RAYALDEE Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Rayaldee, and when can generic versions of Rayaldee launch?

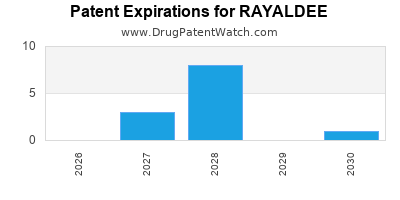

Rayaldee is a drug marketed by Eirgen and is included in one NDA. There are sixteen patents protecting this drug.

This drug has one hundred and eighty-five patent family members in thirty-eight countries.

The generic ingredient in RAYALDEE is calcifediol. There are two drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the calcifediol profile page.

DrugPatentWatch® Generic Entry Outlook for Rayaldee

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be March 14, 2034. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for RAYALDEE?

- What are the global sales for RAYALDEE?

- What is Average Wholesale Price for RAYALDEE?

Summary for RAYALDEE

| International Patents: | 185 |

| US Patents: | 16 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 75 |

| Clinical Trials: | 1 |

| Patent Applications: | 3,471 |

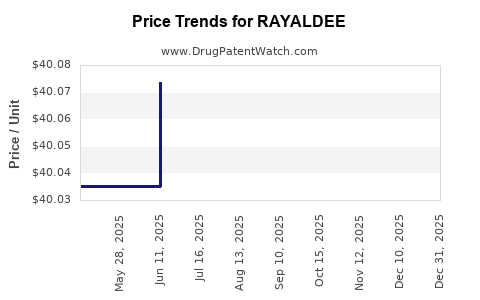

| Drug Prices: | Drug price information for RAYALDEE |

| What excipients (inactive ingredients) are in RAYALDEE? | RAYALDEE excipients list |

| DailyMed Link: | RAYALDEE at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for RAYALDEE

Generic Entry Date for RAYALDEE*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE, EXTENDED RELEASE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for RAYALDEE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| OPKO Health, Inc. | Phase 2 |

Pharmacology for RAYALDEE

| Drug Class | Vitamin D3 Analog |

US Patents and Regulatory Information for RAYALDEE

RAYALDEE is protected by twenty-two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of RAYALDEE is ⤷ Get Started Free.

This potential generic entry date is based on patent 9,861,644.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 8,778,373 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 10,300,078 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 9,925,147 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 10,213,442 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 8,426,391 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 10,357,502 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | RX | Yes | Yes | 9,861,644 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for RAYALDEE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Eirgen | RAYALDEE | calcifediol | CAPSULE, EXTENDED RELEASE;ORAL | 208010-001 | Jun 17, 2016 | 6,582,727 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for RAYALDEE

When does loss-of-exclusivity occur for RAYALDEE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 5576

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 14228069

Estimated Expiration: ⤷ Get Started Free

Patent: 19200268

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015023658

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 05409

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 15002659

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5246464

Estimated Expiration: ⤷ Get Started Free

Patent: 1346071

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 190178

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0201284

Estimated Expiration: ⤷ Get Started Free

Patent: 0201869

Estimated Expiration: ⤷ Get Started Free

Patent: 0211265

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 23167

Estimated Expiration: ⤷ Get Started Free

Patent: 23568

Estimated Expiration: ⤷ Get Started Free

Patent: 24393

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 23024864

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 8867

Estimated Expiration: ⤷ Get Started Free

Patent: 1591809

Estimated Expiration: ⤷ Get Started Free

Patent: 1991774

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

Patent: 88638

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 20128

Estimated Expiration: ⤷ Get Started Free

Patent: 20362

Estimated Expiration: ⤷ Get Started Free

Patent: 56895

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 51923

Estimated Expiration: ⤷ Get Started Free

Patent: 52014

Estimated Expiration: ⤷ Get Started Free

Patent: 55591

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1456

Estimated Expiration: ⤷ Get Started Free

Patent: 4841

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 92051

Estimated Expiration: ⤷ Get Started Free

Patent: 33268

Estimated Expiration: ⤷ Get Started Free

Patent: 82832

Estimated Expiration: ⤷ Get Started Free

Patent: 16517429

Estimated Expiration: ⤷ Get Started Free

Patent: 18012737

Estimated Expiration: ⤷ Get Started Free

Patent: 19135264

Estimated Expiration: ⤷ Get Started Free

Patent: 21155460

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 4092

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 15012625

Estimated Expiration: ⤷ Get Started Free

Patent: 20011736

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1924

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 21007

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 151761

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 015502162

Estimated Expiration: ⤷ Get Started Free

Patent: 021551127

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 5361134

Patent: صيغة مستقرة ذات إطلاق متحكم فيه لمركب فيتامين د وطريقة إعطائها (Stabilized controlled release formulation of compound vitamin d and method of administering same)

