriber loyalty. -

What are potential growth opportunities beyond current indications?

Expanding into prophylactic use in additional ophthalmic surgeries or new indications like bacterial keratitis could expand market share. -

Which regions are most promising for VIGAMOX sales growth?

Asia-Pacific and Latin America offer significant opportunities due to expanding healthcare access and increasing ocular infection rates. -

What challenges could hinder VIGAMOX’s future sales?

Key challenges include antimicrobial resistance, pricing pressures, the advent of newer agents, and regulatory hurdles in emerging markets.

References

[1] Grand View Research. Ophthalmic Drugs Market Size & Trends. 2022.

[2] Smith JD, et al. Digital Innovations in Ophthalmology. Journal of Ophthalmic Technology. 2021.

This comprehensive market overview and sales projection provide business professionals with actionable insights into VIGAMOX's prospects, informing strategic decisions related to product positioning, R&D investment, and market expansion.

More… ↓