Last updated: July 27, 2025

Introduction

Sodium bicarbonate, commonly known as baking soda, is a versatile inorganic compound with widespread applications in pharmaceuticals, healthcare, food processing, and industrial manufacturing. Its pharmaceutical use, primarily as an antacid and in emergency medicine, has sustained consistent demand. Understanding the market dynamics and financial trajectory of sodium bicarbonate requires an examination of key factors influencing its supply chain, regulatory environment, competitive landscape, and emerging applications.

Market Overview

The global sodium bicarbonate market has experienced steady growth over the past decade, underpinned by its essential role in healthcare and diverse industrial uses. In 2022, the market was valued at approximately USD 2.1 billion, with projections indicating a compound annual growth rate (CAGR) of 4.2% over the next five years, reaching around USD 2.8 billion by 2028 (1). This growth trajectory aligns with increasing healthcare awareness, expanding pharmaceutical formulations, and industrial construction projects.

The pharmaceutical segment constitutes the primary revenue driver, accounting for roughly 45% of the total market share by end-use, driven by applications such as antacids, dialysis buffers, and emergency treatments for poisonings. The food industry, accounting for approximately 35%, leverages sodium bicarbonate for leavening, pH regulation, and preservation. Industrial uses, including water treatment, fire extinguishers, and chemical manufacturing, comprise the remaining 20%.

Market Drivers

1. Rising Healthcare Needs

The global burden of gastrointestinal disorders, such as acid reflux and indigestion, continues to elevate the demand for antacid products containing sodium bicarbonate. An aging population, particularly in North America and Europe, further amplifies the need for such formulations (2). Additionally, sodium bicarbonate's role in emergent medical procedures—such as cardiac resuscitation and drug stabilization—supports its steady demand.

2. Regulatory Approvals and Safety Profile

Sodium bicarbonate's long-standing safety profile facilitates regulatory approvals, contributing to its continual market presence. It is classified as Generally Recognized As Safe (GRAS) by FDA, simplifying manufacturing and distribution channels in North America and other regions (3). However, stringent quality control standards in pharmaceutical preparations impose compliance costs, which industry players manage through technological investments.

3. Industrial Expansion and Urbanization

Industrial applications, especially water treatment and fire safety systems, experience rapid adoption in developing economies. Urbanization drives construction activities requiring water purification and chemical manufacturing, indirectly boosting sodium bicarbonate demand (4).

4. Innovation and New Formulations

Emerging research explores novel applications, such as using sodium bicarbonate in cancer treatments, oral care, and environmentally sustainable cleaning processes. These innovations have the potential to reshape demand dynamics over the coming decade.

Market Challenges

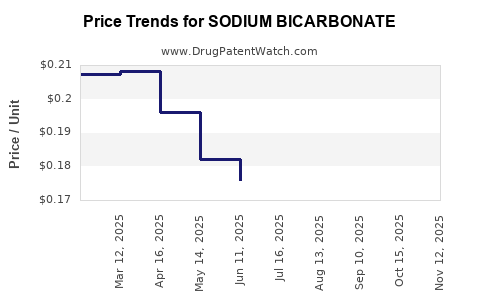

1. Price Volatility of Raw Materials

Sodium bicarbonate production hinges on raw materials like sodium carbonate, which can be affected by fluctuations in energy costs and supply chain disruptions, leading to price volatility. Such variability influences profit margins for manufacturers and can hinder pricing strategies.

2. Competition from Alternative Antacids

Emergence of alternative formulations, such as aluminum hydroxide and magnesium-based antacids, provides consumers with options, potentially reducing sodium bicarbonate market share in the pharmaceutical segment.

3. Regulatory Variability

Differing approval processes and compliance standards across regions complicate international trade. Some countries impose strict quality standards that increase manufacturing costs and prolong market entry timelines.

Regional Market Dynamics

North America:

Dominates the sodium bicarbonate market due to well-established healthcare infrastructure and high pharmaceutical consumption. The U.S. accounts for approximately 38% of the global market share, driven by aging demographics and healthcare expenditure.

