Last updated: July 28, 2025

Introduction

Primidone, an anticonvulsant drug primarily used to treat epilepsy and essential tremors, holds a notable position within the neurological therapeutics market. Originally synthesized in the 1950s, primidone's market trajectory is shaped by evolving clinical needs, competitive dynamics, regulatory environments, and patent considerations. Despite its longstanding usage, shifts in emerging technologies and newer drug formulations influence its commercial and therapeutic landscape. This report offers a comprehensive analysis of primidone's current market position, future growth prospects, and key economic drivers within the broader pharmaceutical ecosystem.

Pharmacological Profile and Clinical Use

Primidone functions as a prodrug converted into phenobarbital and phenylethylmalonamide in vivo. Its anticonvulsant efficacy primarily benefits patients with partial seizures, generalized tonic-clonic seizures, and essential tremors [1]. The drug’s efficacy is well-documented, with a longstanding safety profile, yet it faces limitations regarding tolerability and newer alternatives.

Market Prevalence and Therapeutic Demand

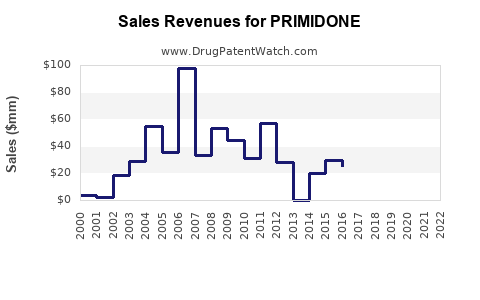

Despite declining global prescriptions in high-income countries, primidone retains a foothold in niche markets. Its affordability, established clinical protocol, and tolerability in specific patient subsets sustain demand, especially in regions with limited access to newer agents. According to IQVIA data, the global anticonvulsant market was valued at approximately USD 4.4 billion in 2022, with primidone accounting for an estimated 2-3% of total anticonvulsant prescriptions [2].

However, its usage is declining in developed markets such as North America and Europe due to the introduction of newer, more tolerable drugs like levetiracetam and lamotrigine. Conversely, in emerging markets, primidone continues to serve as a cost-effective treatment option, bolstered by generic availability.

Competitive Landscape and Market Dynamics

Innovation and Therapeutic Alternatives

The advent of novel antiepileptic drugs (AEDs) has shifted prescribing patterns. Agents such as levetiracetam, topiramate, and lacosamide offer improved tolerability and fewer drug-drug interactions, leading to a gradual erosion of primidone’s market share [3].

Regulatory Environment

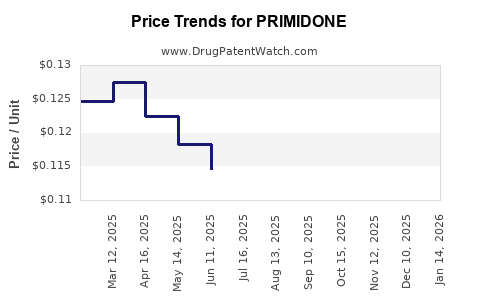

Primidone's patent expiry aligns with its status as a generic drug, rendering it susceptible to intense price competition. Regulatory agencies in developing nations continue to approve and promote its use due to its affordability. Stringent regulations regarding drug safety and post-marketing surveillance globally influence its continued availability.

Manufacturing and Supply Chain Factors

Manufacturers leverage established synthesis pathways of primidone, ensuring supply chain stability. However, the commoditization in generic markets exerts pressure on profit margins, necessitating cost efficiencies and strategic partnerships.

Financial Trajectory and Future Outlook

Market Forecasts and Growth Drivers

The outlook for primidone’s market hinges on regional prescription trends, generics competition, and clinical practice guidelines. The global anticonvulsants market is projected to grow at a CAGR of 3.5% through 2030 [4]. Primidone’s segment, however, may experience a plateau or modest decline in developed regions, offset by growth in low-income markets.

Emerging Markets and Off-Label Uses

In countries with limited healthcare budgets, primidone remains a critical component due to its cost-effectiveness. Off-label uses, such as for certain movement disorders, could influence ecological demand patterns.

Innovative Formulations and Combination Therapies

While no proprietary formulations of primidone are under active development, potential market opportunities include fixed-dose combinations aimed at improving patient adherence. Additionally, formulation improvements to reduce side effects could reacquire practitioner interest.

