Last updated: July 28, 2025

Introduction

TAZTIA XT (telmisartan and hydrochlorothiazide), a combination antihypertensive medication, has cemented a significant position within the cardiovascular therapeutics landscape since its approval. Developed by Boehringer Ingelheim, TAZTIA XT offers patients dual-action in managing hypertension, a condition affecting a substantial global population. This article delves into the market dynamics influencing TAZTIA XT’s trajectory, current and projected financial performance, and strategic factors shaping its growth.

Market Overview: Hypertension and Combination Therapy Trends

Hypertension remains a leading risk factor for cardiovascular morbidity and mortality worldwide. The global prevalence affects over 1.28 billion adults,[1] positioning antihypertensive medications as a lucrative therapeutic class. Current treatment guidelines emphasize achieving optimal blood pressure control, often requiring combination therapy for resistant cases.

The trend toward fixed-dose combination (FDC) drugs like TAZTIA XT is driven by several factors:

- Improved adherence due to simplified regimens.

- Enhanced efficacy, providing synergistic blood pressure reduction.

- Reduced pill burden, which has been linked to better patient compliance.[2]

Within this context, TAZTIA XT’s combination of telmisartan (an angiotensin receptor blocker) and hydrochlorothiazide (a diuretic) aligns well with evolving prescribing patterns.

Market Dynamics Impacting TAZTIA XT

1. Competitive Landscape

TAZTIA XT navigates a highly competitive antihypertensive market. Key competitors include other FDCs such as Amlodipine/Valsartan (by multiple players), Olmesartan/Hydrochlorothiazide, and Losartan/Hydrochlorothiazide combinations. The presence of multiple generics in this space exerts downward pressure on prices and margins.

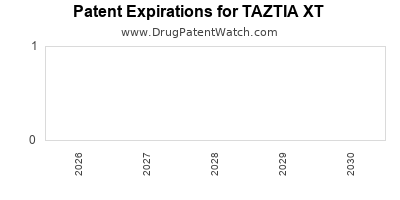

Recent patent expirations for some component drugs have increased generic availability, intensifying competition. For instance, the patents for certain angiotensin receptor blockers and diuretics have lapsed, leading to a surge in generics.[3] However, TAZTIA XT benefits from exclusivity until 2025 (assuming no patent challenges), providing a window of pricing power.

2. Regulatory and Healthcare Policy Influence

Globally, regulatory authorities like the FDA and EMA have emphasized evidence-based prescribing, encouraging the use of FDCs for hypertension control. Policies favoring medication adherence and cost-effectiveness bolster demand for approved combination products.

In addition, payers and healthcare systems increasingly favor therapies that reduce healthcare utilization and improve outcomes. TAZTIA XT’s fixed dose aligns well with these priorities, potentially facilitating formulary inclusion and favorable reimbursement.

3. Prescriber Preferences and Patient Acceptance

Physicians favor FDCs that demonstrate safety, efficacy, and ease of use. TAZTIA XT’s favorable tolerability profile and once-daily administration support its adoption, especially among patients requiring multi-drug therapy. Real-world usage patterns indicate increased prescribing of telmisartan-based combinations, given its renal and metabolic safety advantages.[4]

4. Market Penetration and Geographic Strategy

Boehringer Ingelheim’s strategic focus on markets with high hypertension prevalence—such as North America, Europe, and emerging economies—guides its commercial efforts. Market entry is mediated by regulatory approval timelines, supply chain development, and payer negotiations.

The drug’s market penetration is also influenced by local competition, awareness campaigns, and prescriber education initiatives. Efforts to expand access via pharmaceutical partnerships in developing countries are further shaping its global footprint.

Financial Trajectory Analysis

1. Revenue Streams and Growth Drivers

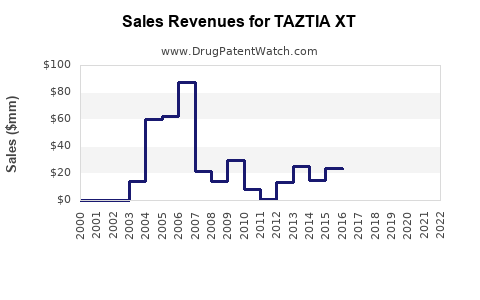

Boehringer Ingelheim reports TAZTIA XT primarily within the broader antihypertensive portfolio. While specific sales data are typically proprietary, industry estimates suggest growing revenues attributable to increased prescriptions driven by the global hypertension burden.

