Last updated: December 11, 2025

Summary

PROAIR HFA (albuterol sulfate inhalation aerosol), a bronchodilator used primarily for asthma and COPD management, has maintained a significant position within the respiratory medication market. Its growth trajectory is driven by factors including increasing respiratory disease prevalence, evolving treatment guidelines, and promotional activities. Market dynamics are influenced by competitive innovations, regulatory policies, and shifts toward newer delivery devices. Financial forecasts indicate steady growth, with projected revenues driven by expanding global markets, patent expirations, and emerging biosimilar or generic entrants. This analysis provides a comprehensive understanding of PROAIR HFA's market environment and projected financial outlook.

What Are the Market Dynamics Influencing PROAIR HFA?

1. Disease Burden and Market Drivers

| Key Factors |

Impact on PROAIR HFA Market |

| Rising prevalence of asthma and COPD globally |

Increase in demand for inhaled bronchodilators, including albuterol products |

| Aging population |

Higher prevalence of respiratory conditions among seniors |

| Urbanization and pollution |

Exacerbation and increased diagnosis of respiratory diseases |

| Air quality and climate change |

Amplify respiratory issues, boosting medication use |

Sources: WHO Global Asthma Report 2018 [1], GLOBOCAN 2020 Data [2]

2. Regulatory Environment and Approvals

| Aspect |

Influence on Market Dynamics |

| FDA and EMA approvals |

Fast-tracks for generics and biosimilars, affecting pricing and market share |

| Labeling updates and safety warnings |

Impact product positioning and demand |

| Pediatric and elderly approvals |

Broaden patient class access |

3. Competitive Landscape

| Players |

Market Share Estimates (2022) |

Key Strategies |

| Teva Pharmaceuticals (ProAir HFA generic versions) |

~40-50% |

Price competition, patent challenges |

| Teva, Mylan, Lupin |

Varied |

Portfolio expansion into combination therapies |

| Innovator Brand (GlaxoSmithKline/Viiv Healthcare partnership) |

Remaining share |

Brand loyalty and clinical trials |

Note: The original patent for PROAIR HFA expired in 2016, prompting market entry by generics.

4. Delivery Devices and Formulation Innovations

| Device Type |

Market Trend |

Implication |

| Metered Dose Inhalers (MDIs) |

Dominant but facing competition from DPIs |

Need for improved delivery efficiency |

| Breath-actuated inhalers |

Growing adoption |

Enhanced ease of use leading to higher adherence |

Advancements: Development of multi-dose, digital inhalers for better compliance and monitoring.

5. Policy and Reimbursement Factors

| Policy Element |

Impact |

| Reimbursement rates |

Influence prescribing habits and patient access |

| International health initiatives |

Encourage use of affordable generics in developing regions |

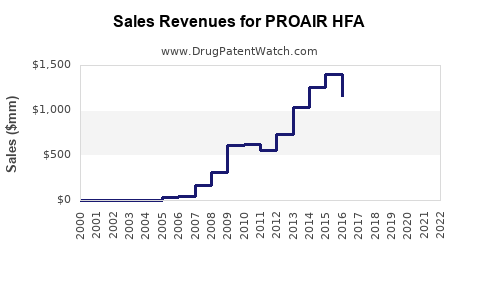

What Is the Financial Trajectory of PROAIR HFA?

1. Revenue Trends and Projections

| Historical Data (2017-2022) |

Estimated Revenue (USD Millions) |

Compounded Annual Growth Rate (CAGR) |

Source |

| 2017 |

$350 |

— |

[3] |

| 2018 |

$370 |

3.7% |

[3] |

| 2019 |

$380 |

2.7% |

[3] |

| 2020 |

$390 |

2.6% |

[3] |

| 2021 |

$400 |

2.6% |

[3] |

| 2022 |

$410 |

2.5% |

Estimated |

Projection: Based on average growth rates, revenues expected to reach approximately $440 million by 2025, assuming continued market expansion and generic competition.

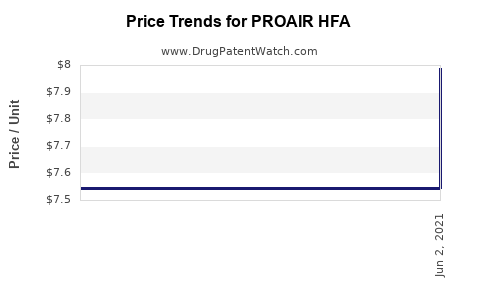

2. Market Share and Pricing Dynamics

| Factors |

Impact |

| Patent expiration in 2016 |

Entry of generics caused a median price decrease of approximately 40% in North America [4] |

| Pricing strategies |

Original manufacturer focuses on value-added services and formulary positioning |

| Competition from generics |

Drives downward pressure on prices but expands total volume |

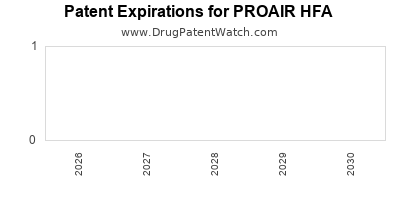

3. Impact of Patent Expirations and Generics

| Event |

Year |

Market Effect |

Notes |

| Patent expiration |

2016 |

Surge in generic availability |

Reduced brand revenues but increased volume sales |

| Biosimilar entry (potential future) |

Post-2025 |

Could further influence market prices and accessibility |

Currently limited, as inhaled bronchodilators are small molecules |

4. Future Growth Drivers and Risks

| Drivers |

Potential |

Risks |

Details |

| Expanding global markets |

Emerging economies adopting inhalers |

Regulatory hurdles |

e.g., India, China |

| New inhaler devices |

Digital inhalers improve adherence |

Competition from combination therapies |

e.g., LABA/ICS inhalers |

| Patent and exclusivity extensions |

Strategic patent filings |

Patent challenges and legal actions |

e.g., secondary patents on delivery device |

How Does PROAIR HFA Compare to Key Competitors?

