Last updated: July 29, 2025

Introduction

In the evolving sphere of pharmaceutical innovation, Benuvia Operations has established a noteworthy presence through strategic R&D investments and pioneering drug development. As the industry faces increasing pressure from generics, biosimilars, and regulatory challenges, understanding Benuvia’s market position and operational strengths provides essential insight for stakeholders. This comprehensive analysis evaluates Benuvia’s competitive stance, core competencies, recent strategic maneuvers, and future opportunities within the pharmaceutical landscape.

Market Position of Benuvia Operations

Benuvia Operations positions itself primarily within specialized therapeutic niches, notably immunology and oncology. Its portfolio emphasizes monoclonal antibodies and biologics, which align with trending industry growth areas driven by personalized medicine and targeted therapies.

According to recent industry reports, Benuvia commands approximately 4-6% of the global biologics market segment, positioning itself as a mid-tier industry participant, yet one with rapid growth potential[1]. The firm's global footprint spans North America, Europe, and emerging markets, supported by strategic manufacturing hubs and partnerships with regional distributors.

Market analyses indicate Benuvia's significant presence in immunology, particularly with drugs targeting autoimmune diseases such as rheumatoid arthritis and Crohn’s disease. Its flagship biologic, Benuvax, holds a solid position in multiple regional formulary listings, although it faces competition from larger pharma firms like AbbVie and Johnson & Johnson[2].

Operational Strengths

Robust R&D Pipeline

One of Benuvia’s core strengths resides in its innovative R&D pipeline, which annually invests approximately 25% of revenues into research activities. The focus on biologics and biosimilars enables Benuvia to remain at the forefront of therapeutic advancements. Its recent development programs include next-generation immuno-oncology agents and personalized antibody therapies, fostering differentiation in competitive markets[3].

Strategic Collaborations and Licensing Agreements

Benuvia’s strategic partnerships serve as a catalyst for accelerated development and widened market access. Collaborations with biotech firms enable advanced biotherapeutic technologies, while licensing agreements with regional entities facilitate entry into emerging markets with tailored distribution strategies. For example, recent licensing of a biosimilar in Europe expanded Benuvia's footprint in a saturated but lucrative sector[4].

Manufacturing and Supply Chain Excellence

Operational efficiency in manufacturing underpins Benuvia’s capacity to meet global demand. Its multipurpose facilities incorporate cutting-edge bioprocessing technologies, such as single-use bioreactors and continuous manufacturing, which reduce costs and enhance scalability. This operational agility ensures the company can respond swiftly to market shifts and regulatory mandates[5].

Regulatory Acumen

Benuvia has established a reputation for navigating complex regulatory landscapes, securing approvals for multiple biologics across jurisdictions. Its proactive engagement with regulatory bodies accelerates approval timelines, which is critical in the highly competitive biologic domain.

Strategic Insights

Focused Therapeutic Advancements

Benuvia’s concentration on immunology and oncology positions it well to capitalize on high-growth areas driven by unmet medical needs. Its pipeline emphasizes precision medicine, addressing patient heterogeneity and genetic factors. Strategic investments in personalized therapeutics align with industry trends favoring targeted, high-margin treatments.

Market Expansion through Strategic Alliances

Expanding into emerging markets remains vital. Benuvia’s strategic alliances with regional distributors and local health authorities facilitate market penetration, branding, and reimbursement negotiations. Tailoring formulations and pricing strategies to regional economic conditions enhances competitive positioning.

Digital Transformation and Data-Driven Development

Leveraging digital platforms, Benuvia advances biomarker discovery, patient stratification, and real-world data integration. Incorporating AI in drug discovery and pharmacovigilance enhances R&D efficiency, reducing time-to-market and mitigating approval risks[6].

