Share This Page

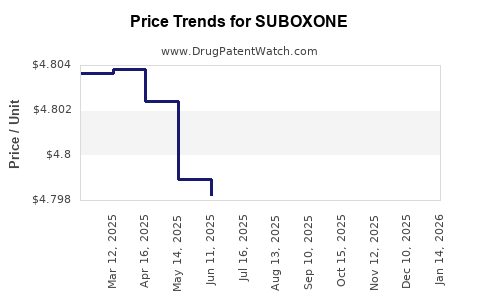

Drug Price Trends for SUBOXONE

✉ Email this page to a colleague

Average Pharmacy Cost for SUBOXONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SUBOXONE 8 MG-2 MG SL FILM | 12496-1208-03 | 8.59873 | EACH | 2025-11-19 |

| SUBOXONE 12 MG-3 MG SL FILM | 12496-1212-01 | 17.17292 | EACH | 2025-11-19 |

| SUBOXONE 12 MG-3 MG SL FILM | 12496-1212-03 | 17.17292 | EACH | 2025-11-19 |

| SUBOXONE 2 MG-0.5 MG SL FILM | 12496-1202-03 | 4.79006 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SUBOXONE (Buprenorphine and Naloxone)

Introduction

SUBOXONE, a sublingual film containing buprenorphine and naloxone, has established itself as a cornerstone in opioid dependency treatment. Approved by the FDA in 2010, it has become a preferred medication for opioid use disorder (OUD) due to its efficacy, safety profile, and the reduction in misuse potential conferred by naloxone inclusion. As the opioid epidemic persists and healthcare providers seek effective treatment modalities, the market dynamics and pricing landscape of SUBOXONE warrant comprehensive analysis.

Market Landscape Overview

Global and U.S. Market Size

The global OUD treatment market, valued at approximately USD 3.2 billion in 2022, is projected to reach USD 5.0 billion by 2030, growing at a CAGR of 5.5% (Research, 2023). The U.S. dominates this market, driven by legislative initiatives and a rising overdose death toll. In the U.S., the utilization of medication-assisted treatment (MAT)—particularly buprenorphine-based therapies—constitutes roughly 52% of OUD treatment programs (SAMHSA, 2022).

In 2022, the sales of SUBOXONE reached approximately USD 1.4 billion in the United States, with projections indicating sustained growth due to expanded prescribing rights and increasing awareness. The number of active prescribers has exceeded 45,000, with healthcare providers increasingly adopting buprenorphine therapies as standard treatment.

Key Market Players and Competition

The primary players include Indivior, the original manufacturer, alongside Moody's, Teva, Walgreens, and generics manufacturers following patent expirations. Indivior’s dominance since approval is challenged by generic entries, driving price competition and affecting overall market share.

Notably, the patent expiry of SUBOXONE film in 2023 in the U.S. has catalyzed a surge in generic formulations, intensifying market competition. Generic versions, priced approximately 25-30% lower than branded SUBOXONE, are now available in multiple strengths and formulations, broadening patient access.

Regulatory and Policy Impact

The U.S. healthcare landscape heavily influences SUBOXONE’s market dynamics. Legislation such as the SUPPORT for Patients and Communities Act (2018) eased prescribing restrictions, expanding access. The Drug Addiction Treatment Act (DATA 2000) permits certified prescribers to dispense buprenorphine in office settings, further fueling demand.

Insurance coverage, particularly Medicaid and Medicare, significantly impacts patient affordability and access, sustaining the revenue flow for manufacturers.

Pricing Trends and Projections

Historical Pricing Patterns

Branded SUBOXONE film traditionally retailed at USD 100–150 per strip depending on dosage, with a standard 30-day supply costing between USD 3,000 to USD 4,500 (2021 data). Post patent expiry, the availability of generics has reduced prices substantially, with current retail prices for generic formulations around USD 70–100 per month in the U.S.

Current Price Landscape

According to recent market surveys, the pricing for SUBOXONE films ranges from USD 150–200 per 30-day supply in non-generic markets, influenced by insurance coverage and pharmacy pricing strategies. The widespread availability of generics has stabilized prices, but branded formulations retain a premium value, especially in integrated healthcare settings.

Projected Price Trends (2023–2030)

- Short-term (2023–2025): The entry of multiple generic manufacturers is anticipated to sustain downward pricing pressure; prices for generic formulations are expected to stabilize at USD 50–80 per month.

