SUBOXONE Drug Patent Profile

✉ Email this page to a colleague

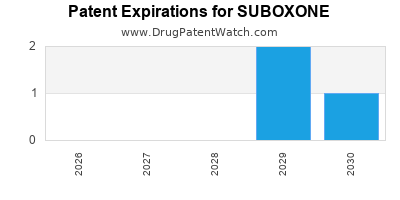

When do Suboxone patents expire, and when can generic versions of Suboxone launch?

Suboxone is a drug marketed by Indivior and is included in two NDAs. There are three patents protecting this drug and three Paragraph IV challenges.

This drug has thirty-two patent family members in twenty-four countries.

The generic ingredient in SUBOXONE is buprenorphine hydrochloride; naloxone hydrochloride. There are twenty-nine drug master file entries for this compound. Twenty-three suppliers are listed for this compound. Additional details are available on the buprenorphine hydrochloride; naloxone hydrochloride profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Suboxone

A generic version of SUBOXONE was approved as buprenorphine hydrochloride; naloxone hydrochloride by ACTAVIS ELIZABETH on February 22nd, 2013.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for SUBOXONE?

- What are the global sales for SUBOXONE?

- What is Average Wholesale Price for SUBOXONE?

Summary for SUBOXONE

| International Patents: | 32 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 30 |

| Clinical Trials: | 100 |

| Drug Prices: | Drug price information for SUBOXONE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for SUBOXONE |

| What excipients (inactive ingredients) are in SUBOXONE? | SUBOXONE excipients list |

| DailyMed Link: | SUBOXONE at DailyMed |

Recent Clinical Trials for SUBOXONE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Indivior Inc. | PHASE2 |

| Erin Winstanley | PHASE4 |

| National Institute on Drug Abuse (NIDA) | PHASE4 |

Pharmacology for SUBOXONE

| Drug Class | Opioid Antagonist Partial Opioid Agonist |

| Mechanism of Action | Opioid Antagonists Partial Opioid Agonists |

Paragraph IV (Patent) Challenges for SUBOXONE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| SUBOXONE | Sublingual Film | buprenorphine hydrochloride; naloxone hydrochloride | 12 mg/3 mg | 022410 | 1 | 2013-05-14 |

| SUBOXONE | Sublingual Film | buprenorphine hydrochloride; naloxone hydrochloride | 2 mg/0.5 mg* and 8 mg/2 mg | 022410 | 1 | 2012-10-15 |

| SUBOXONE | for Injection | buprenorphine hydrochloride; naloxone hydrochloride | 500 mg/vial | 020733 | 2 | 2009-01-26 |

US Patents and Regulatory Information for SUBOXONE

SUBOXONE is protected by three US patents.

Expired US Patents for SUBOXONE

International Patents for SUBOXONE

When does loss-of-exclusivity occur for SUBOXONE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 8417

Patent: COMPOSICIONES DE PELICULA SUBLINGUAL Y BUCAL

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 10279440

Patent: Sublingual and buccal film compositions

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012002817

Patent: composições sublinguais e bucais em filme

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 70180

Patent: COMPOSITIONS PELLICULAIRES SUBLINGUALES ET BUCCALES (SUBLINGUAL AND BUCCAL FILM COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 12000313

Patent: Composición de dosificación de película que comprende una matriz portadora, entre 2-16 mg de buprenorfina, entre 0,5-5 mg de naloxona y un tampón que proporciona un ph local entre 2-4; procedimiento de preparación; uso en el tratamiento de la dependencia de narcóticos en un usuario.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2548535

Patent: Sublingual and buccal film compositions

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 11219

Patent: COMPOSICIONES DE PELÍCULA SUBLINGUALES Y BUCALES

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0160368

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 61795

Estimated Expiration: ⤷ Get Started Free

Patent: 31445

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 61795

Patent: COMPOSITIONS PELLICULAIRES SUBLINGUALES ET BUCCALES (SUBLINGUAL AND BUCCAL FILM COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 31445

Patent: COMPOSITIONS PELLICULAIRES SUBLINGUALES ET BUCCALES (SUBLINGUAL AND BUCCAL FILM COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 71960

Patent: 舌下和口腔用薄膜組合物 (SUBLINGUAL AND BUCCAL FILM COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7964

