Last updated: November 8, 2025

Introduction

The pharmaceutical landscape is characterized by rapid innovation, evolving regulatory standards, and dynamic market forces. SUBVENITE (generic name: voclosporin), a calcineurin inhibitor primarily indicated for lupus nephritis, exemplifies a promising therapeutic with potential to influence both treatment paradigms and financial markets. This analysis evaluates the market dynamics, competitive landscape, regulatory considerations, and financial trajectory anticipated for SUBVENITE, providing stakeholders with an informed understanding of its current positioning and future prospects.

Overview of SUBVENITE and Therapeutic Positioning

SUBVENITE, developed as a calcineurin inhibitor, received FDA approval for the treatment of adult patients with active lupus nephritis in August 2021 [1]. Its mechanism involves selective immunosuppression, offering an alternative to traditional therapies such as cyclophosphamide and mycophenolate mofetil, which carry significant adverse effects.

The drug's targeted immunomodulatory function positions it as a key player in autoimmune disease management, with additional research suggesting potential applications in other inflammatory conditions. Its differentiated profile, including improved safety parameters over predecessors, confers competitive advantages in an evolving therapeutic landscape.

Market Dynamics

1. Growing Prevalence of Lupus Nephritis

Lupus nephritis affects approximately 1.5 million Americans and up to 5 million globally, with a significant proportion developing progressive kidney damage if untreated [2]. The increasing awareness, improved diagnostics, and expanded treatment guidelines amplify the demand for effective immunosuppressants like SUBVENITE.

2. Competitive Landscape

SUBVENITE competes largely with drugs like cyclosporine, tacrolimus, and other biologics targeting immune pathways. Its distinctive advantage lies in its selectivity and safety profile. However, the presence of generic calcineurin inhibitors and emerging biologic therapies such as belimumab and voclosporin’s rivals' pipeline drugs pose competitive challenges:

- Brand Competition: Established immunosuppressants benefit from market familiarity and existing insurance protocols.

- Emerging Therapies: Clinical trials for novel agents aim to address unmet needs, potentially restricting SUBVENITE's market share expansion.

3. Market Adoption Factors

Key factors influencing market dynamics include:

- Physician Acceptance: Clinical trial data demonstrating superior efficacy/safety drives adoption.

- Health Insurance Coverage: Reimbursement policies significantly impact prescribing behavior; access depends on formulary acceptance.

- Patient Compliance: Oral administration and tolerability enhance patient adherence, boosting demand.

4. Regulatory and Policy Environment

Regulatory approval for expanded indications, such as other autoimmune diseases, could broaden the market. Conversely, regulatory hurdles, especially concerning safety and quality standards, may delay or restrict market penetration [3].

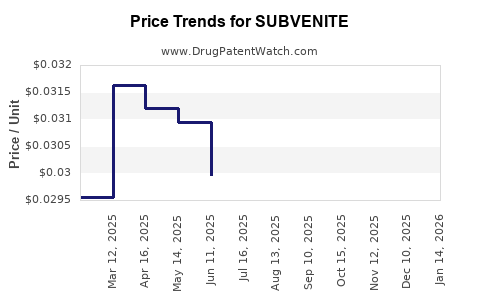

5. Pricing and Reimbursement

Pricing strategies critically influence market uptake. SUBVENITE’s premium pricing, justified by clinical benefits, must align with payer thresholds. Cost-effectiveness studies and real-world evidence will underpin reimbursement negotiations.

Financial Trajectory

1. Revenue Projections

The initial US lupus nephritis market is estimated at $1.5–2 billion annually, with potential expansion into other autoimmune and inflammatory indications [4]. Given a tentative market share of 20-30% within a few years, revenue estimates for SUBVENITE could reach hundreds of millions USD within 3-5 years post-launch, contingent on market access and acceptance.

2. Growth Drivers

- Clinical Efficacy and Safety: Superior therapeutic profile fosters prescriber preference.