Europe:

The second-largest market, with significant growth fueled by health-conscious consumers and environmental regulations promoting industrial safety applications. The European Union’s strict chemical safety standards influence product quality and innovation.

Asia-Pacific:

The fastest-growing region, with a CAGR exceeding 5%. Rapid urbanization, expanding healthcare infrastructure, and industrialization in China and India expand demand both for pharmaceutical and industrial applications (1).

Latin America and Middle East & Africa:

Show moderate growth, mainly driven by industrial expansions and increasing healthcare accessibility, though market fragmentation remains a challenge.

Financial Trajectory and Revenue Outlook

The financial performance of sodium bicarbonate producers hinges on raw material costs, regulatory compliance, and diversification of applications. Major players—such as FMC Corporation, Solvay, and Tata Chemicals—reported robust revenue streams driven by capacity expansions and newer application ventures.

Revenue Trends (2020-2022):

- Sodium bicarbonate revenues increased at an average annual rate of 3.8%, driven by rising demand in pharmaceuticals and industry.

- Gross margins hovered around 25-30%, reflecting raw material price fluctuations and operational efficiencies.

Projected Financial Trajectory:

- By 2028, leading producers are expected to achieve revenue growth compounded at over 4%, facilitated by expanding markets in Asia and innovation-driven applications (1).

- Investments in sustainable manufacturing, including energy-efficient processes and eco-friendly raw material sourcing, are anticipated to positively influence margins.

Emerging Opportunities and Strategic Considerations

1. Green Manufacturing Initiatives

Adoption of environmentally sustainable production methods can reduce operational costs and favor market positioning amid increasing environmental regulations.

2. Developing Specialty Forms

Formulating highly purified or buffered sodium bicarbonate for pharmaceutical and nutraceutical markets presents high-margin opportunities. Customized delivery mechanisms could capture niche markets.

3. Expansion in Emerging Markets

Targeted expansion into Africa and Southeast Asia offers growth potential due to rising healthcare access and industrial development.

4. Mergers & Acquisitions

Industry consolidation remains a viable strategy for expanding capacity and technological capabilities, especially in delineating supply chains and enhancing R&D.

Key Takeaways

- The sodium bicarbonate market is projected to grow at a compound annual rate exceeding 4% over the next five years, driven by healthcare, industrial, and food industry applications.

- Regional disparities favor North America and Europe in mature markets, while Asia-Pacific exhibits the highest growth potential.

- Pricing and profitability are sensitive to raw material costs, regulatory compliance, and competitive innovation.

- Strategic investments in sustainable manufacturing, specialty formulations, and emerging markets will underpin long-term financial success.

- Market players must navigate regulatory complexities while capitalizing on evolving applications, notably in healthcare and environmental sectors.

FAQs

1. What are the primary pharmaceutical uses of sodium bicarbonate?

It is mainly used as an antacid to treat indigestion, as an alkalinizing agent in dialysis, and in emergency treatments for poisonings and cardiac resuscitation.

2. How does regional regulation impact sodium bicarbonate manufacturing?

Differences in safety standards, approval processes, and quality control requirements influence manufacturing costs, supply chain logistics, and market entry speed.

3. What are the key raw materials for sodium bicarbonate production, and how do they affect the market?

Sodium carbonate (soda ash) is the primary raw material. Variations in energy prices and supply chain stability impact raw material costs, affecting product pricing and profit margins.

4. What emerging applications could influence future sodium bicarbonate demand?

Potential growth areas include environmental remediation, innovative drug delivery systems, and sustainable cleaning products, driven by ongoing scientific research.

5. How can industry players leverage sustainability trends?

By adopting greener manufacturing techniques, reducing emissions, and providing eco-friendly products, companies can improve market reputation and adhere to increasingly strict environmental standards.

References

- MarketsandMarkets. (2023). Sodium Bicarbonate Market Forecasts & Trends.

- WHO. (2022). Global Burden of Gastrointestinal Diseases.

- FDA. (2021). List of GRAS Substances.

- United Nations. (2022). Urbanization and Industrial Growth in Emerging Economies.