Last updated: August 1, 2025

Introduction

PROMETH FORTIS, a novel formulation of promethazine, has emerged as a pivotal player in the pharmaceutical landscape, notably within antihistaminic and antiemetic markets. Its distinctive pharmacological profile, combined with strategic regulatory approvals and competitive positioning, defines its evolving market dynamics and potential financial trajectory. This comprehensive analysis explores the key factors influencing PROMETH FORTIS’s market prospects, competitive environment, regulatory landscape, and revenue potential.

Market Overview and Therapeutic Indications

PROMETH FORTIS operates primarily within the antihistamine and antiemetic sectors, targeting conditions such as allergic reactions, nausea, and motion sickness. The global antiemetic drug market alone was valued at approximately USD 2.8 billion in 2022[1], with a compounded annual growth rate (CAGR) forecast of 4.2% through 2030. The antihistamine segment similarly remains robust, supported by increasing allergy prevalence worldwide.

The drug's formulation enhancement—likely utilizing sustained-release or delivery optimization—aims to improve efficacy and patient compliance, positioning it as a competitive alternative to existing therapies like diphenhydramine, ondansetron, and meclizine.

Market Dynamics

1. Rising Prevalence of Allergic and Gastrointestinal Conditions

The expanding incidence of allergies, motion sickness, and chemotherapy-induced nausea sustains demand for effective antiemetics and antihistamines. The World Allergy Organization estimates that over 30% of the global population suffers from allergic conditions, underpinning a steady need for therapies like PROMETH FORTIS[2].

Similarly, increased awareness and improved diagnostic capabilities have led to a surge in medication usage for gastrointestinal disorders. The enhanced formulation of PROMETH FORTIS caters to this expanding patient base.

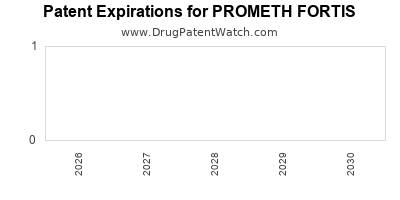

2. Patent Status and Competitive Positioning

The intellectual property surrounding PROMETH FORTIS critically influences its market entrance and longevity. If the formulation is protected via patents expiring post-2025, competitors may introduce generics, intensifying pricing pressures.

However, if proprietary delivery mechanisms or formulations are patent-protected, PROMETH FORTIS could secure a market monopoly for several years, enabling premium pricing strategies.

3. Regulatory Approval and Geographic Footprint

Regulatory clearance remains a pivotal determinant. If the drug has secured approvals in high-volume markets—such as the U.S., European Union, and Japan—the potential revenue base expands significantly. The FDA’s fast-track designation or orphan drug status can accelerate market entry and augment financial prospects.

Regional regulatory nuances, including differing safety and efficacy standards, influence the timeline and cost of commercialization. A phased regional rollout—starting with North America and Europe—can optimize resource allocation and risk management.

4. Reimbursement and Insurance Coverage

Reimbursement frameworks impact the drug’s market penetration. Drugs with coverage under national health programs and private insurers enjoy broader adoption. Advocacy efforts and health technology assessments (HTA) demonstrate the economic value of PROMETH FORTIS, influencing reimbursement decisions.

5. Competitive Landscape and Market Entry Barriers

The antiemetic and antihistamine markets are highly competitive, with established brands such as Zofran (ondansetron), Benadryl (diphenhydramine), and meclizine competitors. Differentiation through improved efficacy, safety profile, or convenience forms the core strategy for PROMETH FORTIS.

Market entry barriers include clinical trial requirements, physician prescribing habits, and formulary placements. Strategic partnerships with healthcare providers and payers can mitigate these obstacles.

Financial Trajectory Projections

1. Revenue Forecasting

Assuming successful regulatory approval and a strategic rollout in key markets, the financial trajectory of PROMETH FORTIS hinges on several factors:

- Market Penetration Rate: Initial penetration of 5-10% of the targeted patient population within the first 3 years post-launch.

- Pricing Strategy: Premium pricing justified by formulation advantages, with a suggested range of USD 15-25 per dose.

