Last updated: July 29, 2025

Introduction

Prasugrel, marketed primarily under the brand name Effient, is an oral antiplatelet agent indicated for the reduction of thrombotic cardiovascular events in patients with acute coronary syndromes (ACS) undergoing percutaneous coronary intervention (PCI). As a third-generation P2Y12 receptor antagonist, prasugrel offers enhanced efficacy over traditional agents like clopidogrel, positioning it as a critical component in the antithrombotic therapeutic landscape. This report analyzes the evolving market dynamics and the financial trajectory of prasugrel, examining key drivers, competitive forces, regulatory influences, and future growth prospects.

Market Overview

The cardiac therapeutic market, particularly antiplatelet agents, continues to expand driven by the growing prevalence of cardiovascular diseases (CVD), aging populations, and advancements in interventional cardiology. The global market for antiplatelet drugs was valued at approximately USD 7.5 billion in 2022, projected to grow at a compound annual growth rate (CAGR) of 7-8% through 2030 [1].

Prasugrel's unique pharmacodynamic profile distinguishes it from competitors and influences its market penetration. Its rapid onset, consistent inhibition, and reduced variability compared to clopidogrel make it a preferred choice in high-risk ACS patients, especially in developed markets like North America and Europe.

Market Drivers

1. Rising Burden of Cardiovascular Diseases

Cardiovascular diseases remain the leading cause of mortality worldwide, with an estimated 17.9 million deaths annually [2]. The increasing incidence of ACS, including unstable angina, NSTEMI, and STEMI, sustains demand for potent antiplatelet therapies like prasugrel.

2. Advancements in PCI Procedures

The evolution of PCI techniques, backed by better stent designs and adjunctive pharmacotherapy, has increased the adoption of oral antiplatelet agents. Guidelines from the American Heart Association (AHA) and European Society of Cardiology (ESC) favor prasugrel for high-risk ACS patients, further fueling its use.

3. Preferential Use in High-Risk Populations

Studies indicate prasugrel's superior efficacy in preventing thrombotic events among diabetic and complex PCI patients, leading clinicians to preferentially prescribe it over first-generation agents.

4. Patent Status and Market Exclusivity

Although Pfizer’s patent for prasugrel expired in some jurisdictions around 2020, exclusivity periods and market protections continue in key markets, influencing pricing and market control.

Competitive Landscape

1. Key Competitors

- Clopidogrel (Plavix): Still the most prescribed agent globally due to cost-effectiveness, despite pharmacokinetic limitations.

- Ticagrelor (Brilinta): Offers reversible binding and quicker onset, gaining market share especially in Europe.

- Cangrelor: An intravenous alternative with rapid onset, used primarily periprocedurally.

2. Market Share Dynamics

In 2022, prasugrel held approximately 20-25% of the oral P2Y12 inhibitor market in North America, with increasing adoption in Europe. The competitive edge of prasugrel hinges on its superior efficacy but faces challenges from the convenience and safety profiles of ticagrelor and the low cost of generic clopidogrel.

Regulatory and Reimbursement Factors

1. Regulatory Approvals

Prasugrel received FDA approval in 2009 and EMA approval in 2009, establishing its role in emergency cardiology settings. Regulatory agencies scrutinize safety concerns such as bleeding risks, impacting prescribing patterns.

2. Reimbursement Policies

Coverage and reimbursement significantly influence market uptake. High costs relative to generic alternatives restrict prasugrel's access in cost-sensitive markets, although payers in developed regions often favor its clinical benefits.

Financial Trajectory and Forecast

1. Revenue Trends

Pfizer’s sales from Effient peaked around USD 400 million in 2018, with subsequent declines attributable to generic competition and shifting prescriber preferences [3]. Additionally, patent expirations diminished exclusivity, leading to pricing pressures.

2. Impact of Patent Expiry and Generics

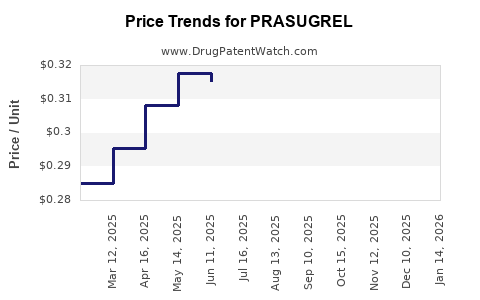

The entry of generic prasugrel formulations around 2020 anticipated to generate significant price competition. Historically, generic erosion can reduce revenues by 40-60% within the first year of market entry [4].

