Last updated: July 27, 2025

Introduction

Vandazole, known generically as metronidazole vaginal gel, is a topical antimicrobial used predominantly in the treatment of bacterial vaginosis (BV). Since its introduction, Vandazole has occupied a critical niche within the gynecological antimicrobial market. As healthcare systems evolve with an increasing focus on personalized and minimally invasive therapies, understanding the market dynamics and projected financial trajectory for Vandazole informs strategic decisions for pharmaceutical stakeholders.

Market Overview

Product Profile and Therapeutic Uses

Vandazole’s primary indication is the management of bacterial vaginosis, characterized by an imbalance of vaginal flora leading to symptoms like discharge and odor. Metronidazole, the active ingredient, exhibits broad-spectrum activity against anaerobic bacteria and protozoa, making it effective for BV and other infections such as trichomoniasis. Its topical formulation ensures targeted delivery with minimal systemic absorption, aligning with patient preferences for localized treatment.

Competitive Landscape

The market for BV treatments is highly competitive, featuring oral formulations (e.g., Flagyl, ClaraTune), topical gels, and other local therapies. Vandazole faces competition from both branded and generic metronidazole products, as well as emerging non-antibiotic therapies targeting the vaginal microbiome.

Key competitors include:

- Flagyl (metronidazole oral and topical formulations): Long-established, with widespread physician familiarity.

- Clindamycin creams and gels: Offering alternative mechanisms and potentially fewer side effects.

- New microbiome-centered therapies: Developing probiotics and targeted biologics.

Market Share and Customer Segments

Vandazole’s market share is influenced by:

- Physician prescribing preferences: Gynecologists and primary care providers often prefer proven, familiar therapies.

- Patient compliance and preferences: Topical gels are favored over oral therapy due to fewer systemic side effects.

- Insurance and reimbursement policies: Coverage influences accessibility and sales.

Market Dynamics

Regulatory Environment

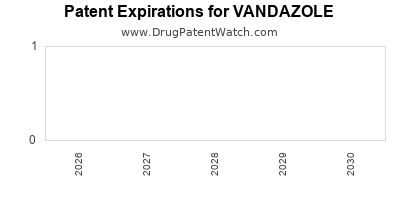

Regulatory approvals and re-approvals impact Vandazole’s market potential. The U.S. FDA’s approval process for generic metronidazole formulations, along with patent expirations, determines entry barriers and pricing strategies. While Vandazole, as a branded formulation, benefits from intellectual property protection, the entry of generics exerts downward pressure on pricing.

Demand Drivers

- Prevalence of bacterial vaginosis: Estimated at 29% among women of reproductive age globally [1]. Growing awareness and routine screening elevate demand.

- Antimicrobial resistance concerns: Rising resistance among anaerobic bacteria prompts clinicians to prefer targeted topical therapies to minimize systemic exposure.

- Patient preference for localized treatments: Due to convenience and reduced systemic side effects.

Supply Chain and Manufacturing Factors

Manufacturing costs for topical gel formulations are relatively stable; however, supply chain disruptions, especially in raw materials like active pharmaceutical ingredients (APIs), can impact availability and margins.

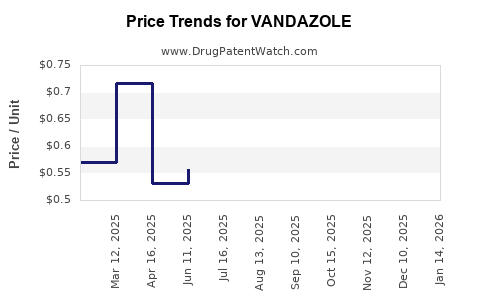

Pricing and Reimbursement Trends

Pricing strategies are crucial; while branded Vandazole commands premium pricing, increasing generic competition necessitates competitive pricing for sustained market share. Payor policies increasingly favor cost-effective therapies, incentivizing the use of generics.

