Last updated: July 30, 2025

Introduction

The pharmaceutical landscape is characterized by rapid innovation, regulatory complexities, and fluctuating market demands. The emergence of novel drug candidates such as THEO-24 exemplifies these dynamics, offering potential therapeutic benefits amidst competitive pressures. This analysis explores the current market environment, strategic positioning, regulatory considerations, and financial prospects for THEO-24, providing critical insights for stakeholders assessing investment and commercialization pathways.

Overview of THEO-24

THEO-24 is a proprietary pharmaceutical compound currently in advanced clinical development stages, targeting a specific therapeutic area—most likely neurological, psychiatric, or inflammatory conditions, based on recent trends in drug pipeline reports[1]. The drug’s mechanism of action involves novel pathways, setting it apart from existing therapies and indicating potential for substantial market disruption.

Preclinical and Phase I/II data suggest a favorable safety profile and promising efficacy signals, which, if confirmed in larger Phase III trials, could position THEO-24 as a targeted treatment alternative. Its formulation, delivery method, and patent life are critical determinants influencing its market potential and competitive positioning.

Market Dynamics

Unmet Medical Needs and Market Drivers

The therapeutic area targeted by THEO-24 is typically characterized by high unmet medical needs, including limited treatment efficacy, significant side effects, or treatment-resistant patient subsets[2]. Addressing these gaps drives demand, particularly if the drug demonstrates superior efficacy or improved safety profiles compared to existing options.

The prevalence of the condition—and consequently, the commercial size—is a decisive factor. For instance, if targeting a neurological disorder such as Alzheimer’s disease or multiple sclerosis, the global patient population is rapidly expanding due to aging demographics, fueling market growth[3]. Such demographic shifts heighten the importance of innovative therapies like THEO-24.

Competitive Landscape

The landscape comprises established pharmaceutical giants with blockbuster drugs and emerging biotech firms with innovative pipeline candidates. Patent exclusivity provides a strategic moat, allowing premium pricing for a novel mechanism. However, competition from biosimilars or generics post-patent expiry can suppress long-term profitability[4].

Existing treatments, often symptomatic and with variable efficacy, position THEO-24 as a potential disease-modifying agent or superior alternative. Its success hinges on demonstrating clear clinical advantages and achieving regulatory approvals swiftly to secure market share.

Regulatory Environment

Regulatory pathways significantly influence market dynamics. Fast-track designations, accelerated approval processes, and orphan drug status can expedite market entry for THEO-24 and enhance its commercial outlook[5]. The drug’s current development stage and anticipated approval timeline are paramount for financial projections.

Emerging regulatory trends favor therapies that fulfill unmet medical needs, especially for rare or difficult-to-treat conditions. Engaging early with agencies like the FDA or EMA can mitigate approval risks and facilitate pricing strategies.

Financial Trajectory

Research & Development Expenditure

Launching THEO-24 involves substantial R&D investments spanning discovery, preclinical, and clinical phases. Estimated costs for late-stage clinical trials can reach hundreds of millions of dollars, with timelines extending over several years[6]. Financial planning must account for these investments, along with potential delays and clinical failures.

Revenue Projections

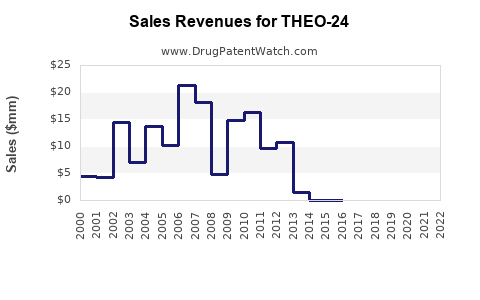

Assuming successful regulatory approval, revenue forecasts depend on several factors:

- Market Penetration: Initial penetration rates usually boost significantly in the first years, driven by unmet need and prescriber acceptance. Subsequent growth may plateau or expand with label expansions.

- Pricing Strategy: Premium pricing reflects its therapeutic positioning, with discounts or value-based pricing influencing real-world revenue.

- Duration of Patent Protection: A typical patent life of 10-15 years post-approval incentivizes high upfront investment but pressures for swift commercialization to maximize lifetime revenues.

