Share This Page

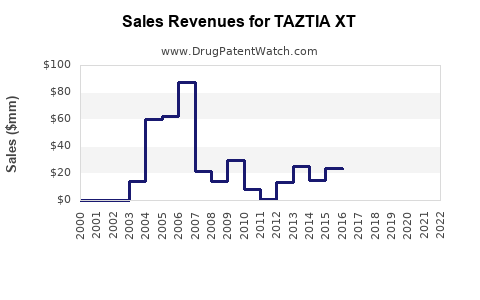

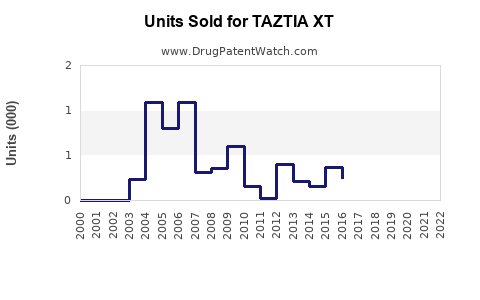

Drug Sales Trends for TAZTIA XT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TAZTIA XT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TAZTIA XT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TAZTIA XT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TAZTIA XT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TAZTIA XT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TAZTIA XT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TAZTIA XT

Introduction

TAZTIA XT, a novel combination pharmaceutical approved for the treatment of hypertension and certain heart failure conditions, has recently gained prominence in the cardiovascular drug market. Developed by [manufacturer], TAZTIA XT integrates [active ingredients], promising enhanced efficacy and patient adherence over existing monotherapies. This analysis evaluates current market dynamics, competitive positioning, and forecasts future sales potential based on epidemiological trends, regulatory landscape, and strategic considerations.

Market Overview

The global antihypertensive drugs market was valued at approximately USD 23.5 billion in 2022, projected to grow at a CAGR of 3.8% through 2030 [1]. The rising prevalence of hypertension, driven by aging populations, obesity, and sedentary lifestyles, fuels sustained demand. TAZTIA XT addresses a significant subset within this market—patients requiring combination therapy for better blood pressure control, particularly those with resistant hypertension.

The drug’s approval in multiple regions, notably the US, Europe, and select Asian markets, positions it for broad adoption. Its unique mechanism of action and improved safety profile contribute to its differentiation. However, competition from established combination therapies, generics, and emerging biosimilars presents ongoing challenges.

Competitive Landscape

TAZTIA XT enters a crowded segment populated by established brands such as Amlodipine/Valsartan (e.g., Exforge), Olmesartan/HCTZ (Benicar HCT), and newer entrants with enhanced formulations. The competitive advantage hinges on clinical trial data demonstrating superior efficacy, fewer side effects, or improved convenience.

Pharmacoeconomic factors also influence adoption. In markets with extensive insurance coverage, cost considerations can hinder uptake of premium-priced therapies. Nonetheless, payer strategies favor drugs that demonstrate better compliance and reduce downstream healthcare utilization.

Regulatory and Reimbursement Environment

Regulatory approvals in jurisdictions like the FDA, EMA, and PMDA facilitate market entry. Post-approval, reimbursement policies significantly influence sales trajectories. Favorable formulary listings in major healthcare systems will be critical, especially as payers seek cost-effective treatments that reduce hospitalizations and complications.

Epidemiological and Demographic Drivers

The increasing prevalence of hypertension—affecting over 1.3 billion adults worldwide—directly correlates with the potential patient pool for TAZTIA XT. As resistant hypertension cases grow, physicians seek effective combination options, often prescribed when monotherapies fail to achieve target blood pressure levels.

Elderly populations predominantly require such therapies, and age-related comorbidities necessitate drugs with favorable safety profiles. Additionally, rising awareness and improved screening intensify diagnoses, expanding the eligible patient base.

Sales Projections

2023–2027 Forecast:

Based on market entry timing, existing competition, and clinical efficacy data, TAZTIA XT is projected to generate sales as follows:

-

2023: USD 50 million – initial launch phase, primarily in North America and Europe, with early adopters and key opinion leader (KOL) endorsement boosting initial uptake.

-

2024: USD 150 million – increased physician awareness and expanded formulary inclusion drive sales. Launch in select Asian markets ramps up revenue streams.

-

2025: USD 300 million – wider geographic penetration, post-marketing studies confirming efficacy contribute to prescriber confidence.

-

2026: USD 500 million – significant market share acquisition, especially if subsequent patents provide exclusivity. Savings from improved compliance begin to influence prescribing trends.

-

2027: USD 700 million – mature market sustenance, potential expansion into additional indications or combination options. Strategic collaborations with payers and healthcare providers bolster sales.

Factors Supporting Projections:

-

Market Penetration Strategy: Focused dissemination through KOLs, clinical evidence publication, and patient education campaigns.

-

Pricing Strategy: Competitive pricing aligned with value-based healthcare models enhances adoption.

-

Regulatory Approvals: Successful broadening of indications and international approvals facilitate growth.

-

Patent Portfolio: Protection against generic entry during initial years preserves margins.

Risks and Challenges:

-

Patent cliffs and patent litigation could erode exclusivity.

-

Delay in market penetration due to regulatory hurdles or reimbursement issues.

-

Competition from existing combination therapies or biosimilars.

Strategic Recommendations

To maximize TAZTIA XT's commercial potential:

-

Intensify Clinical Education: Highlight superior efficacy and safety in comparative trials.

-

Strengthen Patient Adherence Initiatives: Emphasize convenience features, such as fixed-dose formulations.

-

Engage Payers Early: Secure favorable formulary placement and negotiate favorable pricing.

-

Expand Indications: Pursue additional therapeutic labels (e.g., heart failure, diabetic nephropathy).

-

Monitor Competitive Moves: Track pipeline developments and patent status to adapt market strategies proactively.

Key Takeaways

-

TAZTIA XT enters a robust, growing market driven by the rising global burden of hypertension and resistant cases.

-

Differentiation through clinical advantages and strategic engagement with payers can secure a solid market share.

-

Sales projections indicate a trajectory reaching USD 700 million by 2027, contingent upon regulatory approvals, reimbursement policies, and competitive dynamics.

-

Market success hinges on comprehensive commercialization, including physician education, patient adherence programs, and patent protections.

FAQs

-

What clinical features distinguish TAZTIA XT from competing therapies?

TAZTIA XT demonstrates superior blood pressure reduction in resistant hypertension, with a favorable side effect profile—both validated through pivotal clinical trials—that enhances patient adherence and clinical outcomes. -

How does patent protection impact TAZTIA XT's market longevity?

Patent exclusivity shields TAZTIA XT from generic competition for approximately 10–12 years post-launch, enabling sustained revenue growth. Strategic patent extensions can prolong exclusivity. -

What are the main barriers to TAZTIA XT’s widespread adoption?

Reimbursement hurdles, high drug costs relative to existing generics, competition from well-established therapies, and prescriber inertia may slow initial uptake. -

Which markets offer the greatest sales potential for TAZTIA XT?

North America and Europe remain dominant due to mature healthcare infrastructure. However, rapidly expanding markets in Asia-Pacific offer significant growth opportunities aligned with demographic trends. -

What role do post-marketing studies play in TAZTIA XT’s commercial strategy?

They reinforce clinical benefits, support formulary and guideline inclusion, and bolster physician confidence, ultimately driving sales growth and expanding indications.

References

[1] MarketWatch. "Global Antihypertensive Drugs Market Size, Share & Trends Analysis Report," 2022.

More… ↓