Financial Trajectory

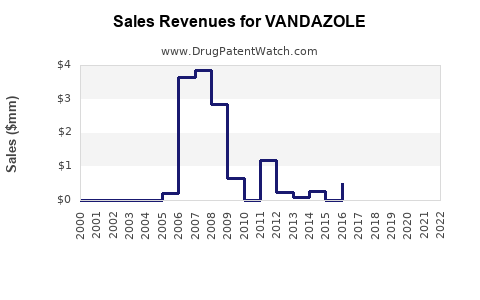

Historical Performance

As a niche product, Vandazole historically achieved steady revenues within its target demographic, supported by clinician familiarity and patent protections. However, with patent expiries and entree of generics, revenue margins likely compressed [2].

Projected Market Growth

Analysts project the global bacterial vaginosis treatment market to expand at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years, driven by rising prevalence and increased awareness [3]. Vandazole, barring major patent challenges, can expect its sales trajectory to mirror this growth but at a moderated pace due to intense generic competition.

Emerging Opportunities and Risks

- Abuse of antibiotics and resistance: Could dampen demand if alternative therapies gain favor.

- Expansion into emerging markets: Opportunities exist in Asia-Pacific and Latin America, regions experiencing rising BV prevalence.

- Innovative formulations: Potential development of sustained-release gels or delivery systems could enhance market share.

Financial Outlook

Given the landscape, the financial trajectory for Vandazole currently shows:

- Stabilized revenues in mature markets due to generic erosion.

- Growth potential through market expansion and new therapeutic indications.

- Cost pressures due to price competition and regulatory compliance.

Forecasts estimate moderate revenue declines in markets with high generic penetration but offset by growth in emerging regions and novel delivery modalities.

Market Challenges and Opportunities

Challenges

- Patent expiration and generic entry reduce profitability margins.

- Increasing antimicrobial resistance may restrict future prescriptions.

- Competition from non-antibiotic therapies and microbiome-focused solutions.

Opportunities

- Market expansion into underserved regions.

- Development of combination therapies targeting multiple vaginal microbiota factors.

- Patient-centric formulations tailored for ease of use and adherence.

Conclusion

Vandazole’s market dynamics are subject to a complex interplay of established therapeutic efficacy, competitive pressures from generics, evolving regulatory landscapes, and shifting consumer preferences. While near-term revenues face constraints due to generic erosion, strategic expansion into emerging markets, innovation in formulation, and addressing antimicrobial resistance can bolster its financial trajectory.

Key Takeaways

- The global BV treatment market offers steady growth prospects driven by increasing prevalence and awareness but faces pricing and competition challenges.

- Vandazole’s future hinges on navigating patent expirations and maintaining competitiveness amidst rising generic entries.

- Expanding into emerging markets presents significant growth opportunities, particularly where healthcare infrastructure improves.

- Innovation in drug delivery—such as sustained-release gels—may rejuvenate Vandazole’s market appeal.

- Addressing antimicrobial resistance remains critical, with a trend toward targeted, localized therapies gaining favor over systemic antibiotics.

FAQs

1. How does Vandazole compare with oral metronidazole in treating bacterial vaginosis?

Topical Vandazole offers direct application with fewer systemic side effects, potentially leading to higher patient compliance and reduced resistance development. However, oral metronidazole remains widely used due to its convenience for some patients and clinicians.

2. What factors most influence Vandazole’s market growth?

Prevalence of BV, clinician and patient preferences for localized therapy, regulatory policies, and the competitive landscape—particularly generic entry—are critical factors.

3. How are antimicrobial resistance trends impacting Vandazole’s market?

Growing resistance among anaerobic bacteria could limit Vandazole’s long-term efficacy, prompting a shift toward alternative therapies and combination approaches.

4. What role do emerging markets play in Vandazole’s future?

Emerging markets, characterized by rising BV prevalence and improving healthcare access, provide opportunities for volume growth due to less saturated competitive environments.

5. What strategic moves can manufacturers consider to prolong Vandazole’s market relevance?

Innovating in drug delivery systems, pursuing new indications, expanding into geographic markets, and engaging in stewardship programs to optimize use are viable strategies.

References

[1] Schwebke, J. R., et al. (2014). Prevalence of Bacterial Vaginosis Among Women of Reproductive Age. Journal of Infectious Diseases.

[2] MarketWatch. (2022). Pharmaceutical Market Trends and Patent Watch.

[3] Grand View Research. (2022). Bacterial Vaginosis Treatment Market Size, Share & Trends.