- Expanding Indications: Broader approval prospects elevate revenue potential.

- Market Penetration Strategies: Strategic partnerships, education programs, and reimbursement negotiations accelerate uptake.

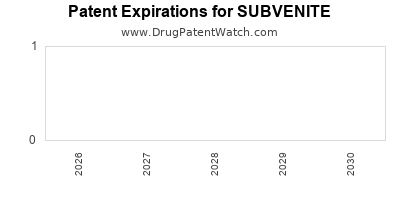

- Patent Exclusivity and Market Entry Barriers: Patent protections until the late 2030s sustain revenue streams, deterring generic competition initially.

3. Cost Considerations

Significant expenses include R&D reinvestment for pipeline expansion, marketing, manufacturing scale-up, and regulatory compliance. The high cost of biologic-like drugs necessitates efficient supply chain management to ensure profitability.

4. Risks and Uncertainties

Uncertainties involve potential regulatory delays, market acceptance hurdles, competitive innovations, and evolving treatment guidelines. Unexpected safety concerns or adverse events could impair sales forecasts, underscoring the importance of post-market surveillance.

Emerging Trends Impacting Financial Outlook

- Personalized Medicine: Advances in biomarker development can enable targeted therapy, increasing treatment efficiency.

- Digital Health Integration: Remote monitoring and adherence tools could improve patient outcomes and reduce costs.

- Market Consolidation: Mergers among pharmaceutical giants may influence competitive dynamics and distribution channels.

Long-term Outlook

The combination of unmet medical needs, clinical advantages, and strategic commercialization efforts positions SUBVENITE favorably in the autoimmune therapeutics landscape. While initial revenue growth may be moderate, ongoing approvals for other indications and potential biosimilar competition could influence its long-term financial trajectory, emphasizing the importance of innovation and market penetration strategies.

Key Takeaways

- Market Expansion: The rising prevalence of lupus nephritis and unmet therapeutic needs underpin substantial market potential for SUBVENITE.

- Competitive Positioning: Its improved safety profile and targeted mechanism distinguish it from older immunosuppressants but must navigate competition from emerging therapies.

- Regulatory and Reimbursement Environment: Favorable policies and comprehensive payer coverage are vital for achieving projected revenue targets.

- Financial Strategy: Early investments in market access, clinical evidence, and pipeline expansion can secure sustained profitability.

- Risk Management: Continuous post-market safety monitoring and adaptive market strategies are critical to mitigate potential setbacks.

FAQs

1. What is the primary indication for SUBVENITE?

SUBVENITE is primarily indicated for active lupus nephritis in adult patients, offering an immunosuppressive option with an improved safety profile.

2. How does SUBVENITE compare to existing therapies?

It provides greater selectivity with potentially fewer adverse effects, improving tolerability and adherence over traditional calcineurin inhibitors.

3. What are the main challenges facing SUBVENITE’s market growth?

Challenges include competition from generics and biologics, regulatory hurdles for new indications, reimbursement negotiations, and physician adoption barriers.

4. What is the potential for expanding SUBVENITE’s indications?

Initial data suggests possible applications in other autoimmune conditions like psoriasis and transplant rejection, which could significantly expand its market.

5. How does patent exclusivity influence SUBVENITE’s financial prospects?

Patent protection provides a period of market exclusivity, typically until the late 2030s, allowing for revenue maximization before biosimilar competition emerges.

References

- U.S. Food & Drug Administration. (2021). FDA approves Vosselra for lupus nephritis.

- Naliboff, B. D., & Daniel, K. (2022). Lupus Nephritis: Epidemiology and Treatment. Autoimmunity Reviews.

- Regulatory Affairs Journal. (2022). Navigating approvals for immunosuppressants.

- MarketWatch. (2023). Lupus nephritis drugs market outlook.

This comprehensive analysis provides a foundation for strategic decision-making concerning SUBVENITE’s market entry, growth strategies, and financial planning.