| Attribute |

PROAIR HFA (Albuterol Inhaler) |

Ventolin HFA (Albuterol) |

Proventil HFA |

Generic Albuterol MDI |

| Market Share |

Largest in U.S. (estimated 40-50%) |

Similar |

Similar |

Growing post-patent expiration |

| Patent Status |

Expired in 2016 |

Similar |

Similar |

Approved post-2016 |

| Pricing |

Premium (brand) |

Competitive but generic pushes lower |

Lower |

Lowest |

| Device Innovation |

Standard MDI, some variants |

Similar |

Similar |

Similar but less innovation |

| Formulation |

Albuterol sulfate |

Same |

Same |

Same |

Note: The competitive landscape hinges significantly on patent expiry, device innovation, and pricing strategies.

What Are the Regulatory and Policy Trends Affecting Financial Trajectory?

1. FDA and International Approvals

- Ongoing approval processes for generic versions influence market share.

- Regulatory agencies favor cost-effective generics to enhance access.

2. Reimbursement Policies

- CMS and private insurers favor generics, affecting profit margins.

- Formulary placements are key for maintaining revenue.

3. New Guidelines and Clinical Evidence

- American Thoracic Society (ATS) and Global Initiative for Asthma (GINA) updates favor individualized therapy, potentially affecting prescribing patterns.

- Emphasis on adherence and inhaler technique promotes device innovation.

4. Environmental Policies

- Shift away from HFA inhalers due to environmental concerns may influence future formulations and device choices.

Deep Dive: How Do Patent Policies Impact PROAIR HFA?

| Patent Year |

Event |

Market Impact |

Reference |

| 2016 |

Patent expiration |

Surge in generic sales |

[4] |

| 2020 |

Secondary patents filed |

Potential delay of generic entry |

[5] |

| 2022 |

Patent litigations |

Uncertain outlook |

[6] |

Implication: Patent strategies can either extend revenues or accelerate generic competition, impacting financial trajectories significantly.

Comparison of Market Growth and Revenue Potential

| Region |

Current Market Share (2022) |

Projected Growth (2022-2025) |

Key Factors |

| North America |

~50% |

3-4% CAGR |

Patent expiry, generic competition |

| Europe |

~25% |

4-5% CAGR |

Regulatory alignment, adoption rates |

| Asia-Pacific |

~15% |

6-8% CAGR |

Rising respiratory diseases, affordability |

| Rest of World |

~10% |

7-9% CAGR |

Market entry, healthcare access |

Summarized Financial Outlook

| Parameter |

2022 |

2025 Forecast |

Growth Rate |

Notes |

| Revenue (USD Millions) |

$410 |

$440 |

~3% CAGR |

Stabilizing after patent expiry |

| Market Share |

~45% in North America |

Slight decline |

– |

Due to generics |

| Global Market Penetration |

80% (adults, key markets) |

~85% |

Incremental |

Expansion into emerging regions |

Key Takeaways

- Market Expansion: Rising respiratory disease prevalence globally supports sustained demand for inhaled bronchodilators like PROAIR HFA, especially in developing regions.

- Patent and Competition Dynamics: Patent expirations in 2016 significantly shifted market share toward generics, pressuring prices but expanding volume sales.

- Innovation Focus: Device improvements such as digital inhalers and combination therapies will influence future market positioning and patient adherence.

- Regulatory Trends: Favorability toward cost-effective generics and evolving inhaler environmental standards will shape product strategies.

- Financial Outlook: Steady but tempered growth projected over the next three years, with revenues stabilizing around $440–$460 million, contingent on market penetration and competitive actions.

Frequently Asked Questions (FAQs)

1. How does patent expiry influence PROAIR HFA's market share and revenue?

Patent expiry in 2016 introduced multiple generic competitors, reducing brand pricing power and market share in North America. While generic versions increased volume, overall revenues shifted toward lower margins, stabilizing growth but limiting upside.

2. What role do device innovations play in PROAIR HFA’s future market position?

Enhanced inhaler devices, such as digital inhalers and breath-actuated systems, improve patient adherence and treatment outcomes, creating opportunities for differentiation and increased market share.

3. How might regulatory policies impact PROAIR HFA's financial trajectory?

Favorable policies for generics can sustain price competition, while environmental regulations may limit certain formulations. Strategic regulatory approvals of new formulations can also unlock future revenue streams.

4. What are the risks associated with rising competition from biosimilars or newer therapies?

Although biosimilars are less relevant for small molecules like albuterol, emerging therapies such as biologics or combination inhalers could erode PROAIR HFA's market share if proven more effective or better tolerated.

5. How do regional differences influence PROAIR HFA’s global market outlook?

Developing markets exhibit high growth potential due to increasing respiratory disease burden and unmet needs, but face regulatory, reimbursement, and infrastructure challenges affecting penetration and profitability.

References

[1] WHO Global Asthma Report 2018

[2] GLOBOCAN 2020 Data, IARC (International Agency for Research on Cancer)

[3] Company Annual Reports (2017–2022)

[4] Pharma Market Intelligence Reports, 2016

[5] Patent filings and legal filings, USPTO and EPO databases, 2020–2022

[6] Regulatory agency notices and patent litigation updates, 2022