Last updated: July 30, 2025

Introduction

UNITHROID, a synthetic form of thyroid hormone (levothyroxine sodium), is primarily prescribed for hypothyroidism management. Since its initial approval, UNITHROID has maintained a significant position within the thyroid hormone replacement therapy segment. Its market dynamics are shaped by regulatory, clinical, and competitive factors, influencing its financial trajectory. This analysis evaluates the current landscape and future outlook of UNITHROID, emphasizing key drivers, challenges, and strategic implications for stakeholders.

Regulatory Framework and Market Entry

UNITHROID's market presence is underpinned by stringent regulatory standards. Approved by the U.S. Food and Drug Administration (FDA) in 1960, it remains a pivotal therapy for hypothyroidism. Recent regulatory shifts, including the reclassification of certain compounded thyroid hormone therapies and intensified Good Manufacturing Practice (GMP) standards, favor branded formulations over compounded drugs, reinforcing UNITHROID's market position.

The Drug Supply Chain Security Act (DSCSA) and ongoing FDA initiatives bolster confidence in branded products, reducing counterfeit risks and ensuring consistent quality. These regulatory landscapes favor established pharmaceutical brands like UNITHROID, although they also impose compliance and cost pressures that influence pricing and profitability.

Market Dynamics

1. Rising Incidence of Hypothyroidism

The global prevalence of hypothyroidism is escalating due to demographic shifts and increased screening. In the U.S., an estimated 4.6% of the population suffers from hypothyroidism, with higher incidence among women aged 30-50 (per American Thyroid Association). Aging populations in developed markets further contribute to rising demand for thyroid hormone replacement therapies. This demographic trend inherently expands the potential market size for UNITHROID, underpinning long-term revenue growth.

2. Competitive Landscape

UNITHROID navigates a competitive environment comprising brand-name drugs (Synthroid, Euthyrox) and compounded thyroid preparations. While generic formulations like levothyroxine are broadly available, branded products such as UNITHROID differentiate on quality assurance, consistent dosing, and manufacturing reputation.

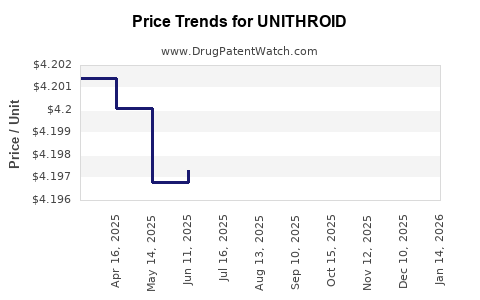

Recently, the entry of generic levothyroxine products has intensified price competition, exerting downward pressure on margins. However, the unique positioning of UNITHROID, especially its reputation for bioequivalence and manufacturing standards, sustains its premium market segment.

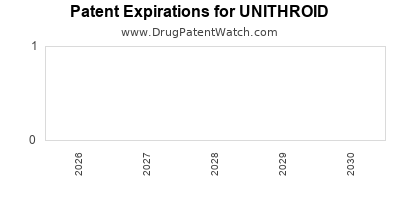

3. Impact of Patent and Exclusivity

UNITHROID benefits from established formulations, with patent protection largely expired. This exposes the drug to generic competition, constraining pricing power. Nonetheless, manufacturing and regulatory hurdles create entry barriers that preserve market share for existing brands.

4. Manufacturing and Supply Chain Factors

Supply chain disruptions have historically impacted thyroid hormone availability, influencing market dynamics. The recent recall of certain levothyroxine products underscored vulnerabilities within manufacturing processes, highlighting the importance of quality control for maintaining market leadership and minimizing financial risks.

Financial Trajectory

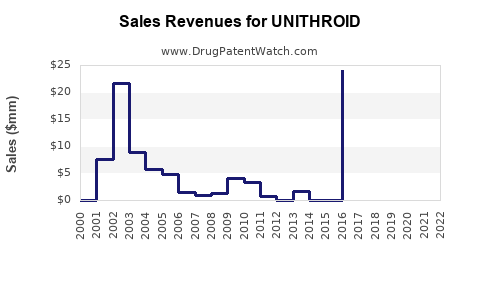

1. Revenue Trends

UNITHROID's revenue is influenced by its market share within the thyroid hormone segment, pricing strategies, and overall demand. Historically, it has maintained a stable revenue base due to brand loyalty and clinical reputation. However, the influx of generic competitors and pricing pressures have muted growth.

Crucially, unbranded generics have exerted downward pressure on prices, yet UNITHROID's premium positioning retains a consumer base willing to pay for assured quality and consistency. Market studies indicate a compound annual growth rate (CAGR) in the low single digits, driven primarily by demographic trends rather than significant market expansion.

