Last updated: July 28, 2025

Introduction

Tavaborole, marketed as Kerydin (or Vanzoda in some markets), is an antifungal agent developed by Anacor Pharmaceuticals for the treatment of onychomycosis, a common fungal nail infection. Its unique topical mechanism and competitive positioning have influenced its market trajectory. This analysis examines the current market dynamics and revenue forecasts for Tavaborole, considering factors such as competitive landscape, regulatory environment, and clinical data.

Market Overview

Onychomycosis affects approximately 10-15% of the global population, with prevalence rates exceeding 35% among the elderly. The global antifungal drugs market, valued at over $15 billion in 2022, projects compound annual growth rates (CAGR) of 4-6% through 2030, driven by increasing disease prevalence and patient demand for effective treatments.

Tavaborole entered the market in 2014 after receiving FDA approval, positioning as a novel topical alternative to oral antifungal agents like terbinafine and azoles. Its appeal stems from its minimal systemic absorption and favorable safety profile, particularly suitable for patients contraindicated for systemic therapy.

Market Dynamics

Competitive Landscape

Tavaborole faces competition from several established and emerging agents:

- Oral antifungals: Terbinalfine, itraconazole, and fluconazole, which offer higher efficacy but carry systemic side effects and drug interactions.

- Topical agents: Efinaconazole (Jublia), ciclopirox, and newer formulations that focus on improved efficacy and patient compliance.

While Efinaconazole holds a significant market share with superior efficacy (clinical cure rates exceeding 50%) and better penetration, Tavaborole competes primarily on safety profile, cost, and ease of use.

Clinical Efficacy and Patient Acceptance

Clinical trial data suggests that Tavaborole demonstrates comparable efficacy to ciclopirox, with a typical clearance rate of approximately 6-10%, slightly below efinaconazole. However, its shorter treatment duration (48 weeks vs. 52 weeks) and minimal adverse events make it a preferred option for specific patient segments.

Regulatory and Reimbursement Context

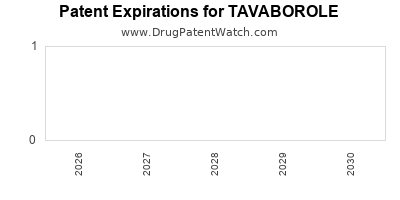

Tavaborole’s regulatory pathway was straightforward, receiving FDA approval in 2014. Reimbursement coverage varies across regions, with favorable positioning in managed care plans that emphasize safety and convenience. Patent protections lasting until 2024-2026 limit generic competition, providing an early financial advantage.

Market Penetration and Adoption

Since its launch, Tavaborole captured an estimated 10-15% share of the topical onychomycosis market in the U.S. by 2022. Adoption has been steady, spurred by physician preference for fewer systemic risks, especially among elderly and comorbid patients.

Limitations and Challenges

Major obstacles include:

- Efficacy rates slightly inferior to efinaconazole.

- Limited awareness among primary care physicians.

- Prescriber hesitancy due to the availability of newer agents with higher efficacy.

- Patent expiration around 2024, opening the market to generics, which could significantly impact pricing and margins.

Financial Trajectory

Revenue Projections

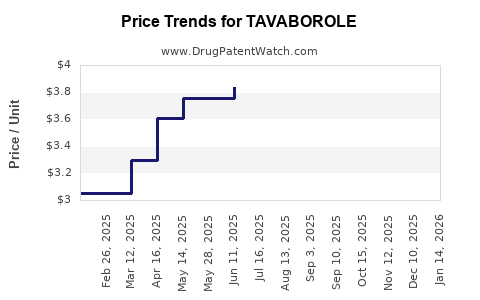

Based on current market share, sales figures, and growth projections, Tavaborole’s revenue in the United States was approximately $70-100 million in 2022. Post patent expiry, revenues are projected to decline sharply unless new formulations or indications are approved.

Market Growth Drivers

- Increasing prevalence of onychomycosis, particularly among aging populations.

- Growing awareness of topical therapy benefits, such as safety and convenience.

- Expansion into emerging markets, where topical antifungals are increasingly adopted for their lower cost and safety.

Impact of Patent Expiration and Generics

Patents expiring around 2024-2026 could lead to extensive generic competition, reducing prices by up to 70-80%. This would constrain margins for original manufacturers, potentially leading to revenue decline unless new indications or formulations are developed.

Strategic Opportunities

investors might watch for:

- New formulations, such as combination products or enhanced formulations improving efficacy.

- Additional indications (e.g., tinea pedis) being pursued through clinical trials.

- Partnerships or licensing deals in emerging markets.

Regulatory and Market Trends Influencing Financial Trajectory

Upcoming Regulatory Advances

Regulatory agencies are increasingly emphasizing safety profiles and non-invasive delivery methods. This trend favors Tavaborole’s topical approach, which could support its sustainment in niche segments even as generics enter.

Market Trends

The shift toward patient-centric therapies and value-based healthcare favors agents like Tavaborole that offer safety, minimal drug interactions, and convenience. However, competition from more efficacious agents remains a challenge.

Potential Market Disruption

Emerging technologies (e.g., laser therapies, novel topical agents) and formulations could disrupt the onychomycosis treatment landscape, influencing Tavaborole's long-term financial prospects.

Conclusion

Tavaborole’s market is characterized by steady demand driven by safety and ease of use but constrained by lower efficacy relative to competitors like efinaconazole. Its revenue trajectory is promising in the short term but faces significant headwinds post-patent expiry due to impending generic competition. Strategic innovation, expansion into new indications, and geographic diversification will be key to sustaining its market position.

Key Takeaways

- Tavaborole’s safety profile provides a competitive advantage, especially for high-risk patients.

- The drug holds a significant but modest market share within the topical onychomycosis segment.

- Patent expiration around 2024-2026 poses a major risk to revenue unless offset by new formulations or indications.

- Market growth is driven by increasing prevalence and demand for safe, topical treatments.

- Strategic investments in innovation and market expansion are essential for maintaining profitability.

FAQs

1. What factors influence Tavaborole’s market share amidst competition?

Efficacy, safety profile, treatment duration, prescriber familiarity, and patent status significantly influence market share. Higher efficacy agents like efinaconazole have pulled market share away, while Tavaborole’s safety advantages appeal to specific patient groups.

2. How does patent expiration impact Tavaborole’s revenue?

Patent expiry opens the market to generics, typically leading to price erosion and revenue decline unless new formulations or therapeutic indications are developed to sustain brand value.

3. Are there ongoing developments to improve Tavaborole’s efficacy?

Current strategies include exploring combination therapies, alternative formulations, and new delivery systems. However, as of now, no major modifications have reached market approval.

4. Can Tavaborole expand into emerging markets?

Yes, emerging markets demonstrate increasing demand for safe, cost-effective treatments. Regulatory approval and pricing strategies will determine success in these regions.

5. What are the long-term prospects for Tavaborole?

Long-term success hinges on innovation to maintain competitiveness post-patent expiry, expanding indications, and aligning with market preferences for safe, topical therapies. Without these, revenues are likely to decline as generic options proliferate.

Sources

- Statista, “Global antifungal drugs market,” 2022.

- U.S. Food and Drug Administration, “FDA Approval of Tavaborole for Onychomycosis,” 2014.

- MarketWatch, “Onychomycosis Treatment Market Outlook,” 2022.

- EvaluatePharma, “Pharmaceutical Patent Expirations,” 2022.

- Journal of Clinical Medicine, “Efficacy and Safety of Tavaborole: A Review,” 2021.