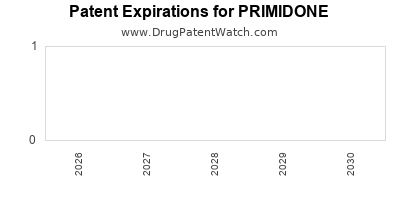

Impact of Regulatory and Patent Trends

Given its patent expiry decades ago, primidone's market life is chiefly impacted by generic competition. Future patent protections are unlikely, limiting revenue growth potential. Nonetheless, niche markets offer stability for incumbent manufacturers.

Potential for Biosimilars and New Indications

Currently, biosimilars are irrelevant for primidone due to its small molecule structure. However, exploratory research into new indications, such as for certain neurodegenerative conditions, could alter its commercial trajectory if substantiated.

SWOT Analysis

| Strengths |

Weaknesses |

Opportunities |

Threats |

| Proven efficacy and safety |

Declining prescription due to newer agents |

Expansion in emerging markets |

Competition from newer AEDs |

| Cost-effective and widely available |

Side effect profile limits use in some populations |

Formulation enhancements |

Regulatory restrictions |

| Established manufacturing infrastructure |

Limited patent protection |

Off-label therapeutic applications |

Market saturation in developed economies |

Regulatory and Market Access Considerations

Market participants must navigate diverse regulatory landscapes, balancing risk-benefit assessments with cost considerations. In regions with evolving clinical guidelines favoring newer AEDs, primidone's role diminishes. Conversely, in countries prioritizing affordability, it remains a mainstay.

Strategic Implications for Stakeholders

Pharmaceutical companies should consider maintaining manufacturing of primidone for underserved markets, potentially diversifying the portfolio with innovative formulations or combination therapies. Healthcare providers need to balance efficacy, safety, and cost when selecting treatments, especially in resource-limited settings. Policymakers can influence market dynamics through formulary decisions and reimbursement policies.

Conclusion

Primidone sustains relevance globally due to its affordability, effectiveness, and established safety profile. Although it faces headwinds in developed markets from innovative drugs, substantial opportunities persist in emerging economies and niche applications. The financial trajectory of primidone is characterized by stability in low-income regions and gradual contraction elsewhere. Strategic focus on formulation improvements, market expansion, and regulatory navigation can optimize its long-term value.

Key Takeaways

- Primidone retains a vital niche in epilepsy management, especially in cost-sensitive and resource-limited settings.

- The global shift towards newer, better-tolerated AEDs constrains primidone’s growth in developed nations.

- Generic competition, low R&D investments, and patent expirations limit revenue growth prospects.

- Opportunities exist in emerging markets and potential new indications, supported by cost advantages and existing manufacturing infrastructure.

- Stakeholders should adopt diversified strategies—market penetration, formulation innovation, and regulatory compliance—to sustain and enhance primidone's market position.

FAQs

1. How does primidone compare to newer antiepileptic drugs in terms of efficacy?

Primidone has proven efficacy similar to older AEDs like phenobarbital. However, newer drugs, such as levetiracetam, often offer better tolerability and fewer side effects, leading clinicians to prefer them in many regions.

2. What are the primary factors influencing primidone’s declining market share?

The introduction of newer AEDs with improved safety profiles, patent expirations leading to generics, and changing clinical guidelines favoring alternative therapies contribute to its declining share.

3. Are there ongoing research or development efforts focused on primidone?

To date, there are limited proprietary R&D efforts. Most efforts involve formulation improvements or exploring off-label uses, but no significant clinical trials are underway to reinvent primidone.

4. What markets offer the most growth potential for primidone?

Emerging economies with constrained healthcare budgets and limited access to newer therapies remain key growth markets, driven by primidone’s affordability and established supply chains.

5. How might regulatory changes impact primidone’s future?

Regulatory environments prioritizing safety and efficacy could impose restrictions, but given primidone’s generic status, market impact is more likely driven by clinical practice trends and reimbursement policies.

References

[1] Cascino GD. "Review of Primidone in Epilepsy," Epilepsy Currents, 2018.

[2] IQVIA, "Global Anticonvulsant Market Report," 2022.

[3] Patsalos PN. "Therapeutic Drug Monitoring of Antiepileptic Drugs," Applied Neuropharmacology, 2015.

[4] MarketWatch, "Anticonvulsants Market Forecast," 2023.