2. Profitability and Cost Structure

The cost structure involves manufacturing expenses, regulatory compliance, marketing, and distribution. High regulatory standards escalate production costs, which, coupled with pricing pressures, constrict profit margins. Long-term profitability hinges on operating efficiencies, supply chain stability, and differentiation strategies.

3. Strategic Initiatives and R&D Investment

To sustain competitiveness, stakeholders are investing in process optimization, formulation improvements, and potential development of combination therapies or innovative delivery systems. While R&D expenditures are comparatively modest given the drug's mature status, incremental innovation may open new revenue streams.

Future Outlook

1. Market Growth Prospects

Projected growth remains modest but stable, with opportunities stemming from increased hypothyroidism diagnoses and the aging population. The global market for thyroid hormone replacements is expected to reach approximately USD 800-900 million by 2025, with UNITHROID capturing a significant share due to brand loyalty and safety profile.

2. Competitive Challenges and Opportunities

Price competition from generics and compounded drugs poses ongoing challenges. To counteract this, manufacturers focus on maintaining high-quality manufacturing standards, expanding patient trust, and enhancing supply resilience.

Emerging markets represent promising expansion avenues. As healthcare infrastructure develops in these regions, demand for reliable thyroid hormone therapies, including UNITHROID, is anticipated to grow.

3. Regulatory and Policy Impacts

Regulatory reinforcement of quality standards favors established brands like UNITHROID but also increases compliance costs. Policy initiatives aimed at reducing healthcare costs may incentivize substitution with lower-cost generics, potentially marginalizing branded drugs.

4. Innovation and Portfolio Diversification

Long-term growth may depend on lifecycle management, including reformulation or adjunct therapies. Investments in biobetters or combination therapies are potential avenues, though they require substantial R&D investment and face regulatory hurdles.

Key Factors Influencing Financial Performance

-

Demographic Trends: Aging populations and increased hypothyroidism prevalence ensure steady demand.

-

Pricing Dynamics: Global push for cost-effective therapies pressures pricing strategies and profitability.

-

Regulatory Compliance: Stringent quality standards enhance market barriers but increase costs.

-

Supply Chain Stability: Reliable manufacturing is critical; disruptions adversely impact revenue.

-

Competitive Strategies: Differentiation through quality assurance and supply reliability sustains market share.

Key Takeaways

-

Sustained Demand: The growing burden of hypothyroidism, especially in aging populations, underpins a stable demand trajectory for UNITHROID, supporting long-term revenue.

-

Market Competition: Bayer’s UNITHROID faces competition from generics and compounded formulations, necessitating differentiation through quality and manufacturing excellence.

-

Pricing Pressures: The influx of lower-cost generics constricts profit margins, prompting strategic focus on operational efficiencies and brand loyalty.

-

Regulatory Environment: Policies favoring brand manufacturers bolster UNITHROID’s market positioning, but escalating compliance costs remain a concern.

-

Growth Opportunities: Emerging markets and incremental innovations offer avenues for expansion, contingent on navigating regulatory hurdles and cost considerations.

5 Unique FAQs

1. How does regulatory approval impact UNITHROID's market stability?

Regulatory standards enforce high manufacturing quality, reinforcing UNITHROID’s reputation for safety and efficacy, thus sustaining its market share. However, compliance costs and evolving regulations necessitate ongoing investment, influencing profitability and pricing strategies.

2. What competitive strategies can UNITHROID leverage amidst rising generic levothyroxine use?

Differentiation via quality assurance, consistent dosing, and supply reliability can maintain brand loyalty. Strategic partnerships and expanding into emerging markets also provide growth pathways.

3. How are demographic shifts influencing UNITHROID’s market outlook?

An aging global population increases hypothyroidism incidence, boosting demand for thyroid hormone replacement. This demographic trend offers a resilient revenue base despite competitive pressures.

4. What risks threaten UNITHROID’s financial trajectory?

Intensified generic competition, price erosion, supply chain disruptions, and regulatory costs pose significant risks. Strategic innovation and market diversification are crucial to mitigate these threats.

5. What role does geographic expansion play in UNITHROID’s future growth?

Emerging markets present considerable opportunities, driven by increasing awareness and healthcare infrastructure improvements. Tailoring regulatory approaches and establishing reliable supply chains will be key success factors.

References

- American Thyroid Association. (2022). Hypothyroidism Overview.

- U.S. FDA. (2023). Drug Approvals and Regulations.

- MarketWatch. (2023). Global Thyroid Hormone Market Outlook.

- IQVIA. (2022). Pharmaceutical Market Data.

- GlobalData Healthcare. (2023). Diagnostic and Therapeutic Trends in Endocrinology.