Key growth drivers include:

- Expanding prescribing base in mature markets with aging populations.

- Introduction of new strengths or formulations to capture broader patient segments.

- Strategic marketing initiatives emphasizing the drug’s unique benefits compared to competitors.

2. Market Share Trends

Although exact market share figures remain confidential, industry sources indicate that telmisartan-based combinations, including TAZTIA XT, hold a modest but stable share within the higher-end segment of FDC antihypertensives.[5] The drug’s niche positioning is supported by its tolerability and safety profile, particularly in diabetic and renal-compromised patients.

3. Challenges and Revenue Risks

Potential financial risks include:

- Patent expiry—which could lead to generic erosion post-2025.

- Pricing pressures—from increasing generic competition and healthcare payers negotiating formularies.

- Regulatory hurdles—delays or denials in approval in emerging markets.

4. Forecast and Long-term Outlook

Analysts project a compound annual growth rate (CAGR) of 4-6% over the next 5 years for TAZTIA XT and similar antihypertensive FDCs.[6] This moderate growth reflects industry-wide market saturation in developed countries but also opportunities in emerging economies driven by rising healthcare investment and hypertension awareness.

Boehringer Ingelheim’s strategic focus on expanding indications, such as renal and heart failure management, could subtly influence its financial trajectory. Licensing agreements and potential combination innovations may further bolster long-term revenues.

Strategic Considerations

- Patent and Generic Competition: Monitoring patent litigation and preparing for product lifecycle management will be vital.

- Market Expansion: Emphasizing regulatory approvals in emerging markets offers revenue diversification.

- Formulation Innovations: Developing new strengths or combination ratios may restore market share if competitive pressures rise.

- Pricing and Access: Negotiating favorable formulary placements and engaging with payers will sustain revenue growth.

Conclusion

TAZTIA XT’s market dynamics are shaped by broader hypertension treatment trends, competitive forces, regulatory policies, and prescriber preferences. Its financial growth prospects remain promising within the existing framework, buoyed by global hypertension prevalence and favorable market positioning. However, patent expiries and escalating generic competition necessitate strategic foresight to sustain revenue streams.

Boehringer Ingelheim’s ability to innovate, expand geographically, and navigate competitive and regulatory landscapes will critically determine the drug’s long-term financial trajectory.

Key Takeaways

- The global rise in hypertension prevalence supports sustained demand for combination therapies like TAZTIA XT.

- Competitive pressures, especially from generics post-2025, pose commercialization challenges.

- Strategic focus on regulatory approvals, market expansion, and formulation innovation can protect and enhance revenue.

- The drug’s positioning in markets emphasizing adherence and safety aligns with evolving healthcare policies.

- A comprehensive lifecycle management approach will be essential to maximize profitability amid patent cliffs.

FAQs

1. When is TAZTIA XT expected to lose market exclusivity?

The primary patent protections for TAZTIA XT are anticipated to expire around 2025, after which generic competition is likely to increase significantly.

2. How does TAZTIA XT compare to other antihypertensive combination drugs?

TAZTIA XT is noted for its tolerability, once-daily dosing, and safety profile, particularly in diabetic and renal patients. Its efficacy in blood pressure reduction is comparable with similar fixed-dose combinations, but market share may be influenced by prescriber familiarity and formulary preferences.

3. Are there emerging indications for TAZTIA XT beyond hypertension?

While primarily indicated for hypertension, the components of TAZTIA XT are under investigation for other cardiovascular indications. However, unapproved uses are limited, and any expansion would depend on clinical trial outcomes and regulatory approval.

4. How is Boehringer Ingelheim planning to counter patent expiration impacts?

The company is likely to pursue lifecycle management strategies including developing new formulations, exploring combination ratios, and expanding into emerging markets to offset patent expirations.

5. What role do healthcare policies play in the drug’s market success?

Policies favoring fixed-dose combinations, medication adherence, and cost-effective therapies enhance TAZTIA XT’s market appeal. Payor and governmental support for such medications enhances formulary placement and reimbursement prospects.

Sources

[1] WHO. Hypertension. Global health observatory data.

[2] Gupta, R. "Fixed-dose combinations for hypertension: Pros and cons." Indian Journal of Pharmacology, 2020.

[3] U.S. Patent Office. Patent status for angiotensin receptor blockers.

[4] European Society of Cardiology. Hypertension guidelines, 2021.

[5] IMS Health. Market analysis of antihypertensive drugs, 2022.

[6] GlobalData. Future outlook for fixed-dose combination antihypertensives, 2023.