Patent: תכשירים בצורה שטוחה המכילים בופרנורפין ונלוקסון, פורמולציות בתצורה שטוחה המכילות אותם, ושימושן בהכנת תרופות לטיפול בתלות בחומרים נרקוטיים (Film dosage compositions comprising buprenorphine and naloxone, film formulations comprising the same and use thereof for the preparation of medicaments for treating narcotic dependence)

Estimated Expiration: ⤷ Get Started Free

Patent: 4974

Patent: תכשירים בצורה שטוחה המכילים בופרנורפין ונלוקסון, פורמולציות בתצורה שטוחה המכילות אותם, ושימושן בהכנת תרופות לטיפול בתלות בחומרים נרקוטיים (Film dosage compositions comprising buprenorphine and naloxone, film formulations comprising the same and use thereof for the preparation of medicaments for treating narcotic dependence)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 19827

Estimated Expiration: ⤷ Get Started Free

Patent: 13501717

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 6006

Patent: SUBLINGUAL AND BUCCAL FILM COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 12001573

Patent: COMPOSICIONES DE PELÍCULA SUBLINGUALES Y BUCALES. (SUBLINGUAL AND BUCCAL FILM COMPOSITIONS.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 8537

Patent: Sublingual and buccal film compositions

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 121136

Patent: COMPOSICIONES DE PELICULA SUBLINGUALES Y BUCALES

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 12108632

Patent: СУБЛИНГВАЛЬНЫЕ И БУККАЛЬНЫЕ ПЛЕНОЧНЫЕ КОМПОЗИЦИИ

Estimated Expiration: ⤷ Get Started Free

Patent: 18121855

Patent: СУБЛИНГВАЛЬНЫЕ И БУККАЛЬНЫЕ ПЛЕНОЧНЫЕ КОМПОЗИЦИИ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 8265

Patent: SUBLINGUAL AND BUCCAL FILM COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

Patent: 201601214V

Patent: SUBLINGUAL AND BUCCAL FILM COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1201647

Patent: SUBLINGUAL AND BUCCAL FILM COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1699321

Estimated Expiration: ⤷ Get Started Free

Patent: 120059538

Patent: SUBLINGUAL AND BUCCAL FILM COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 62634

Estimated Expiration: ⤷ Get Started Free

Patent: 57814

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering SUBOXONE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 1764443 | Thin film with non-self-aggregating uniform heterogeneity and drug delivery systems made therefrom | ⤷ Get Started Free |

| South Africa | 201201647 | SUBLINGUAL AND BUCCAL FILM COMPOSITIONS | ⤷ Get Started Free |

| Singapore | 178265 | ⤷ Get Started Free | |

| Colombia | 6511219 | COMPOSICIONES DE PELÍCULA SUBLINGUALES Y BUCALES | ⤷ Get Started Free |

| Canada | 2456234 | INSTRUMENTS OPTIQUES ACCORDABLES (TUNABLE OPTICAL INSTRUMENTS) | ⤷ Get Started Free |

| Norway | 20056060 | ⤷ Get Started Free | |

| Japan | 5748494 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

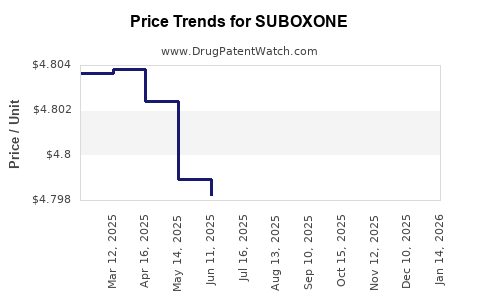

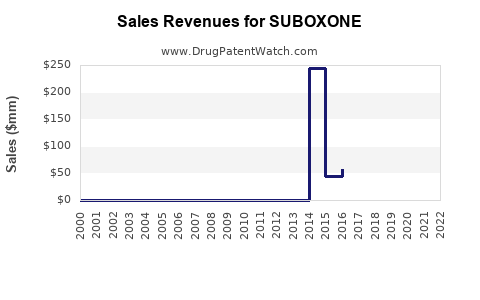

Market Dynamics and Financial Trajectory for SUBOXONE

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.