Last updated: August 1, 2025

Introduction

Ritalin, generically known as methylphenidate, is a central nervous system stimulant primarily prescribed to treat Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a cornerstone in psychostimulant therapy, Ritalin's market landscape is shaped by evolving clinical guidelines, regulatory policies, demographic trends, and the broader psychiatric treatment framework. This article analyzes the current market dynamics and forecasts the financial trajectory of Ritalin, providing critical insights for stakeholders across the pharmaceutical landscape.

Regulatory and Clinical Landscape

Ritalin was first approved in the United States in 1955 and has since become one of the most prescribed medications for ADHD, especially in pediatric populations. The drug's regulatory status remains robust, with the FDA classifying methylphenidate as a Schedule II controlled substance—reflecting concerns about abuse potential. Stringent regulations influence prescribing practices, impacting market volume and pricing.

Clinically, Ritalin's efficacy and safety profile have cemented its role in ADHD management. However, expanding clinical insights into alternative therapies and concerns around side effects and abuse potential influence prescribing trends. Development of generic versions has increased access and minimized costs, sustaining demand.

Market Drivers

1. Rising Prevalence of ADHD

Epidemiological studies indicate a global rise in diagnosed ADHD cases, especially among children and adolescents. In the U.S., the CDC reports that approximately 9.4% of children aged 2-17 have been diagnosed with ADHD [1]. Increased awareness, improved diagnostic criteria, and greater academic and social pressures contribute to this upward trend, fueling demand for methylphenidate-based therapies like Ritalin.

2. Expanding Adult ADHD Treatment

Once considered a pediatric disorder, ADHD is now recognized as persisting into adulthood. According to a 2019 study published in the Journal of Clinical Psychiatry, adult ADHD diagnoses increased by 45% over the past decade [2]. Ritalin's formulations are increasingly prescribed for adults, expanding the market beyond traditional pediatric boundaries.

3. Market Penetration in Developing Economies

Emerging markets exhibit rising healthcare infrastructure and mental health awareness, leading to broader adoption of ADHD diagnostics and treatments. Price competitiveness of generic methylphenidate has facilitated market entry in these regions.

4. Competitive Pharmacotherapy Landscape

Ritalin's main competitors include other stimulants such as amphetamine-based medications (Adderall), non-stimulant drugs (atomoxetine), and behavioral therapies. While these alternatives impact market share, Ritalin's longstanding clinical trust sustains its fundamental position.

Market Restraints

1. Regulatory Constraints and Abuse Concerns

Stringent regulations and control measures aimed at curbing misuse influence prescribing and distribution patterns. Abuse deterrent formulations are under development but not yet universally adopted, creating barriers to expanding Ritalin consumption.

2. Availability of Safer Alternatives

Non-stimulant drugs like atomoxetine (Strattera) offer alternatives, especially in patients with contraindications or history of substance abuse. The preference for non-stimulants in specific patient groups can dampen Ritalin's growth.

3. Societal and Clinical Shifts Toward Multimodal Therapies

Clinicians increasingly favor comprehensive treatment strategies combining medication and behavioral therapy, which may limit reliance solely on pharmacotherapy like Ritalin.

Market Segmentation and Geographic Trends

1. Regional Distribution

- North America: Dominant market accounting for over 50% of global sales, driven by high ADHD prevalence, strong healthcare infrastructure, and cultural acceptance of pharmacological intervention.

- Europe: Steady growth with regulatory variations, with some nations exhibiting strict prescribing controls.

- Asia-Pacific: Rapid growth projected, propelled by rising diagnosis rates and expanding healthcare systems.

2. Formulation Preferences

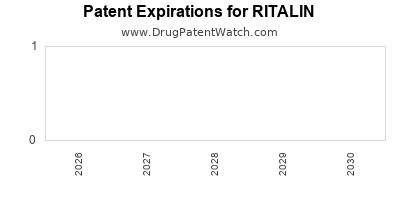

Immediate-release (IR) formulations remain prevalent; however, extended-release (ER) variants are increasingly preferred due to compliance benefits and reduced dosing frequency. The patent expiration of Ritalin IR in many regions has spurred generic proliferation.

