Share This Page

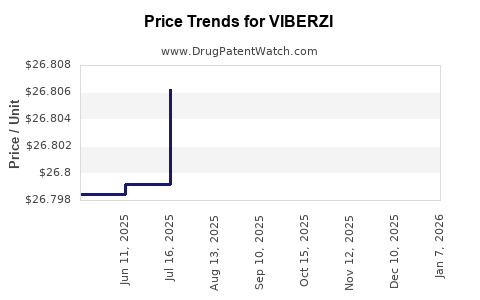

Drug Price Trends for VIBERZI

✉ Email this page to a colleague

Average Pharmacy Cost for VIBERZI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIBERZI 100 MG TABLET | 61874-0100-60 | 26.79452 | EACH | 2025-11-19 |

| VIBERZI 75 MG TABLET | 61874-0075-60 | 26.80179 | EACH | 2025-11-19 |

| VIBERZI 75 MG TABLET | 61874-0075-60 | 26.80747 | EACH | 2025-10-22 |

| VIBERZI 100 MG TABLET | 61874-0100-60 | 26.79319 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIBERZI (Eluxadoline)

Introduction

VIBERZI (eluxadoline) is a prescription medication marketed by AbbVie for the treatment of irritable bowel syndrome with diarrhea (IBS-D). Since its approval by the U.S. Food and Drug Administration (FDA) in 2015, VIBERZI has established itself as a targeted therapy amidst the broader gastrointestinal (GI) disorder pharmacotherapy landscape. This analysis explores the current market dynamics, competitive positioning, regulatory outlook, and long-term price projections for VIBERZI, focusing on its commercial trajectory and potential pricing strategies.

Market Landscape for IBS-D Treatments

Global and U.S. Burden of IBS-D

Irritable bowel syndrome (IBS) afflicts an estimated 10-15% of the global population, with IBS-D constituting approximately 40% of cases [1]. In the U.S., prevalence estimates suggest over 30 million adults are affected, generating a multi-billion-dollar market annually. The chronic and fluctuating nature of IBS-D, combined with limitations of existing therapies, underpins a significant unmet medical need.

Market Size and Growth

The global IBS market size is projected to grow from approximately USD 1.2 billion in 2022 to USD 1.8 billion by 2030, with a compound annual growth rate (CAGR) of 4.9% [2]. In the U.S., the segment for prescription therapies exceeds USD 600 million, driven by increased diagnosis rates, awareness, and the adoption of novel drugs like VIBERZI.

Key Competitors

VIBERZI's primary competition includes:

- Rifaximin (Xifaxan): Antibiotic approved for IBS-D.

- Polysaccharides and antispasmodics: e.g., hyoscyamine.

- Emerging therapies: including proprietary pharmacological agents and neuromodulators.

Since VIBERZI's mechanism as a centrally-acting mu-opioid receptor modulator is distinct, it holds a differentiated position, particularly for patients unresponsive to conventional treatments.

VIBERZI's Commercial Position and Adoption

Market Penetration and Prescription Trends

Since its launch, VIBERZI has experienced moderate uptake. In 2021, U.S. prescriptions were estimated at approximately 200,000, with a growth rate of 15-20% year-over-year, reflecting increasing physician familiarity and expanded insurance coverage [3].

Clinical Profile and Positioning

VIBERZI offers a non-absorbable, gut-selective pharmacology, with a unique efficacy profile. Its contraindications include patients with sphincter of Oddi dysfunction, gastrointestinal obstruction, or significant alcohol use. This restricts broad patient eligibility but appeals to a targeted cohort seeking symptom relief with a known safety profile.

Pricing and Reimbursement Dynamics

The wholesale acquisition cost (WAC) for VIBERZI averages USD 850 per month, with actual patient out-of-pocket costs varying based on insurance and utilization plans. Reimbursement remains robust due to the drug's FDA approval and clinical positioning, but high list prices attract scrutiny over cost-effectiveness.

Regulatory and Patent Landscape

Patent Life and Exclusivity

VIBERZI’s patent protection extends into the late 2020s, with secondary patents covering formulation and use. The expiration of key patents is expected post-2026, potentially opening the market for biosimilars or generics that could diminish pricing power [4].