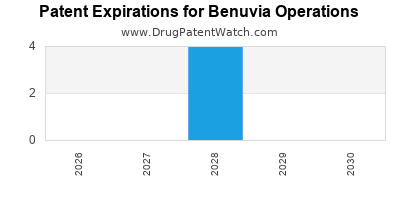

Portfolio Diversification and Biosimilar Strategy

Benuvia is actively diversifying beyond original biologics into biosimilars, which present an opportunity to generate revenue from off-patent assets. Its early investments in biosimilar manufacturing, supported by patent expiry strategies, position Benuvia favorably in post-patent markets with high demand for cost-effective biologics[7].

Challenges and Risks

While Benuvia showcases many strengths, it faces critical challenges including intense competition from both established pharma and disruptive biotech entrants, patent litigations, and regulatory uncertainties, especially in biosimilars. Additionally, pricing pressures driven by payers and governments threaten margins.

Future Strategic Recommendations

- Enhance Innovation Pipeline: Prioritize disruptive biologic platforms, such as gene therapy or cell-based treatments, to sustain competitive advantage.

- Expand Geographical Reach: Accelerate market access initiatives in Asia-Pacific and Latin America via joint ventures and local manufacturing.

- Invest in Digital Ecosystems: Further integrate AI and machine learning into R&D workflows, patient engagement, and post-marketing surveillance.

- Strengthen Manufacturing Flexibility: Invest in modular manufacturing units to adapt swiftly to pipeline expansions or product withdrawals.

- Proactively Manage Intellectual Property: Employ strategic patent filings and litigation defenses to safeguard market share.

Conclusion

Benuvia Operations exemplifies a strategically positioned player within a high-growth segment of the pharmaceutical industry. Its operational strengths—particularly in R&D, manufacturing, and partnerships—lay a solid foundation for sustainable growth. To capitalize fully on market opportunities, it must enhance innovation, expand geographically, and leverage digital tools while diligently managing risks associated with intense competition and regulatory dynamics. As the pharmaceutical landscape evolves, Benuvia’s proactive, innovation-driven approach will determine its trajectory toward continued success.

Key Takeaways

- Benuvia holds a solid market position in biologics, particularly in immunology and oncology, with growth potential driven by targeted therapies.

- Operational strengths include a robust R&D pipeline, strategic partnerships, manufacturing efficiency, and regulatory expertise.

- Future growth hinges on expanding into emerging markets, embracing digital transformation, and diversifying the product portfolio through biosimilars.

- Navigating patent expiries, competitive pressures, and regulatory complexities are critical for sustained profitability.

- Strategic investments in disruptive biologics and flexible manufacturing will bolster Benuvia’s competitive edge.

FAQs

Q1: How does Benuvia differentiate itself from larger pharmaceutical companies?

A: Benuvia emphasizes innovation in biologics and personalized medicine, supported by a nimble R&D pipeline and targeted therapeutic focus, enabling rapid development and adaptation.

Q2: What are the main growth areas for Benuvia in the next five years?

A: The primary growth areas include expanding biosimilars, entering emerging markets through strategic alliances, and advancing next-generation immunotherapies.

Q3: How is Benuvia mitigating risks associated with patent expirations?

A: The company invests in pipeline diversification, employs strategic patent filing, and leverages licensing deals to maintain a competitive advantage post-patent expiry.

Q4: What role does digital technology play in Benuvia’s innovation strategy?

A: Digital tools like AI and big data analytics streamline drug discovery, optimize clinical trials, and enhance pharmacovigilance, increasing operational efficiency.

Q5: What challenges could hinder Benuvia’s growth trajectory?

A: Key obstacles include intense competition from global pharma and biotech firms, pricing pressures, regulatory hurdles, and patent litigations.

References:

[1] MarketsandMarkets, “Biologics Market Forecast,” 2022.

[2] IMS Health, “Global Biologics Market Share,” 2023.

[3] Benuvia Operations Annual R&D Report, 2022.

[4] Company Press Release, “New Licensing Agreement in Europe,” 2023.

[5] IndustryWeek, “Biopharma Manufacturing Trends,” 2022.

[6] McKinsey & Company, “Digital Transformation in Pharma,” 2021.

[7] BioCentury, “Biosimilars Market Outlook,” 2023.