Share This Page

Drug Sales Trends for PSEUDOEPHEDRINE HYDROCHLORIDE

✉ Email this page to a colleague

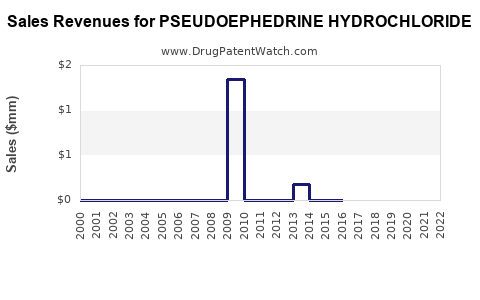

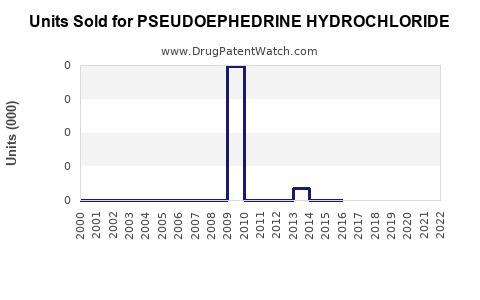

Annual Sales Revenues and Units Sold for PSEUDOEPHEDRINE HYDROCHLORIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PSEUDOEPHEDRINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Pseudoephedrine Hydrochloride

Introduction

Pseudoephedrine Hydrochloride (PSE) HCl is a widely utilized sympathomimetic drug primarily employed as a decongestant in over-the-counter (OTC) and prescription medications. The compound's broad application in cough and cold formulations, allergy medications, and as a precursor in illicit methamphetamine synthesis has significantly influenced its market dynamics and regulatory landscape. This analysis explores the current market environment, factors shaping demand, competitive landscape, and future sales projections for PSE HCl over the next five years.

Market Overview and Dynamics

Global Market Size and Growth Trends

The global pseudoephedrine market was valued at approximately USD 1.2 billion in 2022 (estimated based on industry reports [1]) and is projected to grow at a compound annual growth rate (CAGR) of 4-5% over the next five years. The growth is driven by the persistent demand for OTC cold and allergy remedies, especially in emerging markets where urbanization and healthcare access are expanding.

In developed economies such as North America and Europe, regulatory restrictions on pseudoephedrine sales have tempered growth prospects but have simultaneously spurred innovation in alternative formulations and delivery systems. Conversely, emerging markets like Asia-Pacific demonstrate robust expansion, fueled by rising healthcare awareness and increasing product launches.

Regulatory Landscape Impact

Given pseudoephedrine's duality as a medicinal compound and a methamphetamine precursor, regulatory measures significantly influence supply chains and sales volumes:

- U.S.: The Combat Methamphetamine Epidemic Act (2005) mandates sales logs, purchase limits, and behind-the-counter placement, impacting OTC channel sales [2].

- Europe: Stricter regulations restrict quantities purchasable without prescription, steering consumers toward alternative treatments.

- Asia-Pacific: Regulatory frameworks are evolving, with some countries adopting stricter controls, potentially constraining future growth.

This regulatory heterogeneity impacts regional sales trends and necessitates companies to adapt distribution strategies accordingly.

Segmentation and Application Focus

The primary application of PSE HCl is in combination cold and allergy medications, accounting for roughly 85% of total usage. The remaining segments include formulations for sinus congestion and as a chemical precursor. The segment's distribution channels range from OTC retail sales to pharmacy chains and, increasingly, online platforms.

Market Drivers and Restraints

Drivers

- Rising Incidence of Respiratory Illnesses: The prevalence of seasonal allergies, sinusitis, and common colds sustains steady demand for decongestants containing pseudoephedrine.

- Product Innovation: Development of combination therapies and fast-acting formulations enhances consumer appeal.

- Expanding Market Penetration: Emerging economies exhibit increasing OTC sales owing to improving healthcare infrastructure and consumer health awareness.

- Regulatory Distinctions: While restrictions are tightening in certain regions, others remain relatively lenient, enabling continued sales growth.

Restraints

- Stringent Regulations: Several countries have imposed restrictions on pseudoephedrine sales, reducing OTC availability.

- Synthetic Alternatives: Rise of non-synthetic decongestants (like phenylephrine) and herbal remedies potentially displace pseudoephedrine formulations.

