STEGLATRO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Steglatro, and when can generic versions of Steglatro launch?

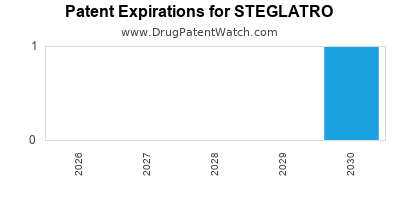

Steglatro is a drug marketed by Msd Sub Merck and is included in one NDA. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has sixty-one patent family members in forty-nine countries.

The generic ingredient in STEGLATRO is ertugliflozin. One supplier is listed for this compound. Additional details are available on the ertugliflozin profile page.

DrugPatentWatch® Generic Entry Outlook for Steglatro

Steglatro was eligible for patent challenges on December 19, 2021.

There have been three patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for STEGLATRO?

- What are the global sales for STEGLATRO?

- What is Average Wholesale Price for STEGLATRO?

Summary for STEGLATRO

| International Patents: | 61 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 56 |

| Clinical Trials: | 4 |

| Patent Applications: | 1,067 |

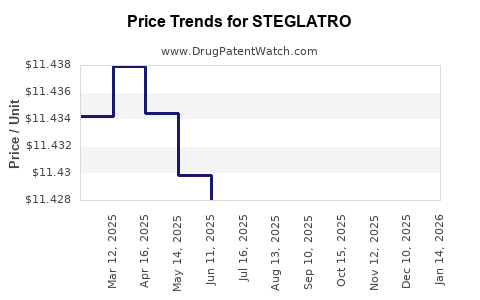

| Drug Prices: | Drug price information for STEGLATRO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for STEGLATRO |

| What excipients (inactive ingredients) are in STEGLATRO? | STEGLATRO excipients list |

| DailyMed Link: | STEGLATRO at DailyMed |

Recent Clinical Trials for STEGLATRO

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Klinikum Wiener Neustadt | Phase 3 |

| General Hospital Linz | Phase 3 |

| Medical University of Vienna | Phase 3 |

Paragraph IV (Patent) Challenges for STEGLATRO

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| STEGLATRO | Tablets | ertugliflozin | 5 mg and 15 mg | 209803 | 3 | 2021-12-20 |

US Patents and Regulatory Information for STEGLATRO

STEGLATRO is protected by one US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Msd Sub Merck | STEGLATRO | ertugliflozin | TABLET;ORAL | 209803-001 | Dec 19, 2017 | RX | Yes | No | 8,080,580 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Msd Sub Merck | STEGLATRO | ertugliflozin | TABLET;ORAL | 209803-002 | Dec 19, 2017 | RX | Yes | Yes | 8,080,580 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for STEGLATRO

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Merck Sharp & Dohme B.V. | Steglatro | ertugliflozin | EMEA/H/C/004315Steglatro is indicated in adults aged 18 years and older with type 2 diabetes mellitus as an adjunct to diet and exercise to improve glycaemic control:as monotherapy in patients for whom the use of metformin is considered inappropriate due to intolerance or contraindications.in addition to other medicinal products for the treatment of diabetes. | Authorised | no | no | no | 2018-03-21 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for STEGLATRO

When does loss-of-exclusivity occur for STEGLATRO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

African Regional IP Organization (ARIPO)

Patent: 28

Estimated Expiration: ⤷ Get Started Free

Argentina

Patent: 3138

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09286380

Estimated Expiration: ⤷ Get Started Free

Austria

Patent: 40040

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0918841

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 33795

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11000394

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2149717

Estimated Expiration: ⤷ Get Started Free

Patent: 3497199

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 41636

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 110077

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0120104

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 003

Estimated Expiration: ⤷ Get Started Free

Patent: 110041

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 12497

Estimated Expiration: ⤷ Get Started Free

Patent: 18024

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 34687

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 011000058

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 11010854

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 11003842

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 8492

Estimated Expiration: ⤷ Get Started Free

Patent: 1100266

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 34687

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1036

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0135803

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 09001652

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 56616

Estimated Expiration: ⤷ Get Started Free

Patent: 93606

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 800031

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1226

Estimated Expiration: ⤷ Get Started Free

Patent: 6804

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 25322

Estimated Expiration: ⤷ Get Started Free

Patent: 12500842

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 334687

Estimated Expiration: ⤷ Get Started Free

Patent: 2018510

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 5418

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 11002166

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 285

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 590

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 0943

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1027

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1100043

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 18019

Estimated Expiration: ⤷ Get Started Free

Panama

Patent: 40801

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 110288

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 34687

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 34687

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 236

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 34687

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1101341

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1338540

Estimated Expiration: ⤷ Get Started Free

Patent: 1446454

Estimated Expiration: ⤷ Get Started Free

Patent: 110045093

Estimated Expiration: ⤷ Get Started Free

Patent: 130116078

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 80408

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 87598

Estimated Expiration: ⤷ Get Started Free

Patent: 1014863

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 11000066

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 3626

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 073

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering STEGLATRO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Africa | 201101341 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 018492 | ⤷ Get Started Free | |

| Lithuania | C2334687 | ⤷ Get Started Free | |

| South Korea | 20130116078 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for STEGLATRO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2334687 | 2018/028 | Ireland | ⤷ Get Started Free | PRODUCT NAME: ERTUGLIFLOZIN, OPTIONALLY AS A CRYSTAL FORM, PARTICULARLY AS A CO-CRYSTAL WITH L-PYROGLUTAMIC ACID, AND SPECIFICALLY AS ERTUGLIFLOZIN L-PYROGLUTAMIC ACID; REGISTRATION NO/DATE: EU/1/18/1267/001 EU/1/18/1267/012 20180321 |

| 2334687 | LUC00079 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: ERTUGLIFLOZINE, EVENTUELLEMENT SOUS FORME CRISTALLINE, EN PARTICULIER EN TANT QUE CO-CRISTAL AVEC L'ACIDE L-PYROGLUTAMIQUE, ET PLUS SPECIFIQUEMENT EN TANT QU'ACIDE ERTUGLIFLOZINE L-PYROGLUTAMIQUE; AUTHORISATION NUMBER AND DATE: EU/1/18/1267 20180323 |

| 2334687 | PA2018510 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ERTUGLIFLOZINAS, PASIRINKTINAI KAIP KRISTALINE FORMA, YPAC KAIP KO-KRISTALAS SU L-PIROGLUTAMO RUGSTIMI, IR YPAC KAIP ERTUGLIFLOZINO L-PIROGLUTAMO RUGSTIS; REGISTRATION NO/DATE: EU/1/18/1267 20180321 |

| 2334687 | 1890026-6 | Sweden | ⤷ Get Started Free | PRODUCT NAME: ERTUGLIFLOZIN,OPTIONALLY IN THE FORM OF ERTUGLIFOZIN L- PYROGLUTAMIC ACID; REG. NO/DATE: EU/1/18/1267 20180323 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for STEGLATRO (Ertugliflozin)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.