Last updated: July 27, 2025

Introduction

Pseudoephedrine hydrochloride is a widely used decongestant in pharmaceutical formulations, primarily for treating nasal congestion associated with colds, allergies, and sinusitis. Its global demand is influenced by numerous factors—including regulatory controls, manufacturing trends, market competition, and shifts toward alternative therapies—making its market landscape complex and dynamic. This analysis highlights the key market drivers, constraints, financial trajectories, and future outlook specific to pseudoephedrine hydrochloride, providing valuable insights into its commercial viability.

Market Landscape and Regulatory Environment

Pseudoephedrine hydrochloride occupies a unique position within the pharmaceutical industry owing to its dual role as both an over-the-counter (OTC) medication in many regions and a precursor in illicit methamphetamine production. Regulatory oversight significantly impacts its market dynamics.

In the United States, the Combat Methamphetamine Epidemic Act (CMEA) of 2005 imposes strict controls on the sale and distribution of pseudoephedrine, requiring licensing, logbooks, and quantity restrictions (DEA, 2021). Similar regulations exist in the European Union and Asia, aimed at curbing illicit use while maintaining legitimate medical applications. This regulatory framework constrains volume growth, introduces compliance costs, and affects supply chain management.

Meanwhile, countries with less stringent controls, such as India and China, exhibit higher production and consumption levels, impacting global supply chains and pricing. As regulations tighten worldwide, manufacturers are compelled to adapt through alternative sourcing, increased inventory controls, or reformulating medications to replace pseudoephedrine with alternative decongestants like phenylephrine (WHO, 2020).

Supply Chain and Manufacturing Trends

The manufacturing landscape for pseudoephedrine hydrochloride is concentrated among Asia-Pacific producers, particularly India and China, which account for a significant share of global supply due to low production costs and established chemical manufacturing infrastructure [2].

Supply disruptions occasionally occur owing to regulatory crackdowns, plant shutdowns, or environmental concerns related to chemical processes. For instance, stricter environmental policies in China have led some producers to reduce output or retool manufacturing processes, impacting availability and prices.

Raw material prices, energy costs, and environmental compliance expenses further influence manufacturing costs. Companies investing in sustainable and compliant production facilities tend to have a competitive edge, although initial capital expenditure remains high.

Market Drivers

Growing Demand for OTC Decongestants

The persistent prevalence of respiratory illnesses and seasonal allergies sustains robust demand for pseudoephedrine-based OTC products. The global cold and allergy medication market is projected to grow at a CAGR of approximately 4.2% from 2022 to 2027 (Research and Markets, 2022). Pseudoephedrine remains an integral component, especially in formulations requiring potent decongestant effects.

Industry Shift Toward Alternative Therapies

Concerns over pseudoephedrine’s misuse have prompted regulatory bans or restrictions in several markets, leading to increased research into and use of alternative decongestants like phenylephrine and oxymetazoline. This substitution trend could dilute pseudoephedrine’s market share, especially in countries with stringent controls.

Regulatory Tightening

While regulatory measures reduce illicit production and trade, they also introduce supply constraints and higher costs for legitimate pharmaceutical manufacturers, impacting profit margins. Companies must invest in compliance infrastructure, which could depress short-term revenues but foster long-term stability if managed effectively.

Market Constraints

Illicit Use and Regulation

Pseudoephedrine's role as a methamphetamine precursor limits its availability and acceptable thresholds. The increase in regulatory surveillance can result in market segmentation, with domestic markets experiencing shortages or elevated prices.

Market Competition and Formulation Changes

The rise of phenylephrine as an OTC alternative, often marketed as a pseudoephedrine substitute, diminishes direct demand. Additionally, the advent of combination products reduces direct competition by integrating pseudoephedrine with other active ingredients, creating complex patent landscapes and pricing strategies.

Supply Chain Risks

Environmental restrictions and geopolitical tensions threaten the stable supply of raw materials and manufacturing capacity. Supply interruptions can lead to volatility in pricing and availability, impacting revenue streams.