3. Market Expansion Opportunities

Emerging markets in Asia and Latin America possess a growing patient pool and increasing healthcare infrastructure, offering long-term growth prospects for prasugrel. Moreover, ongoing clinical trials assessing prasugrel in novel indications (e.g., stroke prevention, peripheral artery disease) could diversify revenue streams.

4. Strategic Collaborations and Licensing

Pfizer has pursued licensing agreements to expand prasugrel’s availability, especially in markets where regulatory approval is pending or has been granted, bolstering potential sales.

Future Outlook and Strategic Considerations

1. Market Penetration in Emerging Economies

Facilitating regulatory approvals and establishing local manufacturing can promote distribution in emerging markets, offsetting declines in mature markets.

2. Competitive Positioning

Innovations in dosing regimens, personalized medicine approaches, and combination therapies may enhance prasugrel’s attractiveness. Simultaneously, competitive pricing and strategic alliances with payers are vital to sustain market share.

3. Clinical Development and Label Expansion

Ongoing trials evaluating prasugrel's efficacy in stroke and peripheral vascular diseases could unlock additional indications, expanding the addressing market.

4. Cost Management Strategies

Pfizer and generic manufacturers adopting aggressive pricing and rebate strategies are critical to maintain competitiveness amidst rising generic competition.

Key Challenges

- Bleeding Risks: Elevated bleeding risks as compared to clopidogrel limit prasugrel’s utilization among certain populations.

- Generic Competition: First-mover advantage erodes as generic versions dominate many markets, pressuring margins.

- Regulatory Hurdles: Approval delays or restrictions in some countries could hinder market penetration.

- Cost Sensitivity: Health economic considerations remain pivotal, especially in emerging markets.

Conclusion

Prasugrel's market is shaped by intricate dynamics involving clinical efficacy, safety profile, regulatory landscapes, and economic factors. While its peak revenues have declined post-patent expiry, strategic growth avenues persist through emerging markets, clinical research expansion, and tailored therapy approaches. The ongoing evolution of the cardiovascular therapeutic landscape demands continuous adaptation by manufacturers and stakeholders to optimize the drug’s financial trajectory.

Key Takeaways

- The global antiplatelet market's growth offers sustained demand for prasugrel, especially in high-risk ACS populations.

- Patent expirations and generic competition exert downward pressure on revenues but open opportunities in emerging economies.

- Efficacy and safety profiles influence prescriber preferences, with prasugrel positioned for niche segments demanding potent antithrombotic agents.

- Clinical trials and label expansions could diversify the drug’s indications, bolstering future growth.

- Cost management, strategic alliances, and regulatory navigation are essential to maintain competitiveness and optimize financial outcomes.

FAQs

1. What factors currently influence prasugrel's market share?

Clinical efficacy, safety profile (bleeding risk), patent status, regulatory approvals, reimbursement policies, and the availability of generic alternatives critically influence its market share.

2. How does prasugrel compare economically to its competitors?

While initially priced higher than generic clopidogrel, prasugrel’s cost-effectiveness is driven by its superior clinical outcomes in certain populations, justifying higher costs in specific settings; however, generic competition substantially reduces prices.

3. What are the main barriers to prasugrel’s adoption?

Risks of bleeding, high costs in some regions, regulatory restrictions, and competition from more convenient or economical agents like ticagrelor and generics limit adoption.

4. What future clinical developments could impact prasugrel’s market?

Trials exploring prasugrel in stroke prevention and peripheral artery disease could expand its indications, increasing revenues and market presence.

5. How can pharmaceutical companies maximize prasugrel’s market potential?

Through strategic regional expansion, clinical research, label expansion, cost-effective pricing, and partnerships with healthcare systems and payers.

References

[1] Global Market Insights. (2022). Antiplatelet Drugs Market Size and Trends.

[2] World Health Organization. (2022). Cardiovascular Diseases Fact Sheet.

[3] Pfizer Inc. (2018). Annual Report.

[4] IMS Health. (2020). Impact of Generic Entry on Pharmaceutical Revenues.