VIBERZI Drug Patent Profile

✉ Email this page to a colleague

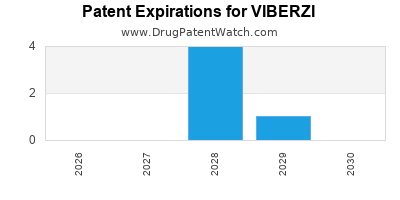

When do Viberzi patents expire, and when can generic versions of Viberzi launch?

Viberzi is a drug marketed by Abbvie and is included in one NDA. There are twenty-one patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and fifty-three patent family members in forty countries.

The generic ingredient in VIBERZI is eluxadoline. There are two drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the eluxadoline profile page.

DrugPatentWatch® Generic Entry Outlook for Viberzi

Viberzi was eligible for patent challenges on May 27, 2019.

There have been nineteen patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are two tentative approvals for the generic drug (eluxadoline), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for VIBERZI?

- What are the global sales for VIBERZI?

- What is Average Wholesale Price for VIBERZI?

Summary for VIBERZI

| International Patents: | 153 |

| US Patents: | 21 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 36 |

| Clinical Trials: | 2 |

| Patent Applications: | 300 |

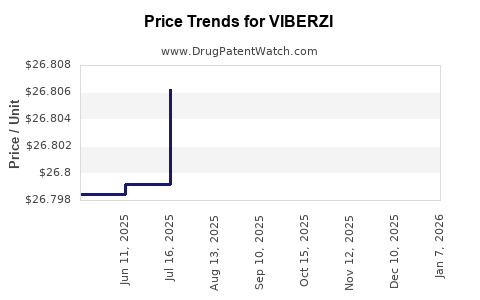

| Drug Prices: | Drug price information for VIBERZI |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for VIBERZI |

| What excipients (inactive ingredients) are in VIBERZI? | VIBERZI excipients list |

| DailyMed Link: | VIBERZI at DailyMed |

Recent Clinical Trials for VIBERZI

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Temple University | Phase 2/Phase 3 |

| University of North Carolina, Chapel Hill | Phase 2 |

| Allergan | Phase 2 |

Pharmacology for VIBERZI

| Drug Class | mu-Opioid Receptor Agonist |

| Mechanism of Action | Opioid mu-Receptor Agonists |

Paragraph IV (Patent) Challenges for VIBERZI

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| VIBERZI | Tablets | eluxadoline | 75 mg and 100 mg | 206940 | 6 | 2019-05-28 |

US Patents and Regulatory Information for VIBERZI

VIBERZI is protected by twenty-two US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | RX | Yes | Yes | 11,311,516 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | RX | Yes | Yes | 9,675,587 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | RX | Yes | Yes | 11,484,527 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | RX | Yes | Yes | 7,786,158 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | RX | Yes | Yes | 9,115,091 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-001 | May 27, 2015 | RX | Yes | No | 9,115,091 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for VIBERZI

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-001 | May 27, 2015 | 9,700,542 | ⤷ Get Started Free |

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | 7,786,158 | ⤷ Get Started Free |

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | 8,344,011 | ⤷ Get Started Free |

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-001 | May 27, 2015 | 10,213,415 | ⤷ Get Started Free |

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | 9,205,076 | ⤷ Get Started Free |

| Abbvie | VIBERZI | eluxadoline | TABLET;ORAL | 206940-002 | May 27, 2015 | 8,609,709 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for VIBERZI

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Allergan Pharmaceuticals International Limited | Truberzi | eluxadoline | EMEA/H/C/004098Truberzi is indicated in adults for the treatment of irritable bowel syndrome with diarrhoea (IBS D). | Withdrawn | no | no | no | 2016-09-19 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for VIBERZI

When does loss-of-exclusivity occur for VIBERZI?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 14241076

Patent: Opioid receptor modulator dosage formulations

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015022753

Patent: formulações de dosagens de moduladores de receptor opióide

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 06472

Patent: FORMULATIONS PHARMACEUTIQUES DE MODULATEUR DES RECEPTEURS AUX OPIOIDES (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5228629

Patent: Opioid receptor modulator dosage formulations

Estimated Expiration: ⤷ Get Started Free

Patent: 0917159

Patent: 阿片样物质受体调节剂剂型 (Opioid receptor modulator dosage formulations)

