TAVNEOS Drug Patent Profile

✉ Email this page to a colleague

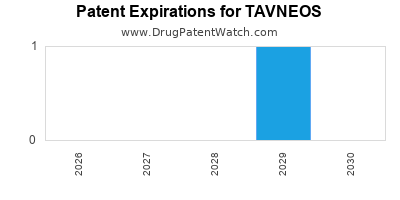

Which patents cover Tavneos, and when can generic versions of Tavneos launch?

Tavneos is a drug marketed by Chemocentryx and is included in one NDA. There are four patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and twenty-eight patent family members in thirty-nine countries.

The generic ingredient in TAVNEOS is avacopan. One supplier is listed for this compound. Additional details are available on the avacopan profile page.

DrugPatentWatch® Generic Entry Outlook for Tavneos

Tavneos was eligible for patent challenges on October 7, 2025.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be February 3, 2031. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TAVNEOS?

- What are the global sales for TAVNEOS?

- What is Average Wholesale Price for TAVNEOS?

Summary for TAVNEOS

| International Patents: | 128 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 27 |

| Clinical Trials: | 1 |

| Patent Applications: | 306 |

| Drug Prices: | Drug price information for TAVNEOS |

| What excipients (inactive ingredients) are in TAVNEOS? | TAVNEOS excipients list |

| DailyMed Link: | TAVNEOS at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TAVNEOS

Generic Entry Date for TAVNEOS*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for TAVNEOS

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Amgen | PHASE2 |

| Robert Spiera, MD | PHASE2 |

Pharmacology for TAVNEOS

| Drug Class | Complement 5a Receptor Antagonist |

| Mechanism of Action | Complement 5a Receptor Antagonists Cytochrome P450 3A4 Inhibitors |

US Patents and Regulatory Information for TAVNEOS

TAVNEOS is protected by four US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TAVNEOS is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,445,515.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | 11,603,356 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | 8,445,515 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | 11,951,214 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | 8,906,938 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Chemocentryx | TAVNEOS | avacopan | CAPSULE;ORAL | 214487-001 | Oct 7, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for TAVNEOS

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Vifor Fresenius Medical Care Renal Pharma France | Tavneos | avacopan | EMEA/H/C/005523Tavneos, in combination with a rituximab or cyclophosphamide regimen, is indicated for the treatment of adult patients with severe, active granulomatosis with polyangiitis (GPA) or microscopic polyangiitis (MPA). | Authorised | no | no | yes | 2022-01-11 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for TAVNEOS

When does loss-of-exclusivity occur for TAVNEOS?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 7162

