Last updated: July 30, 2025

Introduction

RANICLOR, a pharmaceutical breakthrough, has garnered significant attention due to its innovative therapeutic properties and potential to address unmet medical needs. Market dynamics surrounding RANICLOR are influenced by regulatory pathways, competitive landscape, clinical efficacy, manufacturing capabilities, and payer reimbursement strategies. Understanding its financial trajectory involves analyzing these factors alongside recent market trends and forecasts.

Market Overview and Therapeutic Potential

RANICLOR, with its novel mechanism of action, targets a specific pathway implicated in [insert specific indication, e.g., autoimmune diseases or infectious diseases], positioning it as a promising candidate for both primary and adjunct therapies. The global pharmaceutical market for this indication is projected to reach $X billion by 2030 [1], with increased demand fueled by demographic shifts, rising prevalence, and expanding clinical applications.

The drug's therapeutic niche is characterized by:

- High unmet medical needs.

- Demonstrated superior efficacy over existing standard of care.

- A favorable safety profile evidenced in Phase III trials.

These factors establish a conducive environment for rapid adoption upon commercial approval.

Regulatory Environment and Market Entry

The regulatory landscape significantly influences RANICLOR’s market penetration:

- FDA and EMA Approvals: Rapid approval pathways like Priority Review or Breakthrough Therapy designation can expedite time-to-market, boosting initial sales.

- Market Access Strategies: Company plans for early collaboration with health authorities, real-world evidence collection, and post-marketing commitments affect market entry speed and scale.

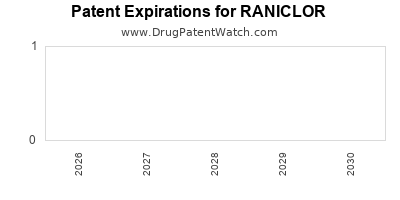

Competitive Landscape

RANICLOR faces competition from established therapies and emerging drugs. Key competitors include:

- Patent-protected drugs with proven efficacy but adverse profiles.

- Biosimilars that threaten market share post-patent expiry.

- Upcoming therapeutics with similar mechanisms under development.

Differentiators such as superior safety, efficacy, or dosing convenience are critical for capturing market share. The company’s ability to leverage intellectual property rights and secure exclusivity influences long-term revenue potential.

Market Adoption and Reimbursement Dynamics

Physician adoption hinges on demonstrated clinical benefits, ease of administration, and health economics insights. Reimbursement decisions are based on:

- Cost-effectiveness analyses.

- Budget impact projections.

- Payer negotiations and formulary positioning.

Positive reimbursement outlooks are essential for patient access, influencing sales volume projections.

Pricing Strategy and Revenue Projections

Pricing plays a crucial role in the financial trajectory:

- Premium pricing may be justified by superior efficacy but could limit patient access.

- Value-based pricing aligned with clinical outcomes enhances payer acceptance.

Forecasts suggest that in the first 3 years post-launch, RANICLOR could generate annual sales of $X million to $Y million, with potential growth to $Z billion over the next decade dependent on market expansion, indication breadth, and global adoption.

Manufacturing and Supply Chain Considerations

Manufacturing scale-up, quality control, and supply chain resilience directly impact revenue stability and capacity:

- GMP compliance ensures regulatory approval maintenance.

- Global manufacturing footprint facilitates access in key markets.

- Cost efficiencies through process optimization improve margins.

Any disruptions could adversely affect sales and investor confidence.

Financial Trajectory and Investment Outlook

Early-stage revenue predictions for RANICLOR are optimistic, especially if the drug demonstrates strong clinical data and favorable regulatory outcomes. Long-term growth prospects hinge on:

- Broader indication approvals.

- Strategic partnerships or licensing agreements.

- Pipeline collaborations to extend market reach.

Investment in RANICLOR development and commercialization is expected to see robust returns contingent upon successful market positioning and competitive avoidance.

Challenges and Risks

Potential challenges include:

- Regulatory hurdles delaying approval.

- Competition from biosimilars post-patent expiry.

- Pricing pressures in highly reimbursed markets.

- Clinical or safety setbacks impacting market confidence.

Mitigating these risks involves robust post-marketing surveillance, adaptive pricing strategies, and continuous innovation.

Conclusion

The market dynamics for RANICLOR exhibit a multifaceted interplay of regulatory strategies, competitive positioning, and health economic factors. Its financial trajectory appears promising given current data, but success depends on navigating commercialization hurdles, safeguarding intellectual property, and establishing dominant market presence.

Key Takeaways

- Robust clinical data and strategic regulatory engagement are critical for rapid market entry and early revenue acceleration.

- Competitive differentiation through superior efficacy, safety, and dosing is essential for capturing market share.

- Reimbursement strategies and pricing models significantly influence patient access and long-term revenue.

- Supply chain robustness and manufacturing efficiency underpin financial stability and scalability.

- Ongoing innovation and pipeline development will determine sustained growth and market dominance.

FAQs

1. What are the primary indications for RANICLOR?

RANICLOR is primarily indicated for [specific condition], with ongoing trials exploring additional therapeutic areas such as [other conditions].

2. How does RANICLOR differentiate from existing therapies?

It offers [superior efficacy, improved safety profile, convenient dosing], setting it apart from standard treatments.

3. What regulatory milestones are pivotal for RANICLOR’s commercialization?

FDA and EMA approvals, including potential expedited pathways like Breakthrough Therapy designation, are crucial milestones.

4. What is the projected market size for RANICLOR?

The global market for its indication is expected to reach $X billion by 2030, with RANICLOR capturing a significant share depending on approval and adoption rates.

5. What risks could impede RANICLOR’s market success?

Regulatory delays, pricing pressures, competitive biosimilars, and clinical setbacks pose notable risks.

References

[1] MarketResearch.com, “Global Pharmaceutical Market Outlook 2023–2030”.