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20892

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 68351

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1559

Patent: ДОЗИРОВАННЫЕ ПРЕПАРАТЫ В КАЧЕСТВЕ МОДУЛЯТОРОВ ОПИОИДНОГО РЕЦЕПТОРА (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 1591768

Patent: ДОЗИРОВАННЫЕ ПРЕПАРАТЫ В КАЧЕСТВЕ МОДУЛЯТОРОВ ОПИОИДНОГО РЕЦЕПТОРА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 68351

Patent: FORMULATIONS PHARMACEUTIQUES DE MODULATEUR DES RÉCEPTEURS AUX OPIOÏDES (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 56321

Patent: FORMULATIONS DE DOSAGE DE MODULATEUR DU RÉCEPTEUR OPIOÏDE (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 65131

Patent: FORMULATIONS DE DOSAGE DE MODULATEUR DU RÉCEPTEUR OPIOÏDE (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 18514

Patent: 阿片受體調節劑劑型 (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 42748

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1561

Patent: פורמולציה למינון מאפנן קולטן אופיאויד (Opioid receptor modulator dosage formulations)

Estimated Expiration: ⤷ Get Started Free

Patent: 8718

Patent: פורמולציה למינון מאפנן קולטן אופיאויד (Opioid receptor modulator dosage formulations)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 49225

Estimated Expiration: ⤷ Get Started Free

Patent: 66975

Estimated Expiration: ⤷ Get Started Free

Patent: 16516694

Patent: オピオイド受容体モジュレーターの投与製剤

Estimated Expiration: ⤷ Get Started Free

Patent: 19014744

Patent: オピオイド受容体モジュレーターの投与製剤 (DOSAGE FORMULATIONS OF OPIOID RECEPTOR MODULATOR)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 68351

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 68351

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 68351

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2435440

Estimated Expiration: ⤷ Get Started Free

Patent: 150140681

Patent: 오피오이드 수용체 조절인자 투여 제제 (OPIOID RECEPTOR MODULATOR DOSAGE FORMULATIONS)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 93374

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 48071

Estimated Expiration: ⤷ Get Started Free

Patent: 1444590

Patent: Opioid receptor modulator dosage formulations

Estimated Expiration: ⤷ Get Started Free

Turkey

Patent: 1815953

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering VIBERZI around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 105228629 | ⤷ Get Started Free | |

| Lithuania | 2653465 | ⤷ Get Started Free | |

| Taiwan | 201444590 | Opioid receptor modulator dosage formulations | ⤷ Get Started Free |

| Taiwan | I648071 | ⤷ Get Started Free | |

| Denmark | 2298744 | ⤷ Get Started Free | |

| China | 111620823 | 一种化合物的新型晶体及其制备方法 (Novel crystal of compound and method for preparing same) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for VIBERZI

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1725537 | 1790007-7 | Sweden | ⤷ Get Started Free | PRODUCT NAME: ELUXADOLINE OR A PHARMACEUTICALLY ACCEPTABLE ENANTIOMER, DIASTEREOMER, RACEMATE OR SALT THEREOF; REG. NO/DATE: EU/1/16/1126 20160921 |

| 1725537 | 132017000028006 | Italy | ⤷ Get Started Free | PRODUCT NAME: ELUXADOLINE O UN ENANTIOMERO, DIASTEREOMERO, RACEMATO FARMACEUTICAMENTE ACCETTABILE O SALI DELLO STESSO(TRUBERZI); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/16/1126, 20160921 |

| 1725537 | 300865 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: ELUXADOLINE OF EEN FARMACEUTISCH AANVAARDBAAR ENANTIOMEER,DIASTEREOMEER, RACEMAAT OF ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/16/1126 20160921 |

| 2176234 | C02176234/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: ELUXADOLIN; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 66549 07.02.2018 |

| 1725537 | 309 6-2017 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: ELUXADOLIN VO VSETKYCH FORMACH CHRANENYCH ZAKLADNYM PATENTOM; REGISTRATION NO/DATE: EU/1/16/1126 20160921 |

| 1725537 | PA2017005 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ELUKSADOLINAS ARBA JO FARMACINIU POZIURIU PRIIMTINAS ENANTIOMERAS, DIASTEREOMERAS, RACEMATAS ARBA DRUSKA; REGISTRATION NO/DATE: EU/1/16/1126 20160919 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Viberzi (Eluxadoline)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.