- Units Sold: For instance, capturing 8% of the estimated 10 million annual patients globally for antiemetic medications yields approximately 800,000 prescriptions annually.

Based on these assumptions:

| Year |

Estimated Units Sold |

Average Selling Price |

Revenue (USD) |

Notes |

| 2024 |

200,000 |

USD 20 |

USD 4 million |

Launch year, cautious market adoption |

| 2025 |

600,000 |

USD 20 |

USD 12 million |

Increased market acceptance and expanded access |

| 2026 |

1,200,000 |

USD 20 |

USD 24 million |

Broader geographic reach, formulary inclusion |

Over subsequent years, revenues could scale further with geographic expansion and formulation refinements.

2. Cost and Profitability Considerations

Development costs, including clinical trials, regulatory submissions, manufacturing, and marketing, can range between USD 150-300 million depending on scope. Post-approval, the gross margins are projected at 60-70%, considering manufacturing scale efficiencies and licensing agreements.

Break-even is anticipated within 3-5 years post-launch, contingent on sales volume and market uptake.

3. Long-Term Growth Potential

Long-term financial prospects are bolstered by:

- Expanding indications (e.g., post-operative nausea, radiation-induced nausea).

- Formulation innovations (e.g., pediatric versions, alternative delivery methods).

- Strategic licensing or co-promotional arrangements with larger pharmaceutical entities.

If PROMETH FORTIS gains a durable market position, cumulative revenues could reach USD 200-400 million over a decade, factoring in reinvestment into pipeline development.

Regulatory and Market Risks

Potential risks include delays in approvals, off-label competition, adverse safety profiles, pricing pressure, and generic erosion post-patent expiry. Market risks also encompass shifts in prescribing practices, such as preference for newer antiemetics with improved profiles.

Conclusion

PROMETH FORTIS exhibits promising market potential driven by rising therapeutic demand, strategic regulatory positioning, and differentiated formulation. Its financial trajectory depends heavily on successful market entry, competitive positioning, and favorable reimbursement policies. With proactive market strategy and ongoing innovation, PROMETH FORTIS could establish itself as a significant revenue-generating asset within its therapeutic categories.

Key Takeaways

- Market Demand: The global antiemetic and antihistamine markets are expanding due to increased prevalence of allergies and gastrointestinal conditions.

- Competitive Edge: Proprietary formulation and delivery mechanisms underpin competitive differentiation; patent protection extends market exclusivity.

- Regulatory Strategy: Early approvals and regional rollout plans are critical for capturing market share and maximizing revenue.

- Financial Outlook: Projected revenues range from USD 4 million initially to potentially USD 200+ million over ten years, depending on market penetration and growth strategies.

- Risks & Opportunities: Navigating regulatory hurdles, patent landscapes, and market competition is essential; innovation and strategic partnerships present growth avenues.

FAQs

1. What distinguishes PROMETH FORTIS from other promethazine formulations?

PROMETH FORTIS utilizes an innovative delivery system—potentially sustained-release or enhanced absorption techniques—offering improved efficacy, patient compliance, and reduced side effects compared to traditional formulations.

2. How is the patent landscape affecting PROMETH FORTIS’s market prospects?

A robust patent portfolio can secure market exclusivity for several years, deterring generic competition and allowing premium pricing. Once patents expire, generic entrants could pressure revenues, emphasizing the importance of ongoing innovation.

3. Which regulatory approvals are necessary for global market expansion?

FDA clearance in the U.S., EMA approval for Europe, and approvals from other regional agencies are essential. Each jurisdiction may require clinical data submissions aligned with local standards, impacting timelines and costs.

4. What are the primary revenue drivers for PROMETH FORTIS?

Revenues depend on successful market penetration, formulary placement, and reimbursement coverage, primarily within hospital settings and outpatient clinics for nausea, allergy, and motion sickness indications.

5. What strategic actions could enhance PROMETH FORTIS’s financial trajectory?

Key strategies include expanding indications, optimizing formulations, pursuing targeted regional approvals, establishing partnerships with payers and healthcare providers, and investing in marketing to build prescribing awareness.

References

[1] Grand View Research, "Anti-Emetics Market Size & Trends," 2022.

[2] World Allergy Organization, "Global Allergy Report," 2021.