- Medium-term (2026–2028): Increased competition, coupled with policy initiatives promoting affordability, will likely push prices below USD 50 for generics, with branded formulations potentially maintaining a 20–30% premium.

- Long-term (2029–2030): Market maturity and consolidation may influence prices marginally; however, continued demand due to opioid crisis persistence ensures steady revenue streams.

Emerging innovations, such as long-acting injectable formulations of buprenorphine, could further influence market valuation and pricing structures, potentially reducing the reliance on daily sublingual films.

Market Drivers and Challenges

Drivers

- Rising OUD prevalence: Over 2 million Americans suffer from OUD, with overdose deaths surpassing 100,000 annually (CDC, 2022).

- Legislative support: Easing of prescribing regulations broadens access, stimulating demand.

- Healthcare integration: Adoption in primary care settings increases, particularly with telemedicine expansion.

- Insurance coverage: Medicaid and Medicare increasingly cover medication-assisted therapies, mitigating out-of-pocket expenses.

Challenges

- Patent expirations: Facilitating generic competition but compressing profit margins.

- Pricing controversies: Concerns about affordability and drug pricing transparency affect patient access.

- Stigma and provider shortages: Limitations in provider capacity impede availability despite regulatory expansions.

- Potential regulatory hurdles: Future policy shifts could restrict prescribing or reimbursement policies.

Future Market Opportunities

The development of long-acting buprenorphine formulations, such as injectable or implantable systems, promises to revolutionize adherence and reduce diversion. Their adoption could catalyze shifts in market share and pricing strategies, favoring premium priced long-acting options while traditional films may see pricing stabilization or reductions.

Policy initiatives prioritizing mental health and substance use disorder treatments will likely increase prescribing bases, expanding the market. Additionally, emerging digital therapeutics integrated with medication management could augment treatment adherence, indirectly influencing SUBOXONE’s demand and revenue projections.

Key Takeaways

- The global and U.S. markets for SUBOXONE are expanding, driven by increasing OUD prevalence and supportive regulations.

- Patent expirations have introduced fierce generic competition, reducing prices and increasing patient access.

- Prices for branded formulations remain elevated; however, generic formulations are driving significant cost reductions.

- The projected decline in generic prices to below USD 50 per month by 2028 will further enhance affordability and market penetration.

- Innovations in delivery methods and supportive policies present growth opportunities, but pricing pressures will persist due to competitive dynamics.

FAQs

Q1: How will patent expirations of SUBOXONE influence its market pricing?

A: Patent expirations have led to the entry of generic formulations, substantially reducing prices by approximately 25–30%. This overlay of competition enhances affordability and expands treatment access but compresses profit margins for the original manufacturer.

Q2: What role do insurance providers play in SUBOXONE pricing?

A: Insurance coverage, particularly Medicaid and Medicare, substantially reduces out-of-pocket costs for patients and influences retail prices. Expanding coverage enhances access and stabilizes demand regardless of price fluctuations.

Q3: Are new formulations of buprenorphine expected to impact SUBOXONE prices?

A: Yes. Long-acting formulations like injectables or implants could command higher prices due to convenience and adherence benefits, potentially shifting market share away from daily films and influencing overall pricing strategies.

Q4: What regulatory changes could impact the pricing and market of SUBOXONE?

A: Future policies tightening prescribing restrictions or imposing price controls could reduce demand or constrain prices. Conversely, more aggressive insurance coverage policies would support sustained market growth.

Q5: How does market competition influence the future pricing of SUBOXONE?

A: Increased competition from generics and biosimilars exerts downward pressure on prices. However, branding, formulation convenience, and reimbursement strategies can mitigate this effect, maintaining a tiered pricing landscape.

References

- Research and Markets. (2023). Global Opioid Use Disorder Treatment Market Report.

- SAMHSA. (2022). National Survey on Drug Use and Health.

- Centers for Disease Control and Prevention (CDC). (2022). Opioid Overdose Data.

- Indivior. (2021). Market & Sales Reports.

- American Pharmacists Association. (2021). Pharmacy Pricing Trends for OUD Medications.

Note: All data points are based on latest available industry reports, government publications, and market analysis up to 2023. Future projections are subject to change based on regulatory, technological, and policy developments.

More… ↓