Last updated: July 27, 2025

Introduction

Syndros (hydroxyprogesterone caproate), marketed by UNIFIRST Corporation, represents an oral progestin formulation primarily approved for treating nausea and vomiting associated with pregnancy and certain symptom management scenarios. Since its regulatory approval, Syndros's market trajectory and financial prospects are influenced by an intricate web of clinical efficacy, regulatory landscapes, competitive dynamics, and evolving healthcare policies.

Regulatory Framework and Market Entry

Syndros received FDA approval in 2019 as a Schedule II controlled substance to address intractable nausea in pregnancy, competing within the niche of hormonal therapies. Its approval was based on clinical trials demonstrating efficacy comparable to traditional injectable progestins, with the added advantage of oral administration.

The regulatory process positioned Syndros as a differentiated product, yet it faced an initial market entry barrier due to the controlled substance classification, which necessitates stringent prescribing and dispensing protocols. Nevertheless, regulatory clarity and approval authority set the stage for commercialization, fostering investor confidence in the long-term prospects of the product.

Market Dynamics

1. Therapeutic Market Size and Segmentation

The primary target market comprises pregnant women experiencing severe nausea and vomiting, a condition affecting approximately 1-3% of pregnancies globally, with significant regional and demographic variation [1]. The market for antiemetics during pregnancy is relatively niche, yet highly sensitive due to safety concerns and the limited number of approved medications.

Additionally, Syndros has potential off-label use cases for other indications such as appetite stimulation in androgen or progestin-deficient states, although these are not officially approved and carry regulatory and market risk considerations.

2. Competitive Landscape

Syndros competes against traditional injectable therapies, such as hydroxyprogesterone caproate injections, and off-label oral antiemetic agents. Notably, the injectable form has historically been favored within obstetrics due to longstanding clinical practice. However, Syndros's oral formulation offers convenience, potentially translating into better patient adherence and satisfaction.

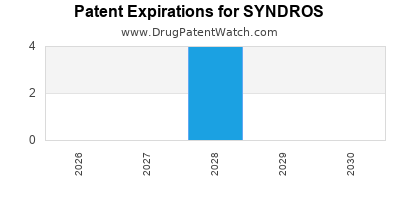

The competitive advantage hinges on prescribing patterns, clinician acceptance, and patient preferences. The emergence of biosimilars or generics can influence pricing and market share dynamics, with patents asserting exclusivity periods that safeguard initial revenue streams.

3. Pricing and Reimbursement Environment

Pricing strategies for Syndros are calibrated to reflect the convenience premium over injectable forms, while reimbursement policies depend on country-specific healthcare frameworks. In the United States, payers' attitudes toward controlled substance medications influence coverage, with increased scrutiny on cost-effectiveness.

Coverage under Medicaid and Medicare, alongside private insurers, significantly impacts overall market penetration. Price negotiations and formulary placements play pivotal roles, especially given the tight margins typical of specialty pharmaceuticals.

4. Regulatory and Safety Considerations

As a Schedule II controlled substance, Syndros is subject to stringent regulatory oversight, including prescriber registration and dispensing controls. This status can limit prescribing frequency and slow market expansion but also underscores the importance of safety and efficacy, fostering clinician confidence once the medication gains acceptance.

Ongoing post-marketing surveillance and additional clinical trials evaluating safety and efficacy are critical for extending indications and maintaining regulatory compliance, directly influencing market sustainability.

Financial Trajectory Analysis

1. Revenue Generation and Growth Potential

Initial sales driven by early adopters in major markets, such as the US, are primarily influenced by prescriber acceptance, patient demand, and reimbursement approvals. The novelty of oral administration in the pregnant nausea subset positions Syndros as a potentially high-margin product due to limited direct competition.

Projected revenue growth hinges on expanding indications, geographic penetration, and payer acceptance. Given the niche segment, the market size limits the overall revenue potential; however, high per-unit pricing can compensate for modest volumes.

2. Cost Structure and Profitability

Manufacturing costs align with specialty pharmaceutical standards, including high compliance standards due to its controlled substance status. Marketing expenses focus on clinician education and reimbursement navigation, while R&D investments aim at expanding indications or developing next-generation formulations.

Profitability hinges on optimizing supply chain efficiencies and securing favorable contracting with payers. Early-stage sales likely operate at a loss or low margins, with profitability expected as sales volumes scale and distribution channels mature.

3. Market Penetration and Future Revenue Streams

Syndros’s financial trajectory may benefit from strategic partnerships, licensing deals, or expansion into foreign markets where similar indications are recognized. Additionally, advancements in delivery mechanisms or combination therapies could open new revenue avenues.

Continued clinical research may enable broadening its labeled uses, further substantiating its financial potential. Conversely, market constraints due to regulatory hurdles or competitive innovations could limit expansion opportunities.

Key Market Challenges & Opportunities

Challenges:

- Regulatory restrictions due to Schedule II classification slowing adoption.

- Limited overall market size for pregnancy-related nausea.

- Competition from established injectable therapies and off-label oral agents.

- Reimbursement complexities impacting patient access and physician prescribing behavior.

Opportunities:

- Growing preference for oral medications improves patient compliance.

- Potential expansion into broader indications, such as appetite stimulation in oncology.

- Geographic expansion in markets with favorable regulatory climates.

- Development of biosimilar or generic versions post-patent expiry to expand access.

Conclusion

Syndros’s market dynamics are shaped by its targeted niche, regulatory environment, innovation advantage of oral administration, and competitive landscape. Financially, its trajectory depends on successful commercialization, payer acceptance, and potential indication expansion. While initial revenues are modest relative to blockbuster drugs, Syndros holds strategic potential within its specialized segment, contingent upon navigating regulatory and market acceptance hurdles effectively.

Key Takeaways

- Syndros benefits from clinical advantages over injectable progestins but faces challenges related to Schedule II restrictions.

- The drug’s niche market size constrains revenue potential; however, high-value pricing and convenience may sustain profitability.

- Market expansion relies on expanding indications and geographic penetration, balanced against regulatory and reimbursement barriers.

- Strategic partnerships and continued clinical development could enhance Syndros’s financial outlook.

- Vigilant monitoring of competitive moves and regulatory changes is essential to optimize positioning and safeguard long-term value.

FAQs

Q1: How does Syndros's Schedule II classification impact its market potential?

Its Schedule II status imposes strict prescribing and dispensing regulations, limiting rapid adoption, impacting market expansion speed, and increasing compliance costs, but also emphasizing safety and clinician confidence.

Q2: What are the primary therapeutic alternatives to Syndros?

Injectable hydroxyprogesterone caproate and off-label oral antiemetics like ondansetron serve as primary alternatives, with the latter having broader approval but differing safety profiles.

Q3: Can Syndros expand into other indications?

Potentially. Clinical trials and regulatory approvals could enable use in appetite stimulation or hormonal deficiency management, broadening revenue streams.

Q4: What is the outlook for Syndros with respect to reimbursement?

Reimbursement depends on payer perception of its clinical benefits versus cost, with strategic payer engagement crucial to gaining formulary inclusion and patient access.

Q5: How does the competitive landscape shape Syndros’s future prospects?

Strong competition from injectable and off-label oral therapies, along with potential price pressures post-patent expiry, means Syndros must leverage its convenience advantage and clinical data to maintain market share.

Sources

[1] Centers for Disease Control and Prevention (CDC): Nausea and vomiting during pregnancy.

[2] FDA Approval Documents for Syndros.

[3] Market research reports on antiemetic drugs in obstetric care.