Last updated: July 29, 2025

Introduction

Venfer (Ferric Carboxymaltose) stands as a prominent intravenous (IV) iron formulation predominantly used to treat iron deficiency anemia (IDA). Its unique pharmacokinetic profile, coupled with evolving clinical guidelines and increasing global prevalence of anemia, positions VENOFER as a critical asset within the pharmaceutical landscape. This analysis dissects the market forces influencing VENOFER’s trajectory, evaluates historical financial performance, and forecasts upcoming trends shaping its commercial destiny.

Market Overview and Key Drivers

Global Burden of Iron Deficiency Anemia

Iron deficiency anemia affects over 1.6 billion people globally, according to the World Health Organization (WHO)[1]. It is prevalent across all age groups, with heightened incidence among pregnant women, chronic kidney disease (CKD) patients, and individuals with chronic heart failure. The rising incidence directly elevates demand for effective IV iron therapies like VENOFER.

Advantages Over Oral Iron Therapy

Oral iron supplements, although first-line for mild cases, exhibit poor absorption and tolerability issues. IV iron formulations circumvent gastrointestinal side effects, enable rapid correction of deficiency, and are favored for patients with malabsorption or needs for swift repletion. VENOFER’s favorable safety profile and dosing convenience bolster its adoption, especially in hospital settings and specialized clinics.

Regulatory Approvals and Expanding Indications

Initially approved for adult iron deficiency anemia in Europe and the US, VENOFER has obtained additional regulatory clearances for use in CKD patients, chemotherapy-induced anemia, and surgical blood management. The broadening scope amplifies its market penetration.

Healthcare Infrastructure & Reimbursement Policies

Healthcare systems worldwide are increasingly integrating IV iron therapies into anemia management guidelines. Reimbursement frameworks favor pharmaceuticals offering safety, efficacy, and cost-effectiveness, enhancing their market share.

Market Dynamics & Competitive Landscape

Competitive Positioning

VENOFER's primary competitors include Ferric Gluconate, Iron Dextran, Ferumoxytol, and newer formulations like Ferric Derisomaltose. Its advantages include low hypersensitivity risk, flexible dosing regimens, and established clinical efficacy, reinforcing its standing in the IV iron segment.

Market Penetration Strategies

Manufacturers leverage clinical data demonstrating superior tolerability, expand indications, and develop companion clinical guidelines. Partnerships with healthcare providers and targeted marketing foster VENOFER’s market adoption.

Research and Development Trends

Ongoing clinical trials aim to optimize dosing protocols and explore additional indications, such as heart failure-related anemia. Technological innovations focus on improving formulation stability and patient convenience.

Financial Trajectory and Revenue Forecasts

Historical Performance

Pharma giant Vifor Pharma, which manufactures VENOFER, reported consistent revenue streams from IV iron products, with global sales in the hundreds of millions USD annually[2]. The growth trajectory aligns with increasing anemia prevalence, expanding indications, and regulatory approvals.

Market Growth Projections

The global IV iron market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7-9% from 2023 to 2030, driven by broader disease indications and emerging markets[3]. VENOFER, holding a significant market share, is poised to benefit proportionally.

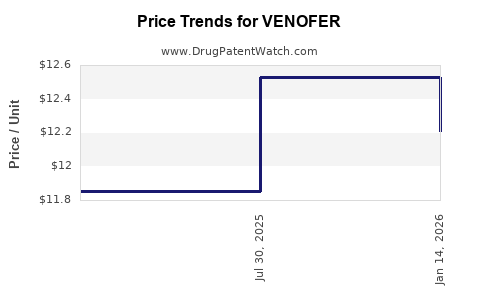

Reimbursement Impact and Pricing Strategies

Price adjustments based on regional reimbursement policies influence revenue streams. In established markets like North America and Europe, reimbursement enhances revenue stability. Conversely, emerging markets present higher growth potential but may entail pricing pressures.

Potential Disruptors

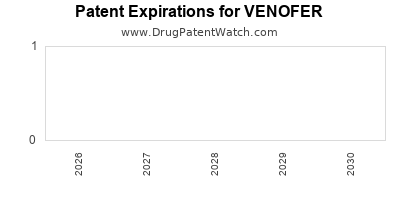

Emerging oral agents with improved bioavailability and safety could challenge IV formulations, including VENOFER. Additionally, biosimilars and generics in the pipeline may exert downward price pressures.

Financial Risks and Opportunities

Risks encompass regulatory delays, adverse safety reports, or stiffening competition. Conversely, expanding the formulation’s indications and forging strategic partnerships present growth opportunities.

Regulatory and Market Access Strategies

Maintaining proactive dialogue with regulators, demonstrating safety and efficacy through clinical data, and engaging with payers will sustain VENOFER’s market momentum. Emphasis on cost-effectiveness and real-world evidence strengthens reimbursement prospects.

Conclusion: Outlook for VENOFER

Venfer’s market standing remains robust in addressing the global anemia burden. The combination of expanding indications, increasing disease prevalence, and favorable reimbursement policies fuels its growth. Nevertheless, competitive pressures, evolving treatment paradigms, and macroeconomic factors will influence its financial trajectory. Strategic innovation and market access optimization are vital for maximizing its commercial potential.

Key Takeaways

- The escalating global burden of iron deficiency anemia strongly supports sustained demand for IV iron therapies like VENOFER.

- Its safety profile, dosing flexibility, and broadening indications underpin its competitive advantage.

- Market growth is expected to accelerate, especially in emerging markets and specialized clinics.

- Revenue potential aligns with the expanding IV iron landscape; however, competitive and regulatory factors mandate vigilant strategic planning.

- Continuous innovation and alignment with healthcare trends will be critical to VENOFER’s long-term financial success.

FAQs

Q1: How does VENOFER compare to other IV iron formulations regarding safety and efficacy?

A: VENOFER boasts a well-established safety profile, including a lower risk of hypersensitivity reactions. Efficacy in replenishing iron stores is comparable or superior due to its rapid and complete iron delivery capabilities. Its flexible dosing and fewer infusion-related adverse events position it favorably among IV iron formulations.

Q2: What are the main markets driving VENOFER’s growth?

A: North America and Europe are mature markets with stable growth driven by clinical guidelines and reimbursement structures. Emerging markets in Asia-Pacific and Latin America present high growth potential, fueled by expanding healthcare infrastructure and increasing anemia prevalence.

Q3: What future developments could impact VENOFER’s market trajectory?

A: Advances in oral iron formulations with improved tolerability may reduce dependence on IV therapy. Additionally, emerging biosimilars and novel delivery systems could introduce price competition, influencing revenue streams.

Q4: How does reimbursement influence VENOFER’s adoption and sales?

A: Favorable reimbursement policies facilitate widespread adoption, particularly in hospital and outpatient settings. Reimbursement status impacts pricing strategies and overall market penetration.

Q5: What strategies should Vifor Pharma adopt to maximize VENOFER’s market share?

A: Emphasizing clinical evidence through published studies, expanding indications, enhancing patient convenience, engaging with healthcare providers, and optimizing reimbursement negotiations are key strategies.

Sources:

[1] World Health Organization. (2021). Global prevalence of anemia.

[2] Vifor Pharma Financial Reports, 2022.

[3] Market Research Future. (2022). IV Iron Market Forecast.