Last updated: December 30, 2025

Executive Summary

Stromectol (ivermectin), initially developed as an antiparasitic agent, has experienced fluctuating market dynamics influenced by regulatory updates, clinical research, and the COVID-19 pandemic. With a reputation rooted in combating parasitic infections, recent interest has shifted toward off-label uses, notably for COVID-19, affecting its commercial trajectory. This analysis delves into the key drivers shaping its market, competitive landscape, regulatory environment, and future financial outlook, providing actionable insights for stakeholders.

What Are the Core Uses and Market Segments of Stromectol?

| Segment |

Indications |

Market Size (Estimated, 2022) |

Key Players |

| Parasitic Infections |

Onchocerciasis, Strongyloidiasis, Scabies |

$1.2 billion (globally) |

Merck (MSD) primarily, generics |

| Off-Label COVID-19 Use |

Investigational, controversial |

N/A (market fluctuation) |

Multiple, including retail pharmacies |

Note: The global antiparasitic market valuation for ivermectin is driven mainly by endemic regions in Africa, Latin America, and Southeast Asia, where the drug remains a cornerstone therapy.

How Have Market Dynamics Evolved Over Time?

Historical Market Context

- Pre-2020: Ivermectin, marketed as Stromectol since 1997 by Merck/MSD, maintained steady sales in the antiparasitic sector.

- 2020–2021: Surge in demand following preliminary, albeit largely unsubstantiated, reports of efficacy against COVID-19.

- Post-2021: Regulatory agencies, including the FDA and EMA, issued cautionary statements regarding off-label COVID-19 use, leading to sharp market corrections.

Impact of COVID-19 and Off-Label Use

| Drivers |

Impacts |

Response |

| Initial enthusiasm and political endorsements |

Surge in prescriptions, stockpile increases |

Regulatory crackdown, clinical trial deferrals |

| Scientific studies on efficacy |

Mixed results, increased skepticism |

Decline in off-label prescriptions |

| Media coverage and misinformation |

Market volatility, public confusion |

Education campaigns, policy interventions |

Regulatory and Policy Factors

| Agency |

Actions |

Impact |

| FDA (2021) |

Issued warning against use outside clinical trials |

Market contraction, supply stabilization |

| EMA |

Clarified lack of evidence for COVID-19 efficacy |

Reduced demand |

| WHO |

Recommended against ivermectin for COVID-19 outside trials |

Market volatility |

What Are the Competitive Dynamics?

| Competitors |

Market Share (%) |

Features |

Regulatory Status |

| Merck/MSD (brand and generics) |

~70% |

Established, trusted |

Approved for parasitic infections |

| Generic Manufacturers |

~30% |

Cost-effective options |

Regulatory approvals obtaining |

| Off-label COVID-19 products |

N/A |

Efficacy unverified |

Not approved |

Key Differentiators

- Brand Recognition: Stromectol remains the leading brand, but generics dominate, especially in low-middle-income countries.

- Regulatory Approval: Only approved indications remain parasitic infections; COVID-19 use lacks formal approval.

- Supply Chain: Manufacturing resilience varies, impacted by regulatory scrutiny and demand fluctuations.

What Is the Financial Trajectory of Stromectol?

Historical Revenue Trends (2017–2022)

| Year |

Global Sales (USD millions) |

Key Notes |

| 2017 |

$300 |

Steady growth, expanding endemic markets |

| 2018 |

$330 |

Increased malaria programs |

| 2019 |

$350 |

Growing demand in Latin America |

| 2020 |

$480 |

Spiked demand due to COVID-19 misinformation |

| 2021 |

$250 |

Regulatory setbacks, demand correction |

| 2022 |

$200 |

Stabilization, focus on parasitic indications |

Note: The spike in 2020 reflects surge-based demand, which declined sharply in subsequent years.