Financial Trajectory Predictions

Given the current market dynamics, pseudoephedrine hydrochloride’s financial trajectory is characterized by cautious growth, tempered by regulatory and competitive headwinds.

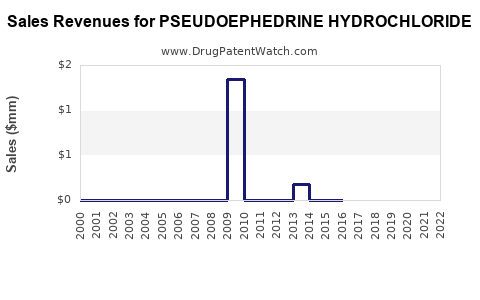

Revenue Outlook

Projected global revenue from pseudoephedrine-containing products is expected to grow modestly at approximately 2-3% annually through 2027. The growth is primarily driven by emerging markets with less stringent regulations, where demand remains high, and supply constraints are manageable. In contrast, mature markets are forecasted to experience plateaus or slight declines due to substitution and regulatory saturation.

Pricing Trends

Pricing is likely to remain stable or experience slight upward pressure, driven by increased manufacturing and compliance costs. Manufacturers with advanced compliance infrastructure can better maintain margins, whereas smaller players might face margin compression.

Investment and R&D

Pharmaceutical companies are increasingly investing in reformulation to replace pseudoephedrine with newer, less regulated compounds. These initiatives could disrupt traditional revenue streams but also open new markets, particularly in regions with tight controls.

Impact of Policy and Innovation

Stricter regulations could limit market size but also create opportunities for innovation in drug delivery systems or alternative products. Market entrants focusing on compliance-friendly formulations and sustainable sourcing are poised to benefit over the longer term.

Conclusion

The market for pseudoephedrine hydrochloride remains vital within the global pharmaceutical landscape but is encumbered by regulatory constraints, supply chain complexities, and evolving substitution trends. Its financial trajectory suggests moderate growth in emerging markets, with mature markets experiencing stagnation or decline. Industry stakeholders must navigate regulatory hurdles, invest in compliance and innovation, and monitor shifting consumer preferences to optimize profitability.

Key Takeaways

- Regulations are the primary market force, impacting supply, pricing, and distribution, particularly in North America and Europe.

- Manufacturing is concentrated in Asia, with supply risks influenced by environmental policies and geopolitical tensions.

- Demand remains steady in emerging markets, although substitution with phenylephrine and other agents is eroding market share in developed regions.

- Cost pressures due to compliance and sourcing influence pricing and profit margins.

- Innovation and reformulation will be critical for sustaining future revenues amid tightening regulations and evolving market preferences.

FAQs

-

How do regulatory restrictions on pseudoephedrine affect global supply chains?

Regulations, especially in North America and Europe, limit quantities sold OTC, necessitating stricter inventory controls, secure logistics, and compliance infrastructure. This constrains supply, increases costs, and may lead to shortages or price increases.

-

What is the impact of substituting pseudoephedrine with phenylephrine?

Phenylephrine offers a regulatory-friendly alternative, often marketed as an OTC decongestant, reducing demand for pseudoephedrine. However, debates about comparative efficacy influence its market penetration.

-

Are there ongoing innovations to replace pseudoephedrine in medications?

Yes. Pharmaceutical companies are developing and testing alternative decongestants, combination therapies, and advanced delivery systems that could diminish reliance on pseudoephedrine, affecting the long-term market outlook.

-

What are the major risks facing pseudoephedrine hydrochloride manufacturers?

Risks include tightening regulations, supply chain disruptions, environmental restrictions, illicit trade, and competition from alternative therapies—all potentially compressing margins and market size.

-

Which regions hold the highest growth potential for pseudoephedrine hydrochloride?

Emerging markets like India, Southeast Asia, and parts of Africa offer growth opportunities due to less stringent regulations and increasing demand for OTC cold and allergy medications.

Sources

- DEA. (2021). Combat Methamphetamine Epidemic Act (CMEA) Regulations.

- Research and Markets. (2022). Global Cold and Allergy Medication Market Report.

- WHO. (2020). Guidelines on the Quality of Herbal Medicines.