Last updated: July 27, 2025

Introduction

Saxagliptin, marketed under the brand name Onglyza, is an oral antihyperglycemic agent used to manage type 2 diabetes mellitus (T2DM). As a dipeptidyl peptidase-4 (DPP-4) inhibitor, saxagliptin enhances insulin secretion and decreases glucagon levels, offering an important therapeutic option within the expanding diabetes treatment landscape. Understanding its market dynamics and financial trajectory involves analyzing regulatory filings, patent landscapes, competitive positioning, and emerging trends.

Market Evolution and Demand Drivers

The global T2DM therapeutics market has experienced exponential growth driven by rising prevalence, lifestyle changes, and increasing awareness. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide had diabetes in 2021, projected to reach 643 million by 2030. This surge in patient numbers propels demand for efficacious, safe, and convenient treatments like saxagliptin.

Saxagliptin entered the market in 2009, offering a novel mechanism of action compared to traditional agents such as sulfonylureas and insulin. Its once-daily oral administration amplifies patient adherence, a crucial factor considered by prescribers amidst numerous treatment options. The drug's positioning as a second-line agent post-metformin further sustains its market relevance.

Regulatory and Patent Landscape

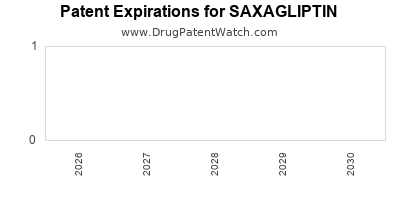

Saxagliptin's initial patent protections extended until approximately 2023-2025, with subsequent patent filings and exclusivity periods maintaining its market position. The expiration of key patents often results in generic entrants, intensifying price competition and impacting revenue streams.

In 2016, the U.S. Food and Drug Administration (FDA) reviewed post-marketing safety data revealing increased risks of heart failure associated with saxagliptin. This led to updated prescribing information, influencing market acceptance and physician confidence. Ongoing safety assessments continue to shape the drug’s profile and, by extension, its market share.

Emerging Biosimilar and Generic Competition

Pending patent expirations suggest a possible influx of generic and biosimilar competitors. Generics typically reduce prices by 80-85%, substantially impacting revenue and positioning. Companies preparing filings or developing alternatives are closely monitoring saxagliptin’s patent landscape and regulatory approvals to capitalize on market penetration opportunities.

Competitive Landscape

Saxagliptin contends within a crowded class of DPP-4 inhibitors—including sitagliptin (Januvia), linagliptin (Tradjenta), and alogliptin (Nesina)—each vying for market share. Among these, sitagliptin, as the first FDA-approved DPP-4 inhibitor (2006), holds a dominant position due to market familiarity and extensive clinical data.

However, saxagliptin differentiates itself with specific dosing regimens and safety profiles suited to certain patient subgroups. Yet, safety concerns linked to heart failure and the emergence of newer agents with broader cardiovascular and renal benefits, such as SGLT2 inhibitors and GLP-1 receptor agonists, influence prescribing trends.

Pharmacoeconomic Considerations

Insurance coverage, cost-effectiveness analyses, and regulatory approvals influence the drug’s uptake. Patients with cardiovascular comorbidities—where newer agents demonstrate superiority—may bypass saxagliptin in favor of alternatives, impacting its financial trajectory.

Market Outlook and Revenue Forecasts

Considering patent expirations, safety data, and competition, saxagliptin’s revenue trajectory exhibits a typical decline post-patent expiry, compounded by generic entry. However, strategic lifecycle management, such as developing fixed-dose combinations (FDCs), expands indications, and leveraging real-world evidence, can bolster sales.

In 2019, AstraZeneca reported worldwide sales of approximately $600 million for Onglyza. Market analysts project a compound annual growth rate (CAGR) decline of about 10-15% from 2023 onward, primarily driven by patent expiration and competitive pressures [1].

Conversely, niche markets—such as specific patient populations with renal impairment—may sustain modest demand for saxagliptin if supported by targeted clinical data. Partnerships, out-licensing, and co-marketing agreements further influence long-term revenue streams.

Innovations and Future Opportunities

Development of novel formulations or combination therapies incorporating saxagliptin presents opportunities to extend lifecycle and market relevance. For instance, co-formulations with metformin (Kombiglyze XR) have demonstrated improved adherence, potentially maintaining market share amidst generics.

Furthermore, ongoing research into saxaogliptin’s cardiovascular safety profile may identify niche indications or repositioning opportunities, especially if further evidence indicates favorable outcomes compared to peers.

Regulatory and Policy Impacts

Evolving healthcare policies emphasizing value-based care and cost containment influence drug utilization. The push toward generic substitution, biosimilars, and biosimilar-like approaches accelerates price reductions, constraining profit margins.

Key Takeaways

- Prevalence-driven demand sustains saxagliptin’s baseline sales; however, increasing competition, patent expiry, and safety considerations temper growth prospects.

- Patent expirations herald impending generic competition, leading to substantial price declines and revenue erosion unless supplementary strategies are employed.

- Market positioning depends on clarity regarding safety profiles, especially concerning heart failure risks, with prescribers favoring newer agents with demonstrated cardiovascular benefits.

- Lifecycle management strategies, including developing FDCs and exploring novel indications, are essential for maintaining revenue streams amid generic entry.

- Emerging treatment paradigms, particularly those prioritizing cardiovascular and renal protection, may marginalize saxagliptin unless it demonstrates comparable or superior benefits.

FAQs

1. How will patent expirations impact saxagliptin’s market share?

Patent expirations typically usher in generic competitors, resulting in significant price reductions and decreased revenue for branded saxagliptin. The extent depends on patent outcomes and regulatory approvals of generics, but a decline of 80-85% in sales volume is common post-expiry.

2. What safety concerns influence saxagliptin’s market trajectory?

Post-marketing data identified an increased risk of heart failure hospitalization associated with saxagliptin, prompting updates to prescribing information. These safety signals influence clinician preferences, favoring agents with more favorable cardiovascular profiles.

3. Are there clinical strategies to extend saxagliptin’s lifecycle?

Yes. Developing fixed-dose combination products, exploring new therapeutic indications, and conducting clinical trials that demonstrate additional benefits can prolong market relevance and revenues.

4. How does the competitive landscape affect saxagliptin’s future?

The presence of newer agents with proven cardiovascular or renal outcomes, combined with price competition from generics, challenges saxagliptin’s market share. Its future depends on strategic positioning, comparative safety data, and lifecycle management.

5. What is the outlook for saxagliptin in niche markets?

In patient populations with specific clinical needs, such as those with renal impairment, saxagliptin may retain a role if supported by supportive evidence. Tailored marketing and clinical positioning can sustain niche demand despite broader market challenges.

References

[1] AstraZeneca. (2019). Annual Report 2019. Available at: AstraZeneca Annual Reports