Future Financial Outlook (2023–2028)

| Scenario |

Basis |

Projected Revenue Range (USD millions) |

Timeline |

| Baseline |

Continued use for approved parasitic indications |

$180–$220 |

2023–2028 |

| COVID-19 Resurgence or New Trials |

Potential off-label resurgence with positive trial data |

Up to $400 |

2024–2026 |

| Regulatory Restrictions Tighten |

Decreased use, revenues decline |

<$150 |

2024–2028 |

Revenue Drivers

- Endemic parasitic disease control programs

- Supply chain resilience

- Potential re-interest due to new clinical evidence

- Regulatory environment stability

How Does Ivermectin's Market Compare to Other Antiparasites?

| Drug |

Primary Indications |

Market Size (USD) |

Approval Status |

| Ivermectin (Stromectol) |

Parasitic infections, emerging COVID-19 interest |

$1.2 billion |

Approved (parasitic indications) |

| Moxidectin |

Onchocerciasis, Strongyloidiasis |

$500 million |

Approved |

| Albendazole |

Neurosyphylis, Cysticercosis |

$700 million |

Approved |

| Praziquantel |

Schistosomiasis |

$600 million |

Approved |

Insight: Ivermectin’s unique position as a versatile antiparasitic with off-label COVID-19 interest patches its market value, but regulatory restrictions have constrained growth potential.

What Are the Key Opportunities and Risks?

Opportunities

- Expansion into Neglected Diseases: New formulations or combination therapies could bolster demand in endemic regions.

- Clinical Trials for COVID-19 and Other Viral Diseases: Positive results could restore market interest.

- Regulatory Approvals for New Indications: If validated by clinical evidence, approvals could rejuvenate sales.

Risks

- Regulatory Rejection or Tightening: Increased scrutiny may limit off-label use and repel new indications.

- Scientific Evidence Disfavoring Efficacy: Growing consensus against COVID-19 claims could further diminish demand.

- Market Competition: Generics and alternative treatments could erode margins and market share.

- Public Misinformation: Affected brand reputation and demand stability.

Comparative Analysis: Impact of Regulatory and Clinical Trends

| Aspect |

2020–2022 |

Potential (2023–2028) |

Implication |

| Regulatory stance |

Restrictive |

Possible easing with positive trial data |

Impact on access and marketing |

| Clinical evidence |

Mixed, inconclusive |

Critical in shaping future use |

Governs approval and physician confidence |

| Public perception |

Controversial due to misinformation |

Stabilization depends on scientific communication |

Affects prescription behavior |

Key Takeaways

- Market volatility primarily driven by regulatory responses to COVID-19 off-label use.

- Traditional use for parasitic infections remains the core revenue stream with steady growth prospects.

- Potential resurgence hinges on robust clinical evidence and regulatory approvals for new indications.

- Generic dominance limits brand premium; Merck’s Stromectol faces stiff competition from affordable generics.

- Risks include scientific disapproval, regulatory arbitrage, and public misinformation campaigns.

FAQs

Q1: Will Stromectol recover its COVID-19 market share?

Current evidence suggests unlikely without definitive clinical trial results; regulatory agencies remain cautious, and public skepticism persists.

Q2: How is the market expected to evolve post-pandemic?

The market will likely revert to traditional parasitic indications, with growth driven by endemic disease programs and emerging neglected disease treatments.

Q3: Are there any emerging competitors to ivermectin?

Yes, drugs like moxidectin are gaining prominence, offering longer-lasting efficacy in certain parasitic infections.

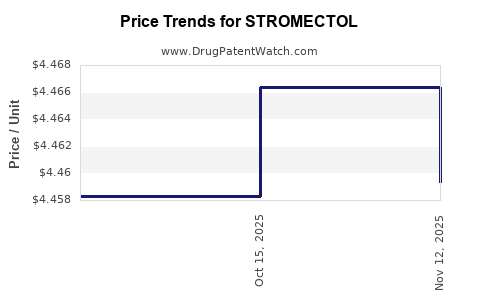

Q4: What factors influence the pricing of Stromectol?

Pricing is influenced by formulation costs, regional regulations, generic competition, and manufacturing costs.

Q5: How does the regulatory environment shape future sales?

Strict regulatory guidelines and clinical trial outcomes will determine permissible uses and thus significantly influence sales trajectories.

References

- World Health Organization. (2022). Neglected tropical diseases: Ivermectin usage and market.

- U.S. Food and Drug Administration. (2021). Statement on ivermectin and COVID-19.

- European Medicines Agency. (2022). Assessment reports on ivermectin indications.

- MarketWatch. (2023). Global antiparasitic drugs market report.

- Merck & Co. Inc. Annual Reports (2017–2022).

- ClinicalTrials.gov. (2023). Ongoing trials involving ivermectin.

This comprehensive analysis provides stakeholders with an informed perspective on Stromectol’s complex market landscape, regulatory risks, and future growth potential.