Last updated: August 6, 2025

Introduction

UNITHROID (levothyroxine sodium) is a widely prescribed medication used primarily for the treatment of hypothyroidism and other thyroid hormone deficiencies. As a longstanding generic drug, UNITHROID commands substantial market share within the thyroid hormone replacement therapy segment. This analysis explores the current market landscape, competitive dynamics, regulatory factors, and future price projections, offering insights for stakeholders including manufacturers, investors, and healthcare policymakers.

Market Overview

Global and U.S. Market Size

The global thyroid disorder therapeutics market was valued at approximately USD 4.1 billion in 2022, with the U.S. accounting for over 45% of this revenue due to high disease prevalence and advanced healthcare infrastructure [1]. The demand for levothyroxine products like UNITHROID remains robust, driven by the increasing diagnosis rates of hypothyroidism, particularly among aging populations and women.

Key Players and Market Share

UNITHROID, produced by Mylan (now part of Viatris), commands a significant portion of the generic levothyroxine segment. Its widespread formulary inclusion, trusted efficacy, and longstanding market presence contribute to its dominant position. Other competitors include Synthroid (AbbVie, formerly Ironwood), Levoxyl (Pfizer), and generics from multiple manufacturers, introducing a highly competitive landscape.

Prescription Trends and Usage

Prescription volumes for levothyroxine products in the U.S. have remained relatively stable but with gradual growth. The prevalence of hypothyroidism exceeds 12 million Americans, with many patients requiring lifelong therapy [2]. Transitioning formulary preferences, pricing strategies, and supply chain dynamics influence market shares among suppliers.

Regulatory and Manufacturing Factors

Regulatory Environment

The U.S. Food and Drug Administration (FDA) regulates levothyroxine as a drug requiring bioequivalence standards for generics. Recent FDA initiatives emphasize consistent manufacturing quality, influencing manufacturing practices and costs. Stratified approval pathways for updated formulations or formulations with improved bioavailability could impact the market.

Manufacturing and Supply Chain

Mylan's (Viatris's) manufacturing capabilities and supply chain reliability significantly affect UNITHROID's market stability. Supply disruptions or quality issues can cause shifts in prescribing patterns, impacting pricing and market share. The advent of complex formulations, such as liquid or coated versions, may influence future market dynamics.

Pricing Dynamics and Historical Trends

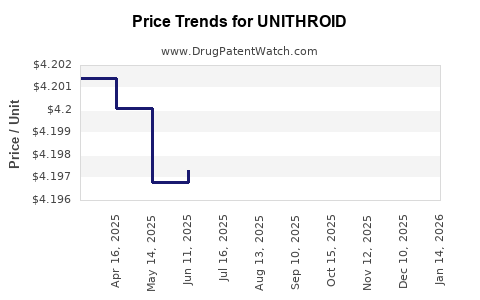

Historical Price Trajectory

Historically, the price of UNITHROID has experienced periods of stability and slight fluctuations. The introduction of generic competition in the early 2010s initially drove down prices. However, in recent years, generic levothyroxine prices stabilized, with some increases linked to supply constraints or manufacturing costs.

Current Pricing Landscape

As of 2023, the average wholesale acquisition cost (WAC) for UNITHROID is approximately USD 0.17 per tablet (50 mcg), with variations depending on dosage and supplier [3]. Patient co-pays are often significantly lower due to insurance coverage and pharmacy benefit management agreements.

Market-Driven Price Factors

Factors influencing prices include:

- Regulatory compliance costs.

- Manufacturing quality improvements.

- Supply chain stability.

- Competition from branded and generic alternatives.

- Price sensitivity among payers and consumers.

Projected Price Trends (2023-2028)

Short-term Outlook (1-2 years)

Given recent supply chain disruptions and FDA scrutiny on manufacturing quality, prices for UNITHROID may experience modest increases. Market consolidation and limited generic competition could also lead to slight upward pressure. Industry insiders forecast a 2-4% annual increase in wholesale prices driven by manufacturing costs and regulatory compliance.

Medium to Long-term Outlook (3-5 years)

Several factors could influence long-term prices:

-

Enhanced formulations: Development of SR (sustained-release) or liquid formulations may shift demand patterns and pricing.

-

Regulatory interventions: Stricter regulations or approval of bioequivalent formulations with superior stability could modify pricing strategies.

-

Market Competition: Introduction of biosimilars or more affordable generics could exert downward pressure on prices.

-

Supply Chain Dynamics: Stabilization post-pandemic and improved manufacturing efficiencies can regulate costs and prices.

Based on these factors, industry projections estimate a compounded annual growth rate (CAGR) of approximately 2% in the wholesale price of UNITHROID over the next five years, with potential deviations depending on market and regulatory developments.

Implications for Stakeholders

- Manufacturers should monitor FDA regulations and invest in manufacturing quality to avoid supply disruptions that could impact pricing power.

- Payers and Healthcare Providers must consider the cost-effectiveness of UNITHROID relative to newer formulations or alternatives.

- Investors need to weigh stable demand against potential competitive pricing pressures and regulatory shifts impacting revenue streams.

Conclusion

The market for UNITHROID remains stable, with a resilient demand underpinning modest pricing growth. Supply chain integrity and regulatory compliance are critical to maintaining market position. While short-term projections suggest slight price increases, long-term trends could be moderated by intensified competition and formulation innovations.

Key Takeaways

- UNITHROID sustains a dominant market position among levothyroxine therapies, supported by high prescription volumes and longstanding clinical trust.

- Price stability has generally persisted, with slight increases driven by supply chain issues and manufacturing costs.

- Future price projections indicate an annual growth rate of approximately 2%, contingent upon regulatory, competitive, and supply chain factors.

- Manufacturers should prioritize quality assurance and supply chain resilience to sustain pricing power.

- Stakeholders must consider emerging formulation options and competitive pressures when strategizing market positioning.

FAQs

1. How does UNITHROID pricing compare to branded alternatives like Synthroid?

UNITHROID typically costs less than branded counterparts such as Synthroid, owing to its generic status. Wholesale prices are approximately USD 0.17 per tablet, whereas Synthroid often retails at a significantly higher rate, influenced by branding and marketing.

2. What factors could lead to a decline in UNITHROID prices?

Introduction of biosimilars or new generic formulations, improved manufacturing efficiencies, or increased competition could exert downward pressure on prices.

3. Are supply shortages likely to impact UNITHROID prices in the near term?

Yes, historically, supply disruptions due to manufacturing or regulatory issues can lead to price spikes. Recent supply chain challenges post-COVID-19 pandemic have underscored this risk.

4. How might regulatory changes affect the UNITHROID market?

Enhanced quality standards or approval of alternative formulations could influence market share and pricing. Regulatory scrutiny on manufacturing practices emphasizes the need for ongoing compliance.

5. What emerging formulations could influence future demand for UNITHROID?

Liquid levothyroxine and sustained-release formulations are in development and could shift demand away from traditional tablets, impacting prices and market dynamics.

Sources

- Market Research Future, "Thyroid Disorder Therapeutics Market Size," 2022.

- American Thyroid Association, "Hypothyroidism Facts and Figures," 2023.

- GoodRx, "Average Wholesale Prices for Levothyroxine," 2023.