Last updated: July 27, 2025

Introduction

Triazolam, a short-acting benzodiazepine primarily indicated for insomnia, has historically occupied a niche segment within the global anxiolytic and sedative-hypnotic drug markets. As an established pharmaceutical, its market position is increasingly influenced by evolving regulatory landscapes, patent statuses, therapeutic alternatives, and shifting prescribing behaviors. This analysis delineates the key market dynamics and forecasts the financial trajectory of triazolam, guiding stakeholders in strategic decision-making.

Historical Context and Regulatory Status

Introduced in the early 1980s, triazolam gained rapid adoption owing to its quick onset and efficacy in managing transient insomnia. Manufactured initially by western pharmaceutical giants like Hoffmann-La Roche, its patent protections have expired, leading to widespread generic availability. Currently, triazolam is classified as a third-line therapy, with regulatory agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) emphasizing cautious use due to risks of dependence and adverse effects.

In recent decades, regulatory authorities have implemented tighter controls over benzodiazepines to mitigate misuse potential, affecting market accessibility. The current regulatory environment thus exerts downward pressure on sales, especially amid heightened scrutiny of sedative overprescription.

Market Demand and Therapeutic Alternatives

Declining Prescriptions due to Safety Concerns

The primary driver affecting triazolam’s market is a paradigm shift towards safer alternatives. Increasing awareness of dependence, tolerance, and withdrawal risks associated with benzodiazepines has led clinicians to favor non-benzodiazepine hypnotics (e.g., zolpidem, eszopiclone), melatonin receptor agonists, and cognitive-behavioral therapy for insomnia (CBT-I).

Data from the CDC and prescription databases reveal a consistent decline in benzodiazepine prescriptions over the past decade, with a notable reduction in short-acting agents like triazolam. This decline is compounded by regulatory initiatives, such as the DEA reclassification of certain benzodiazepines to stricter schedules, further impeding market expansion.

Emerging Indications and Off-Label Use

While triazolam’s primary indication remains insomnia, some off-label uses in anesthesia premedication and alcohol detoxification have been explored. Nonetheless, such use cases are limited, and safety concerns restrict widespread adoption. The absence of new therapeutic claims diminishes potential revenue streams.

Competitive Landscape

The market landscape is punctuated by newer hypnotics with improved safety profiles. For instance, non-benzodiazepine "Z-drugs" like zolpidem, zaleplon, and eszopiclone have gained favor due to their reduced dependence potential. Additionally, the rising adoption of non-pharmacologic interventions restricts further growth for triazolam.

Patent and Market Exclusivity

Given triazolam’s expired patents, generic manufacturers dominate the production landscape, fostering significant price erosion. The resultant commoditization stresses profit margins and discourages investment in marketing or formulation innovations. Consequently, revenue streams have stabilized at lower levels, aligned more with manufacturing costs than premium pricing.

Pricing Dynamics and Revenue Projections

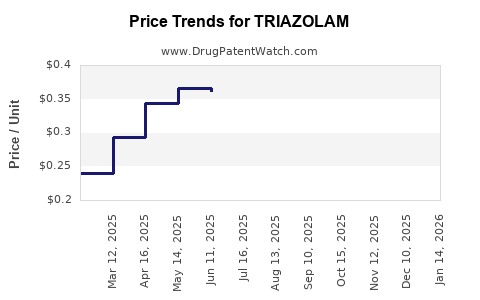

The**

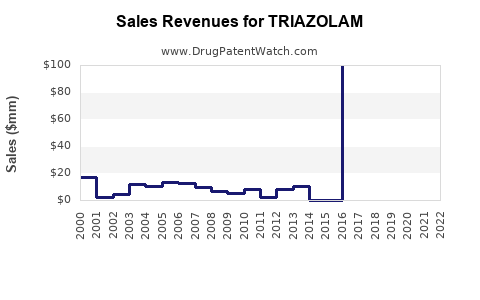

global revenues of triazolam, derived mainly from the U.S. and European markets, have experienced a downward trajectory due to decreased prescriptions and generic competition. Current retail prices for generic triazolam are approximately $0.50 to $1.50 per tablet, with annual US prescriptions exceeding 700,000 units at their peak [1].