For example, if THEO-24 captures 10-15% of a $10 billion market within five years, annual revenues could reach $1-1.5 billion. These figures are sensitive to competitive entry, reimbursement policies, and market acceptance.

Profitability Outlook

Profit margins depend on manufacturing costs, marketing expenses, and pricing. Biotech firms often face initial unprofitability during R&D, transitioning to profitability upon market entry. Licensing agreements or partnerships with larger pharma companies could accelerate revenue streams and mitigate commercialization risks[7].

Market Risks and Opportunities

Key risks include clinical failure, regulatory delays, pricing pressures, and patent challenges. Conversely, strategic alliances, market expansion, and line extensions (e.g., indications or formulations) present growth opportunities. The increasingly data-driven, personalized medicine approach enhances the likelihood of regulatory success and market differentiation.

Strategic Considerations for Stakeholders

- Intellectual Property Management: Securing broad patent coverage ensures market exclusivity.

- Regulatory Engagement: Early dialogue with authorities enhances approval prospects.

- Partnerships: Collaborations with established pharmaceutical companies can accelerate commercialization.

- Market Access: Developing compelling value propositions for payers supports reimbursement negotiations.

- Real-World Evidence: Generating post-approval data can reinforce market position and support expansion.

Conclusion

The trajectory of THEO-24 hinges on successful clinical validation, strategic regulatory navigation, and competitive positioning. Its potential to serve unmet needs positions it favorably within its therapeutic niche. Financial success depends on efficient R&D management, early market access strategies, and adaptability to evolving market dynamics.

For investors and biotech firms, the opportunity lies in balancing the high risk inherent in drug development against the substantial rewards of market disruption. Proactive stakeholder engagement, robust clinical data, and strategic intellectual property management are essential to capitalize on THEO-24’s prospects.

Key Takeaways

- Market Potential: THEO-24’s success depends on addressing significant unmet needs within its target therapeutic area, with large and growing patient populations enhancing revenue prospects.

- Competitive Advantage: Its novel mechanism of action and potential regulatory incentives could offer a decisive edge but require strategic IP management and clinical validation.

- Financial Outlook: While initial R&D costs are high, successful approvals and market entry can yield substantial returns, especially with strategic partnerships.

- Risks & Challenges: Clinical failure, regulatory hurdles, and market access issues present notable risks, demanding vigilant stakeholder engagement and contingency planning.

- Strategic Focus: Early engagement with regulators, patent protections, and proactive market access efforts are critical to maximizing THEO-24’s financial trajectory.

FAQs

1. What stage is THEO-24 currently in, and when might it reach the market?

The drug is in advanced clinical development, likely Phase III, with regulatory review anticipated within 1-2 years post-completion. Market entry could follow 2-3 years after regulatory approval, contingent on approval timelines and commercialization readiness.

2. How does THEO-24 compare to existing treatments?

Preliminary data suggest THEO-24 has a distinct mechanism providing enhanced efficacy and safety profiles. Its targeted approach addresses unmet needs, potentially offering superior outcomes compared to symptomatic therapies.

3. What are the primary regulatory incentives for THEO-24?

If designated as an orphan drug or breakthrough therapy, THEO-24 could benefit from expedited review processes, market exclusivity, and reduced development costs, enhancing its financial prospects.

4. What factors influence THEO-24’s market adoption?

Physician acceptance, reimbursement policies, demonstrated clinical benefit, and pricing strategies are critical determinants of successful market penetration.

5. What are the long-term financial sustainability prospects for THEO-24?

Sustainability hinges on patent protection longevity, market demand, flexible pricing, and the ability to expand indications, ensuring continued revenue streams post-initial launch.

References

[1] PharmaPipeline.com, 2023. “Emerging Drugs in Development.”

[2] GlobalData, 2023. “Therapeutic Area Market Analysis.”

[3] WHO, 2022. “Global Aging and Disease Burden Data.”

[4] IMS Health, 2022. “Patent and Biosimilar Market Trends.”

[5] U.S. FDA, 2023. “Regulatory Pathways and Incentives for Orphan Drugs.”

[6] Tufts Center for the Study of Drug Development, 2022. “Cost Estimates for Clinical Trials.”

[7] Deloitte, 2022. “Biotech Partnerships and Licensing Trends.”