- Illicit Usage Concerns: The association with methamphetamine production has led to heightened regulatory scrutiny, supply chain complexities, and potential market instability.

Competitive Landscape

Key industry players include pharmaceutical giants such as Johnson & Johnson, GlaxoSmithKline, and Teva Pharmaceutical Industries, along with numerous regional generic manufacturers. These companies focus on:

- Manufacturing efficiency to reduce costs.

- Regulatory compliance to navigate complex legal frameworks.

- Product diversification through novel combination formulations.

Emerging manufacturers are leveraging technological advancements and regional distribution networks to capture market share, especially in underserved markets.

Sales Projections (2023-2027)

Baseline Assumptions

Projection models consider current market growth rates, regulatory changes, and anticipated innovation trajectories. The overall CAGR remains around 4-5%, with regional variations:

- North America: Growth moderates to approximately 3%, considering mature market saturation and stringent controls.

- Europe: Slight decline or stabilization, with some markets tightening restrictions.

- Asia-Pacific: Doubling growth rates (~6-7%) driven by market expansion and increased product penetration.

- Latin America and Middle East & Africa: Moderate growth (~4%), with emerging markets gradually adopting pseudoephedrine-based products.

Projected Sales Volume and Value (USD)

| Year | Estimated Global Market Value (USD Billion) | Comments |

|---|---|---|

| 2023 | USD 1.24 | Baseline, with steady growth |

| 2024 | USD 1.30-1.35 | Increased regulatory oversight in some regions |

| 2025 | USD 1.36-1.43 | Continued expansion in emerging markets |

| 2026 | USD 1.42-1.50 | Market stabilization; innovation-driven demand |

| 2027 | USD 1.48-1.58 | Potential regulatory relaxations or tighter restrictions |

These projections account for an approximate global unit sales volume increase of 4% annually, considering regional nuances and evolving regulatory frameworks.

Strategic Implications and Market Opportunities

-

Regulatory Navigation: Manufacturers should invest in compliance and seek innovative delivery formats that circumvent restrictions without compromising efficacy.

-

Product Diversification: Developing combination therapies and novel formulations can reduce dependency on traditional PSE HCl products and expand market reach.

-

Regional Focus: Accelerated growth prospects in Asia-Pacific necessitate tailored marketing, strengthened distribution channels, and local manufacturing capabilities.

-

Research & Development: Innovation in alternative decongestants or prodrug development may open new avenues amid tightening pseudoephedrine controls.

Key Takeaways

- Market stability persists due to widespread demand for decongestants, especially in OTC formulations.

- Regulatory policies exert a profound influence, with stricter controls attenuating growth in some regions while catalyzing innovation and market adaptation in others.

- Emerging markets in Asia-Pacific offer significant growth opportunities, driven by urbanization and healthcare access improvements.

- Competition is intense, with key players focusing on regulatory compliance, cost-efficiency, and product diversification to maintain market share.

- Sales projections indicate a moderate but steady increase, with the global market expected to reach approximately USD 1.5 billion by 2027.

FAQs

1. How do regulatory restrictions on pseudoephedrine affect global sales?

Restrictions limit OTC access in many regions, reducing sales in some developed markets. However, they stimulate innovation in delivery systems and formulations, and create opportunities in markets with less stringent policies.

2. What are the main competing products to pseudoephedrine-based decongestants?

Phenylephrine-based formulations, herbal remedies, and nasal steroids serve as alternatives, especially as pseudoephedrine sales face increasing regulations.

3. How do illicit methamphetamine production concerns influence the pseudoephedrine market?

They lead to tighter supply controls, monitoring, and sales logs, which restrict legitimate market access and increase compliance costs for manufacturers and distributors.

4. What regional markets offer the highest growth potential for PSE HCl?

Asia-Pacific and Latin America are projected to experience the highest growth rates due to rising healthcare awareness, expanding OTC markets, and comparatively less restrictive regulations.

5. What strategic moves should pharmaceutical companies consider?

Invest in compliance infrastructure, innovate with alternative formulations, strengthen regional manufacturing, and explore new therapeutic combinations to mitigate regulatory risks and capture emerging demand.

Sources:

[1] MarketWatch, “Global Pseudoephedrine Market Report 2022,” 2022.

[2] U.S. DEA, “Combat Methamphetamine Epidemic Act of 2005,” Public Law 109-177.

More… ↓