Financial Trajectory and Market Forecast

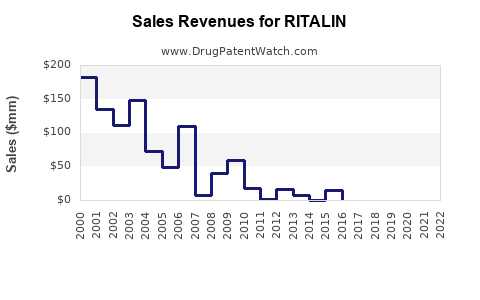

Current Market Valuation

As of 2022, the global methylphenidate market was valued approximately at USD 1.2 billion, with Ritalin contributing a significant portion. The North American sector dominates, reflecting its high diagnosis rate and prescribing volume.

Forecast for 2023-2030

Analysts project a Compound Annual Growth Rate (CAGR) of 3-6% for the methylphenidate segment globally, reaching an estimated USD 1.8 billion by 2030 [3]. Factors influencing this trajectory include:

- Persistent ADHD diagnosis rates, especially in adults.

- Increased adoption of generic formulations, reducing costs and expanding access.

- Innovation in delivery systems, including transdermal patches and long-acting formulations, improving adherence.

- Regulatory advancements, possibly easing restrictions in emerging markets.

Potential Market Disruptors

- Regulatory crackdowns on stimulant misuse could decrease Ritalin availability.

- Emergence of novel therapies with better safety profiles may shift prescribing patterns.

- Legal and societal crackdowns on substance abuse could incentivize a shift towards non-stimulant medications.

Strategic Implications for Stakeholders

- Pharmaceutical companies should invest in innovative delivery systems and monitor regulatory pathways.

- Healthcare providers need to balance efficacy with safety, especially considering abuse risks and regulatory compliance.

- Investors should recognize the growth potential in emerging markets and the importance of patent landscapes affecting profitability.

- Regulators must navigate balancing access and control to sustain market growth while mitigating abuse.

Key Takeaways

- The Ritalin market benefits from high ADHD prevalence and expanding adult diagnoses, underpinning steady growth.

- Generic formulations support affordability and access, but regulatory and societal challenges could constrain expansion.

- Innovations in drug delivery and formulations present opportunities for market differentiation.

- Emerging markets will play a pivotal role in future growth, driven by healthcare infrastructure and awareness.

- Stakeholders must stay vigilant of regulatory trends, societal shifts, and therapeutic alternatives to optimize strategic positioning.

FAQs

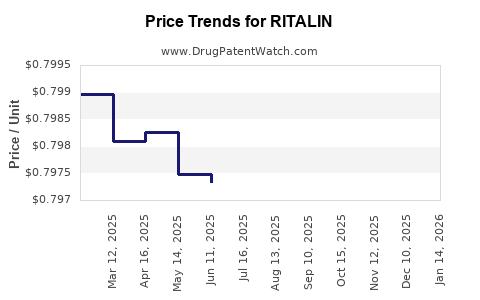

1. What factors influence the pricing of Ritalin in global markets?

Pricing is driven by regulatory controls, generic competition, regional healthcare policies, and manufacturing costs. Generic competition typically reduces prices, increasing accessibility.

2. How does Ritalin compare to its competitors regarding efficacy and safety?

Ritalin (methylphenidate) shares comparable efficacy with other stimulants like amphetamines but may carry a different side effect profile. Regulatory controls mitigate abuse potential, but each medication's safety profile warrants individualized clinical assessment.

3. What is the impact of regulatory policies on Ritalin's market growth?

Stringent regulations, including prescription monitoring and abuse deterrent requirements, can restrict supply and prescribing, potentially limiting growth. Conversely, regulatory acceptance facilitates market expansion.

4. Are there any innovative formulations of Ritalin currently in development?

Yes, extended-release formulations and transdermal patches are in various stages of development, aimed at improving adherence and reducing misuse.

5. How will emerging markets influence the long-term outlook of Ritalin?

Emerging markets' expanding healthcare infrastructure, increasing awareness, and affordability improvements will likely drive substantial growth in Ritalin market consumption over the next decade.

References

[1] Centers for Disease Control and Prevention (CDC). Data & Statistics on ADHD. 2022.

[2] Faraone, S. V., et al. (2019). The rising prevalence of Adult ADHD: A review. Journal of Clinical Psychiatry.

[3] MarketsandMarkets. (2022). Methylphenidate Market Forecast & Trends.

In summary, Ritalin remains a pivotal agent within the ADHD therapeutic landscape, supported by rising diagnosis rates, especially among adults. While regulatory, societal, and clinical factors impose constraints, ongoing innovations and market expansion in emerging regions suggest a stable yet cautious growth trajectory. Stakeholders must align strategies accordingly to leverage opportunities and mitigate risks inherent to this dynamic market.