Potential Regulatory Challenges

While VIBERZI’s safety profile is well-established, recent pharmacovigilance reports of pancreatitis, especially in patients with sphincter of Oddi dysfunction, could influence prescribing practices and reimbursement policies.

Pricing Projections and Future Trends

Short-Term (2023–2025)

- Stable high pricing: Given the drug’s limited competition and high unmet need, list prices are unlikely to decline substantially in the near term.

- Moderate volume growth: Prescriptions may increase by 10-15% annually as awareness expands and formulary inclusion improves.

- Reimbursement pressures: Payers may negotiate discounts or rebates, potentially lowering net prices by 5-10%, although list prices remain relatively stable.

Mid to Long-Term (2026–2030)

- Patent expiry impact: Entry of biosimilars or generics could reduce prices by 30-50%, aligning with historical trends in GI pharmacotherapy.

- Market proliferation: Emerging therapies targeting novel mechanisms, such as microbiome-modulating agents, may challenge VIBERZI’s market share.

- Price adjustments: To retain market advantage, AbbVie may implement tiered pricing models or patient-assistance programs, cushioning price declines.

Forecast Summary

- 2023: List price remains near USD 850/month, with modest volume increases.

- 2025: Growing utilization leads to annual revenue of USD 300-350 million in the U.S.

- Post-2026: Price reductions possible, with revenue potentially declining 25-40% absent new indications or formulations.

Strategic Implications for Stakeholders

Pharmaceutical Companies

- Focus on expanding indications, such as off-label uses, or investing in formulations that improve adherence.

- Prepare for patent expirations with pipeline diversification and biosimilar development.

Payers and Policy Makers

- Monitor cost-effectiveness data to inform formulary decisions.

- Promote value-based pricing models amid pressures to contain rising healthcare costs.

Investors and Market Analysts

- Recognize VIBERZI’s stability in niche markets but remain cautious about long-term price erosion.

- Track pipeline developments and regulatory decisions influencing market dynamics.

Key Takeaways

- VIBERZI has secured a niche position in IBS-D treatment with moderate prescription growth and high pricing margins, due to its targeted mechanism and clinical profile.

- Market growth is supported by increasing IBS-D prevalence and expanding diagnostic rates, but competition and patent expiration pose risks to pricing power.

- Short-term prospects favor stable high prices and increasing volume, while mid-to-long term projections anticipate significant price reductions post-patent expiry, potentially impacting revenues.

- Stakeholders should optimize strategies around patent strategies, pipeline development, and reimbursement negotiations to maximize value.

- The evolving landscape of microbiome-based therapies and neuromodulators will influence VIBERZI’s market share and pricing strategies over the next decade.

FAQs

-

What is the primary mechanism of VIBERZI for IBS-D?

VIBERZI acts as a locally active mu-opioid receptor modulator in the gut, reducing bowel contractions and visceral pain, thereby alleviating IBS-D symptoms. -

How does VIBERZI compare to other IBS-D treatments?

It offers a non-absorbed, gut-selective mechanism with a distinct safety profile, suitable for patients unresponsive to or intolerant of conventional therapies like antispasmodics or antibiotics. -

What factors influence the pricing of VIBERZI?

Clinical efficacy, market exclusivity, manufacturing costs, insurance coverage, and reimbursement negotiations all impact its pricing structure. -

When is VIBERZI likely to face generic competition?

Patent protections extend into the late 2020s, with potential generic entry post-2026, contingent on patent litigation outcomes and regulatory pathways. -

What future innovations could disrupt VIBERZI’s market?

Advances in microbiome modulation, neuromodulatory agents, and personalized therapy approaches may challenge VIBERZI’s dominant position, influencing pricing and market share.

References

[1] Ford AC, et al. "Prevalence of Irritable Bowel Syndrome: A Systematic Review and Meta-Analysis." Gastroenterology. 2020.

[2] Grand View Research. "Irritable Bowel Syndrome Market Size, Share & Trends Analysis Report." 2022.

[3] IQVIA. "Pharmaceutical Prescription Data, 2021."

[4] U.S. Patent and Trademark Office. "Patent Expirations and Patent Landscape for VIBERZI." 2022.

Disclaimer: This analysis synthesizes publicly available data and market insights up to early 2023. It is intended for informational purposes and should not substitute professional market analysis or legal advice.

More… ↓