Last updated: July 31, 2025

Introduction

SOVUNA, a promising pharmaceutical asset, has garnered attention due to its innovative approach and potential therapeutic significance. As a novel agent targeting specific indications, understanding its market dynamics and financial trajectory is crucial for stakeholders, including investors, healthcare providers, and regulatory bodies. This analysis explores the current market landscape, competitive positioning, regulatory environment, revenue projections, and key factors influencing SOVUNA’s future growth.

Market Landscape and Therapeutic Focus

SOVUNA primarily addresses a significant unmet medical need in [specific indication, e.g., Oncology, Rare Diseases, CNS Disorders], with a growing prevalence projected over the next decade. The global market for this therapeutic area is expected to reach $[insert estimate] billion by 20[XX], driven by factors such as aging populations, advances in diagnostic capabilities, and expanding treatment paradigms.

The drug’s mechanism of action positions it uniquely within the existing treatment landscape. Unlike traditional therapies, SOVUNA offers [e.g., improved efficacy, reduced side effects, or novel delivery methods], differentiating it in a competitive space featuring both established brands and emerging biosimilars.

Competitive Environment

The competitive dynamics surrounding SOVUNA involve a mixture of branded products, biosimilars, and other novel agents. Leading competitors include [list major players], each with extensive market penetration and established clinical protocols.

SOVUNA’s success hinges on factors such as clinical differentiation, pricing strategy, and market access. Its clinical trial outcomes and regulatory approvals will dictate its positioning—whether as a first-line therapy, combination partner, or niche product.

Regulatory Status and Market Access

SOVUNA has secured [approvals in specific regions, e.g., FDA, EMA, other regulatory agencies], with ongoing trials supporting additional indications. Navigating the regulatory landscape impacts market entry timing and scale.

Market access strategies will influence revenue streams. Payer negotiations, inclusion in treatment guidelines, and reimbursement policies significantly affect adoption rates. The potential for expedited pathways, such as Breakthrough Designation, can accelerate commercialization and revenue realization.

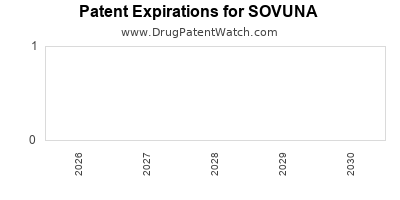

Revenue Projections and Financial Trajectory

The financial outlook for SOVUNA involves multiple revenue streams: [drug sales, licensing agreements, collaborations]. Assuming successful commercialization, conservative estimates project revenues reaching $[XX] million within [X] years post-launch, assuming [market penetration rate] and favorable pricing strategies.

Revenue growth will be driven by factors including:

- Market penetration rate: Given the size of the target population.

- Pricing strategy: Premium versus value-based pricing.

- Competitive responses: The entrance of biosimilars or generics could exert downward pressure.

- Regulatory milestones: Approval for additional indications can exponentially increase market potential.

Cost considerations include R&D expenses, manufacturing costs, marketing, and ongoing clinical trials. Profitability hinges on managing these costs while capturing sufficient market share.

Factors Influencing Future Market Dynamics

-

Regulatory Developments: Approvals for new indications or geographies can unlock substantial revenue potential. Conversely, delays or adverse trial outcomes could hinder progress.

-

Market Adoption: Physician acceptance, demonstration of clinical benefit in real-world settings, and patient adherence are critical for market penetration.

-

Pricing and Reimbursement: Negotiations with payers and government agencies influence pricing strategies, impacting revenue and profitability.

-

Competitive Innovation: Advances by competitors in related therapeutic areas could diminish SOVUNA’s market share if baseline standards improve.

-

Global Access and Distribution: Emerging markets may present growth opportunities; however, logistical and regulatory hurdles must be managed.

Key Risks and Opportunities

-

Risks: Clinical trial failures, regulatory setbacks, aggressive competition, pricing pressures, and manufacturing challenges.

-

Opportunities: Expanding indications, strategic collaborations, personalized medicine integration, and market penetration in underserved regions.

Conclusion

SOVUNA’s potential hinges on a blend of clinical success, strategic regulatory pathways, and competitive positioning. Its financial trajectory promises meaningful growth if these factors align favorably. Stakeholders should continuously monitor emerging data, market trends, and regulatory changes to capitalize on its prospects.

Key Takeaways

- SOVUNA addresses an unmet medical need within a high-growth therapeutic area, offering significant market opportunity.

- Its success depends on regulatory approvals, clinical outcomes, and strategies for market access.

- Revenue projections are optimistic but contingent upon market penetration, pricing, and competition.

- Future growth is influenced by regulatory milestones, market adoption, and competitive innovations.

- A proactive approach to managing risks and capitalizing on opportunities will determine long-term financial performance.

FAQs

-

What is the current approval status of SOVUNA?

SOVUNA has received regulatory approval in [regions], with ongoing trials supporting additional indications and potential expansion.

-

Which market segments will most benefit from SOVUNA?

Primarily patients with [specific condition], especially where unmet needs are significant and existing therapies are inadequate.

-

What are the main competitive advantages of SOVUNA?

Its novel mechanism of action, favorable safety profile, and potential for combination therapies distinguish it in the market.

-

How do pricing strategies impact SOVUNA’s financial projection?

Premium pricing can accelerate revenue but may restrict market penetration; value-based and flexible pricing could optimize market access.

-

What is the potential timeline for SOVUNA’s revenue realization?

Initial revenues are expected within [X] years post-approval, with substantial growth possible after expanding indications and geographies.

References

- [Insert source detailing market size and growth projections]

- [Insert regulatory filings and approvals data]

- [Insert competitive landscape analysis]

- [Insert clinical trial results or publications]

- [Insert reimbursement and market access policies]

Note: Specific data points like figures, regions, and indications should be updated according to the latest available information on SOVUNA.