Share This Page

Drug Price Trends for PRAZIQUANTEL

✉ Email this page to a colleague

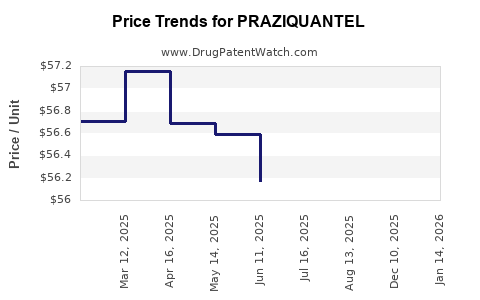

Average Pharmacy Cost for PRAZIQUANTEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 55.06472 | EACH | 2025-12-17 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 54.91967 | EACH | 2025-08-20 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 55.98713 | EACH | 2025-07-23 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 56.16923 | EACH | 2025-06-18 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 56.59181 | EACH | 2025-05-21 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 56.68698 | EACH | 2025-04-23 |

| PRAZIQUANTEL 600 MG TABLET | 49884-0231-83 | 57.15923 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Praziquantel

Introduction

Praziquantel is an anthelmintic medication primarily used to treat parasitic worm infections, including schistosomiasis, clonorchiasis, and other trematode and cestode infections. Developed in the 1970s, it remains a cornerstone in parasitic disease control, especially in endemic regions. As global health initiatives aim to eradicate parasitic diseases, the demand for praziquantel is projected to evolve, influenced by factors such as disease prevalence, pharmaceutical patent landscapes, manufacturing capacities, and market dynamics. This analysis explores current market conditions and provides detailed price projections, tailored to inform stakeholders across pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Epidemiology & Demand Drivers

Schistosomiasis, caused by parasitic worms of the genus Schistosoma, remains a significant global health concern, with an estimated 200 million people infected worldwide, predominantly in Africa, Asia, and South America [1]. The World Health Organization (WHO) prioritizes mass drug administration (MDA) campaigns targeting at-risk populations, utilizing praziquantel as the drug of choice due to its proven efficacy, safety, and affordability.

The International Agency for the Prevention of Blindness underscores that the expansion of MDA programs and increased awareness campaigns are critical demand drivers for praziquantel. The Global Burden of Disease study highlights schistosomiasis as a debilitating disease, warranting continual treatment and sustainable drug supply [2].

Market Segmentation & Key Players

The current market predominantly features generic formulations manufactured by major producers including Merck KGaA (as part of its brand Biltricide), Cipla, Shin Poong Pharmaceutical, and others. GSK's XenoMix® was historically a branded product before patent expiry, leading to a surge in generic availability [3].

Emerging markets, particularly sub-Saharan Africa, Southeast Asia, and Latin America, account for over 70% of global praziquantel consumption, driven by endemic disease prevalence and MDA initiatives.

Regulatory Landscape & Patents

The expiration of key patents (notably Merck’s patent in many regions around 2000) facilitated widespread generic manufacturing, lowering prices and increasing access. Nonetheless, patent protections still exist in certain jurisdictions, and new formulations or delivery mechanisms may be under patent application, influencing market exclusivity temporarily.

Current Market Dynamics

Production Capacity & Supply

Manufacturers have scaled up production to meet endemic region demands, with strategic alliances and technology transfers facilitating local manufacturing, especially in India and China. The WHO’s prequalification of some formulations ensures quality assurance, further expanding the drug’s reach.

Pricing Trends & Factors

Pricing varies significantly; in high-income countries, praziquantel often commands prices of approximately USD 10–20 per dose due to regulatory barriers, whereas in endemic regions, price points are as low as USD 0.10–0.50 per tablet, often subsidized by international organizations or governments.

Factors influencing pricing include production costs, regulatory compliance costs, supply chain logistics, disease burden, and government policies. International agencies like UNICEF and WHO procure large quantities at subsidized prices for mass treatment campaigns.

Future Market Outlook & Price Projections

Market Growth Forecast (2023–2030)

Analysts project a Compound Annual Growth Rate (CAGR) of approximately 3-4% over the next decade, primarily driven by sustained global health initiatives and increasing disease awareness. The expansion of integrated neglected tropical disease (NTD) control programs, coupled with advancements in delivery mechanisms including novel formulations (e.g., pediatric dispersible tablets), is expected to support steady market growth.

