Last updated: July 29, 2025

Introduction

Praziquantel, an anthelmintic medication initially developed in the 1970s, has established itself as a cornerstone in treating parasitic worm infections, notably schistosomiasis and various trematode and cestode infestations. Its widespread clinical efficacy, safety profile, and affordability have cemented its status globally. Understanding the evolving market dynamics and forecasting the financial trajectory of praziquantel involves examining epidemiological trends, regulatory influences, competitive landscape, and emerging innovations.

Epidemiological and Market Drivers

The primary driver for praziquantel's market remains the global burden of parasitic infections. According to the World Health Organization (WHO), schistosomiasis affects over 236 million individuals across 78 countries, predominantly in sub-Saharan Africa, the Middle East, and parts of South America [1]. The endemic regions' reliance on mass drug administration (MDA) strategies positions praziquantel centrally in controlling these diseases.

Public health initiatives and international aid: Organizations like WHO and the Global Schistosomiasis Alliance champion mass treatment programs, especially in low- and middle-income countries. These programs stimulate consistent demand, reinforcing praziquantel's market stability.

Epidemiological trends: Rising awareness and improved diagnostic capabilities are identifying more cases, particularly in previously underdiagnosed regions. Additionally, climate change and water infrastructure deficiencies perpetuate transmission, maintaining the need for effective treatments.

Regulatory and Pricing Landscape

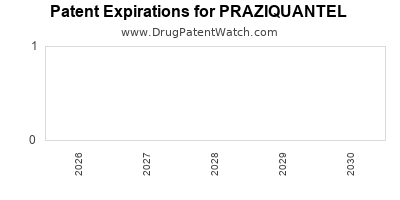

Patent expirations and generic proliferation: Praziquantel's patent expiration in the early 2000s spurred a surge of generic manufacturers, leading to significant reduction in prices. This democratized access but also increased market competition, impacting branded sales [2].

Regulatory approvals and quality assurance: The drug's widespread deployment depends heavily on quality control. Regulatory authorities, such as the FDA and EMA, have approved various formulations, including pediatric and fixed-dose combinations, widening application scope.

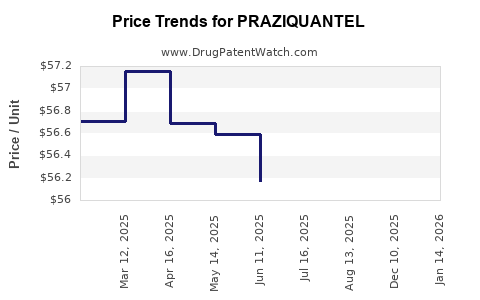

Pricing policies: Governments and NGOs often procure praziquantel at subsidized rates, sometimes through pooled procurement platforms like UNICEF and Pan-American Health Organization. This entices large-volume sales, fostering stable revenue streams for manufacturers.

Competitive and Market Challenges

While praziquantel faces little direct competition in its primary indication, certain limitations influence its market trajectory:

-

Limited scope for patent protections: The absence of patent exclusivity limits profit margins for producers. Most revenues come from high-volume sales rather than premium pricing.

-

Limited formulation innovations: Despite efforts, the drug's formulation remains relatively unchanged. Lack of new delivery mechanisms potentially hampers growth in populations with compliance issues, such as children.

-

Emerging resistance concerns: Though clinically infrequent, reports of reduced susceptibility in some parasite populations warrant vigilance. Resistance could challenge long-term demand if substantiated.

Alternative therapies and research initiatives: Advances in vaccine development and alternative treatments, such as oxamniquine derivatives or combination therapies, may contest praziquantel's market share in the future [3].

Emerging Trends and Innovations

Development of pediatric formulations: Recognizing the need for palatable, age-appropriate preparations increases usable markets. Several pharmaceutical companies are investing in dispersible tablets and syrups tailored for children, expanding both demand and therapeutic adherence.

Combination therapies: Trials exploring praziquantel with other anti-parasitic agents aim to enhance efficacy, prevent resistance, and streamline treatment protocols. Such formulations can potentially command premium pricing and foster market differentiation.

Digital health surveillance: Integration of health data systems for case monitoring improves program efficiency, potentially increasing drug distribution scalability.

Sustainable drug supply chains: Efforts to improve manufacturing capacity, particularly in endemic regions, aim to reduce costs further and ensure supply stability amid geopolitical or logistical disruptions.

Financial Trajectory Analysis

Given the current landscape, praziquantel's financial outlook appears resilient, with several caveats:

-

Steady revenue streams from endemic regions: Government procurement in heavily affected countries promises consistent sales, unaffected by patent restrictions, but sensitive to funding cycles and policy shifts.

-

Impact of generic competition: The proliferation of low-cost generics constrains profit margins but sustains volume-driven revenues. Large-scale procurement contracts offset lower per-unit margins with high sales volumes.

-

Market expansion potential: Increasing use in pediatric populations and integration into broader parasitic disease control programs could augment sales. However, limited innovation and resistance concerns may temper growth.

-

Regulatory hurdles and supply chain disruptions could temporarily impact revenue, especially in emerging regions. Ensuring quality and access remains critical.

Forecast: The global praziquantel market is projected to grow modestly at a compound annual growth rate (CAGR) of approximately 2–3% over the next five years, primarily driven by endemic country programs and new formulation initiatives [4].

Conclusion

Praziquantel's market dynamics are predominantly shaped by epidemiological necessity, international health policies, and manufacturing economics. While it faces challenges like limited innovation and resistance risks, its entrenched position in parasitic disease management ensures a stable financial trajectory, especially with ongoing efforts to improve formulations and expand indications.

Key Takeaways

-

Stable Demand: The global burden of schistosomiasis and neglected tropical diseases sustains consistent demand for praziquantel, driven by public health initiatives.

-

Pricing and Competition: Patent expirations led to generic proliferation, fostering affordability but limiting profit margins for proprietary manufacturers.

-

Innovation and Expansion: Development of pediatric formulations and combination therapies offers growth avenues; resistance monitoring remains critical.

-

Market Outlook: Modest growth is expected, with current efforts focused on improving access, quality, and treatment adherence in endemic regions.

-

Strategic Focus: Manufacturers should prioritize formulation innovation, comprehensive quality assurance, and forging partnerships with health organizations to secure market share.

FAQs

1. What are the primary parasites treated by praziquantel?

Praziquantel effectively treats schistosomiasis, trematode, and cestode infections, including clonorchiasis and taeniasis.

2. How does resistance to praziquantel impact its market?

Although resistance is rare, emerging reports may threaten future efficacy, prompting research into alternative therapies and combination treatments.

3. Are there pediatric formulations of praziquantel?

Yes, several pharmaceutical companies are developing age-appropriate, palatable formulations like dispersible tablets and liquids to improve compliance among children.

4. How do regulatory policies influence praziquantel's market?

Regulatory approvals facilitate market entry of new formulations, ensuring safety and efficacy, which can expand usage and user trust.

5. What are the key challenges faced by praziquantel manufacturers?

Challenges include low profit margins due to generic competition, limited formulation innovation, supply chain disruptions, and resistance concerns.

References

[1] World Health Organization. (2022). Schistosomiasis Fact Sheet. WHO.

[2] GBD 2019 Disease and Injury Incidence and Prevalence Collaborators. (2020). Global burden of disease study. The Lancet.

[3] Gray, D. J., et al. (2017). Advances in schistosomiasis drug discovery. Parasitology, 144(14), 1821–1829.

[4] MarketsandMarkets. (2023). Parasitic Disease Treatment Market Report.