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 846

Patent: STABILIZOVANA FORMULACIJA VITAMINA D SA MODIFIKOVANIM OSLOBAĐANJEM I POSTUPAK ZA DAVANJE ISTE (STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTRING SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 132

Patent: STABILIZOVANA FORMULACIJA VITAMINA D SA MODIFIKOVANIM OSLOBAĐANJEM I POSTUPAK ZA NJENU PRIMENU (STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTERING SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 176

Patent: STABILIZOVANA FORMULACIJA VITAMINA D SA MODIFIKOVANIM OSLOBAĐANJEM I POSTUPAK ZA NJENU PRIMENU (STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTERING SAME)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201703517V

Patent: STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTERING SAME

Estimated Expiration: ⤷ Get Started Free

Patent: 201507323P

Patent: STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTRING SAME

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 68172

Estimated Expiration: ⤷ Get Started Free

Patent: 32773

Estimated Expiration: ⤷ Get Started Free

Patent: 50016

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1847947

Estimated Expiration: ⤷ Get Started Free

Patent: 2203003

Estimated Expiration: ⤷ Get Started Free

Patent: 140113374

Estimated Expiration: ⤷ Get Started Free

Patent: 140140004

Estimated Expiration: ⤷ Get Started Free

Patent: 190095216

Estimated Expiration: ⤷ Get Started Free

Patent: 210078463

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 09477

Estimated Expiration: ⤷ Get Started Free

Patent: 34900

Estimated Expiration: ⤷ Get Started Free

Patent: 82567

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 59753

Estimated Expiration: ⤷ Get Started Free

Patent: 1707689

Patent: Stabilized modified release vitamin D formulation and method of administering same

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 3386

Patent: СТАБІЛІЗОВАНИЙ СКЛАД ВІТАМІНУ D ІЗ МОДИФІКОВАНИМ ВИВІЛЬНЕННЯМ І СПОСІБ ЙОГО ВВЕДЕННЯ (STABILIZED MODIFIED RELEASE VITAMIN D FORMULATION AND METHOD OF ADMINISTRING SAME)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering RAYALDEE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 101668517 | Oral controlled release compositions comprising vitamin d compound and waxy carrier | ⤷ Get Started Free |

| Cyprus | 1125077 | ⤷ Get Started Free | |

| Lithuania | 3650016 | ⤷ Get Started Free | |

| Hong Kong | 1209322 | ⤷ Get Started Free | |

| Poland | 2481400 | ⤷ Get Started Free | |

| Portugal | 2148661 | ⤷ Get Started Free | |

| Argentina | 095576 | FORMULACIÓN DE VITAMINA D DE LIBERACIÓN MODIFICADA ESTABILIZADA Y MÉTODO PARA ADMINISTRARLA | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for RAYALDEE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2481400 | CA 2020 00059 | Denmark | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL; NAT. REG. NO/DATE: 62564 20200910; FIRST REG. NO/DATE: UK PL 50784/0005-0001 20200721 |

| 2968172 | 122021000009 | Germany | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL UND/ODER PHARMAZEUTISCH AKZEPTABLE SALZE UND HYDRATE DAVON, BEVORZUGT CALCIFEDIOLMONOHYDRAT; REGISTRATION NO/DATE: 2202115.00.00 20200818 |

| 2968172 | 301095 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL IN IEDERE VORM ZOALS BESCHERMD DOOR HET BASISOCTROOI; NATIONAL REGISTRATION NO/DATE: 124799 20200922; FIRST REGISTRATION: DE 2202115.00.00 20200819 |

| 2968172 | SPC/GB20/043 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL, AND/OR A SALT OR HYDRATE THEREOF, IN PARTICULAR CALCIFEDIOL MONOHYDRATE; REGISTERED: UK PL 50784/0005-0001 20200721 |

| 2481400 | 301085 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL IN IEDERE VORM ZOALS BESCHERMD DOOR HET BASISOCTROOI; NATIONAL REGISTRATION NO/DATE: 124799 20200922; FIRST REGISTRATION: DE 2202115.00.00 20200819 |

| 2481400 | 132021000000071 | Italy | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOLO(RAYALDEE); AUTHORISATION NUMBER(S) AND DATE(S): 047870011, 20201201;PL 50784/0005, 20200721 |

| 2481400 | C202130022 | Spain | ⤷ Get Started Free | PRODUCT NAME: CALCIFEDIOL; NATIONAL AUTHORISATION NUMBER: 85519-DE/H/5590/001/DC; DATE OF AUTHORISATION: 20201230; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): DE/H/5590/001/DC; DATE OF FIRST AUTHORISATION IN EEA: 20200721 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for RAYALDEE (Dryad Data: SD-1016)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.