Forecasting forward, the market is expected to recede further. Conservative estimates project a compound annual decline rate (CAGR) of approximately 5-8% over the next five years, driven by declining demand, prescriber retreat, and regulatory constraints. This results in a potential revenue shrinkage from current levels of roughly $150-$200 million annually to under $100 million within five years.

Market Drivers and Barriers

Drivers:

- Existing Efficacy: Proven effectiveness in short-term insomnia.

- Cost-Effectiveness: Low-cost generic options appeal to cost-sensitive healthcare systems.

- Patient Tolerance: Favorable pharmacokinetics for short-term management.

Barriers:

- Safety Profile: Risks of dependence, cognitive impairment, and falls hamper use.

- Regulatory Constraints: Stricter prescribing guidelines limit access.

- Competitive Alternatives: Rise of safer, newer agents and CBT.

Opportunities and Strategic Outlook

Despite challenges, niche opportunities exist in specialized markets such as minor sleep disorder clinics where traditional drugs remain in use. Additionally, reformulation or combination products addressing safety concerns could revitalize interest. However, innovation in this domain remains limited due to safety issues and low profitability margins.

Pharmaceutical companies are increasingly divesting or discontinuing triazolam formulations. Investment focus shifts toward novel therapeutics targeting sleep disorders, including orexin receptor antagonists and dual orexin antagonists, which exhibit better safety profiles.

Impact of Broader Market Trends

Growing Focus on Opioid and Benzodiazepine Stewardship

Government and insurer-led initiatives to curtail sedative use significantly hinder triazolam’s market. The CDC’s guidelines and state-level prescription drug monitoring programs (PDMPs) impose stringent controls, reducing prescription volumes further.

Non-Pharmacologic Interventions

Cognitive-behavioral therapy for insomnia (CBT-I) gains prominence, with reimbursement becoming more accessible. This diminishes reliance on pharmacotherapy, particularly short-acting benzodiazepines.

Healthcare Reimbursement Policies

Payer preference leans toward therapies with proven long-term safety and efficacy profiles, often excluding older benzodiazepines like triazolam from formularies. This further constrains growth potential.

Future Outlook and Financial Trajectory

The triazolam market is on a declining trajectory globally. Assuming current trends persist, revenues are poised to diminish annually over the next five years, overshadowed by generics’ commoditization and societal shifts towards safer alternatives. Stakeholders should consider strategizing around niche markets or diversification to mitigate risks associated with obsolescence.

Key Takeaways

- Evolving Regulatory and Safety Landscape: Heightened safety concerns and stricter regulations significantly impede triazolam’s market growth.

- Competitive Displacement: Non-benzodiazepine hypnotics and non-pharmacological therapies have supplanted triazolam as first-line options.

- Declining Market Revenues: Forecasted annual revenues are projected to decline at a CAGR of approximately 5-8%, driven by decreased prescriptions and price erosion.

- Limited Innovation Incentives: Patent expirations and safety issues diminish attractiveness for investment and innovation.

- Strategic Diversification Needed: Stakeholders should explore niche applications, formulations, or transition to alternative sleep therapeutics to maximize value.

FAQs

1. Why is the market for triazolam shrinking globally?

Due to safety concerns like dependence and adverse cognitive effects, regulatory agencies impose stricter prescribing guidelines. Additionally, newer, safer sleep agents and non-pharmacologic therapies are replacing triazolam, leading to declining demand.

2. Are there any new formulations or derivatives of triazolam in development?

Currently, no significant advancements or reformulations are underway. The focus has shifted toward developing novel sleep agents with improved safety profiles rather than modifications of existing benzodiazepines.

3. How do regulatory changes impact the profitability of triazolam?

Regulatory restrictions reduce prescribing and promote generic competition, leading to lower prices and profit margins. Reclassification or scheduling, like DEA’s stricter controls, further limit access, diminishing sales.

4. Is there a niche market where triazolam remains viable?

Limited niche applications exist in specialized clinics or research settings. However, broader market viability remains limited unless safety concerns are addressed or formulations are improved.

5. What alternative therapeutic options are replacing triazolam?

Non-benzodiazepine hypnotics (zolpidem, zaleplon, eszopiclone), melatonin receptor agonists (ramelteon), and behavioral interventions like CBT-I are now preferred due to better safety profiles.

References

[1] IQVIA, Prescription Data, 2022.