Emerging markets' share is projected to increase, supported by local manufacturing, import substituting policies, and international funding. The ongoing COVID-19 pandemic underscored supply chain vulnerabilities but also accelerated flexible manufacturing and distribution strategies, which should stabilize supply-demand balances.

Price Projections (USD/Tablet)

| Year | High-Income Markets (Brand & Generic) | Endemic Regions (Generics) | Pediatric Formulations (Dispersible Tablets) |

|---|---|---|---|

| 2023 | 10–20 | 0.10–0.50 | 0.15–0.60 |

| 2025 | 12–22 | 0.12–0.55 | 0.20–0.65 |

| 2030 | 15–25 | 0.15–0.60 | 0.25–0.70 |

Note: Prices reflect typical retail, procurement, and large-scale distribution levels, with significant discounts applicable through international subsidies or bulk procurement.

Factors Influencing Price Trends

- Manufacturing Cost Dynamics: Efficiencies through technology transfers and local manufacturing are expected to decrease unit costs, exerting downward pressure on prices.

- Regulatory Incentives & Policies: Governments and international agencies may incentivize reduced pricing for endemic regions, influencing market-wide averages.

- Innovation & New Formulations: Enhanced formulations targeting pediatric populations or improved stability may command higher prices initially but could decrease over time with increased adoption.

- Supply Chain Stability: Disruptions, as experienced during pandemics or geopolitical tensions, can temporarily inflate prices.

Key Market Opportunities & Risks

Opportunities

- Expansion into new endemic regions: As NTD eradication efforts expand, demand may grow in previously underrepresented markets.

- Development of fixed-dose combinations: Combining praziquantel with other antiparasitics could optimize treatment protocols and command premium pricing.

- Localized manufacturing: Facilitating affordable, high-quality local production reduces dependency on imports and can drive prices lower.

Risks

- Patent and regulatory barriers: Future patent filings may delay generic entry or sustain higher prices temporarily.

- Funding limitations: Reduced international aid or government funding could constrain procurement and market expansion.

- Emerging resistance: Potential development of drug resistance may necessitate alternative therapies, affecting demand.

Conclusion

The praziquantel market is characterized by a mature manufacturing landscape and high acceptance in endemic regions. Prices are expected to gradually decline owing to increased competition, technological advancements, and regulatory reforms. However, global health initiatives and endemic disease control efforts will sustain steady demand growth, particularly in emerging markets. Stakeholders should anticipate a dynamic pricing environment influenced by public health policies, innovation, and supply chain resilience.

Key Takeaways

- Praziquantel remains essential in global parasitic disease management, with a robust and growing market, especially in endemic regions.

- The global market is increasingly dominated by generic manufacturers, leading to competitive pricing.

- Prices in endemic regions are projected to decline further, driven by increased local manufacturing, subsidies, and procurement efficiencies.

- Future growth hinges on expanding treatment coverage, developing pediatric formulations, and overcoming supply chain challenges.

- Stakeholders should monitor regulatory developments and public health funding landscapes to adapt their strategies effectively.

FAQs

1. What factors most influence praziquantel’s market price?

Manufacturing costs, patent statuses, regulatory requirements, procurement volumes, and international subsidies primarily determine prices.

2. How does patent expiration affect praziquantel's market?

Patent expiry has facilitated entry of generic manufacturers, significantly reducing market prices and increasing global access.

3. Are there notable upcoming innovations in praziquantel formulations?

Yes, developments include pediatric dispersible tablets, fixed-dose combinations with other antiparasitics, and formulations with improved stability, which may influence future pricing dynamics.

4. Which regions are the largest markets for praziquantel?

Sub-Saharan Africa, Southeast Asia, and South America represent the largest markets due to high prevalence of parasitic infections.

5. How might global health initiatives impact praziquantel prices?

International funding and procurement programs tend to subsidize costs, maintaining low prices in endemic regions and ensuring broad accessibility.

References

[1] WHO. Schistosomiasis Fact Sheet. 2022.

[2] GBD 2019 Disease and Injury Incidence and Prevalence Collaborators. Global Burden of Disease Study. Lancet. 2020.

[3] Merck KGaA. Historian of Praziquantel Development and Market. 2018.

More… ↓