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09330194

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0923384

Estimated Expiration: ⤷ Get Started Free

Patent: 2012033075

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 47522

Estimated Expiration: ⤷ Get Started Free

Patent: 65223

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2264227

Estimated Expiration: ⤷ Get Started Free

Patent: 3068385

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 00172

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0161010

Estimated Expiration: ⤷ Get Started Free

Patent: 0171176

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 25130

Estimated Expiration: ⤷ Get Started Free

Patent: 22012

Estimated Expiration: ⤷ Get Started Free

Patent: 22014

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 81778

Estimated Expiration: ⤷ Get Started Free

Patent: 85064

Estimated Expiration: ⤷ Get Started Free

Patent: 78658

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0874

Estimated Expiration: ⤷ Get Started Free

Patent: 1101009

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 81778

Estimated Expiration: ⤷ Get Started Free

Patent: 85064

Estimated Expiration: ⤷ Get Started Free

Patent: 78658

Estimated Expiration: ⤷ Get Started Free

Patent: 08477

Estimated Expiration: ⤷ Get Started Free

Patent: 15504

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1020

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 64639

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 30630

Estimated Expiration: ⤷ Get Started Free

Patent: 33644

Estimated Expiration: ⤷ Get Started Free

Patent: 200025

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3676

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 19730

Estimated Expiration: ⤷ Get Started Free

Patent: 89989

Estimated Expiration: ⤷ Get Started Free

Patent: 38086

Estimated Expiration: ⤷ Get Started Free

Patent: 12513402

Estimated Expiration: ⤷ Get Started Free

Patent: 13529647

Estimated Expiration: ⤷ Get Started Free

Patent: 16130249

Estimated Expiration: ⤷ Get Started Free

Patent: 17193586

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 46

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 2022006

Estimated Expiration: ⤷ Get Started Free

Patent: 08477

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0258

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 11006550

Patent: C5AR ANTAGONISTAS. (C5AR ANTAGONISTS.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 975

Patent: مضادات c5ar

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1166

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4140

Patent: C5AR ANTAGONISTS

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 22018

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 81778

Estimated Expiration: ⤷ Get Started Free

Patent: 85064

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 81778

Estimated Expiration: ⤷ Get Started Free

Patent: 85064

Estimated Expiration: ⤷ Get Started Free

Patent: 78658

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02200074

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 998

Patent: ANTAGONISTI C5AR (C5AR ANTAGONISTS)

Estimated Expiration: ⤷ Get Started Free

Patent: 332

Patent: ANTAGONISTI C5AR (C5AR ANTAGONISTS)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 2338

Patent: C5AR ANTAGONISTS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 81778

Estimated Expiration: ⤷ Get Started Free

Patent: 85064

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1104588

Patent: C5AR ANTAGONISTS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1680818

Estimated Expiration: ⤷ Get Started Free

Patent: 110100661

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 77548

Estimated Expiration: ⤷ Get Started Free

Patent: 32975

Estimated Expiration: ⤷ Get Started Free

Patent: 34746

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 65434

Estimated Expiration: ⤷ Get Started Free

Patent: 1028380

Patent: C5aR antagonists

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 2514

Patent: АНТАГОНІСТИ C5aR

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TAVNEOS around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Chile | 2021001389 | ⤷ Get Started Free | |

| Cyprus | 2022012 | ⤷ Get Started Free | |

| Canada | 3120999 | ⤷ Get Started Free | |

| Brazil | PI0923384 | ⤷ Get Started Free | |

| Japan | 2012513402 | ⤷ Get Started Free | |

| Croatia | P20230551 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TAVNEOS

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2381778 | C202230016 | Spain | ⤷ Get Started Free | PRODUCT NAME: AVACOPAN Y SALES FARMACEUTICAMENTE ACEPTABLES DEL MISMO; NATIONAL AUTHORISATION NUMBER: EU/1/21/1605; DATE OF AUTHORISATION: 20220111; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/21/1605; DATE OF FIRST AUTHORISATION IN EEA: 20220111 |

| 2381778 | 22C1020 | France | ⤷ Get Started Free | PRODUCT NAME: AVACOPAN ET SES SELS PHARMACEUTIQUEMENT ACCEPTABLES; REGISTRATION NO/DATE: EU/1/21/1605 20220119 |

| 2381778 | LUC00258 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: AVACOPAN ET LES SELS PHARMACEUTIQUEMENT ACCEPTABLES QUI EN DERIVENT; AUTHORISATION NUMBER AND DATE: EU/1/21/1605 20220119 |

| 2381778 | CR 2022 00022 | Denmark | ⤷ Get Started Free | PRODUCT NAME: AVACOPAN AND PHARMACEUTICALLY ACCEPTABLE SALTS THEREOF; REG. NO/DATE: EU/1/21/1605 20220119 |

| 2381778 | 301166 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: AVACOPAN OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/21/1605 20220119 |

| 3508477 | PA2022006,C3508477 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: AVAKOPANAS IR JO FARMACINIU POZIURIU PRIIMTINOS DRUSKOS ; REGISTRATION NO/DATE: EU/1/21/1605 20220111 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TAVNEOS (Avacopan): An In-Depth Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.