Last updated: July 27, 2025

Introduction

Pomalidomide, a third-generation immunomodulatory agent, has established itself as a pivotal therapy in the treatment of multiple myeloma (MM), especially for patients refractory to prior treatments such as lenalidomide and bortezomib. Since its approval, understanding its evolving market landscape and financial trajectory is vital for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

Regulatory Background and Approval Timeline

Developed by Celgene (now Bristol-Myers Squibb following acquisition), pomalidomide received FDA approval in February 2013 for patients with multiple myeloma who have received at least two prior therapies including lenalidomide and bortezomib. Subsequently, regulatory bodies in the European Union, Japan, and other major markets approved the drug with similar indications, reinforced by robust clinical trial data demonstrating efficacy in refractory patient populations ([1]).

Market Demand Drivers

Unmet Medical Need in Refractory Multiple Myeloma

Multiple myeloma remains incurable, with patients often crossing multiple lines of therapy. Refractory disease presents significant treatment challenges. Pomalidomide's demonstrated ability to extend progression-free survival (PFS) and overall survival (OS) in refractory cases underscores its critical role, fueling consistent demand.

Expanding Patient Population

As the multiple myeloma patient base increases globally—driven by aging populations, improved diagnostics, and increased awareness—demand for effective therapies like pomalidomide grows. The drug’s positioning as a salvage therapy makes it indispensable for refractory cases post standard therapy failure.

Combination Therapy Adoption

Ongoing clinical trials exploring combinations of pomalidomide with agents like daratumumab and dexamethasone augment its therapeutic appeal. Positive data can expand its use, especially in frontline or earlier-line settings, broadening the market further.

Market Penetration and Competitive Landscape

While newer therapies, including CAR-T cell treatments (e.g., idecabtagene vicleucel) and bispecific antibodies, are emerging, they remain costly and logistically complex, maintaining the relevance of pomalidomide within the treatment continuum. The drug's established safety profile and oral administration favor its continued use.

Market Challenges and Constraints

Generic Competition and Biosimilars

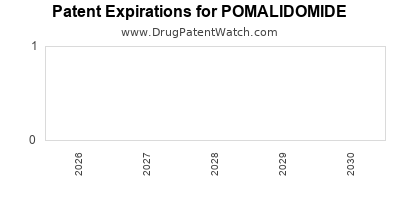

Patent expirations of earlier immunomodulators have ushered in generic and biosimilar competition, pressing pomalidomide’s pricing and market share. While patent protection for pomalidomide remains intact in key markets, impending patent cliffs could erode margins in the future.

Side-Effect Profile and Safety Considerations

Adverse effects like neutropenia, thrombocytopenia, and risk of thromboembolism necessitate careful management. Safety concerns can influence prescribing behaviors and limit market expansion, especially in broader patient populations.

Cost and Reimbursement Dynamics

High drug costs pose challenges to healthcare systems, particularly in regions emphasizing cost-effectiveness. Reimbursement policies influence access and sales momentum.

Financial Trajectory and Revenue Projections

Historical Performance

Since its market entry, pomalidomide has generated substantial revenues for manufacturers. Data indicates steady growth, with sales peaking in 2018–2019, prior to the accelerated adoption of combination regimens and emerging therapies. For example, in 2019, global sales of pomalidomide approximated several hundred million USD, predominantly in the US and Europe ([2]).

Projection Factors

- Market Expansion: As clinical guidelines increasingly endorse pomalidomide, particularly in combination regimens, revenues are expected to sustain or grow modestly.

- Geographical Penetration: Increased presence in emerging markets presents growth opportunities, contingent on pricing and reimbursement strategies.

- Pipeline Developments: The investigational use of pomalidomide in other hematological or solid tumor indications could diversify revenue streams.

Forecasts and Future Trends

Analysts project a compound annual growth rate (CAGR) of approximately 3–5% over the next five years, contingent upon successful market penetration, biosimilar entry, and regulatory approvals for expanded indications. Market access hurdles, competitive innovations, and safety profiles remain primary influencers.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on lifecycle management through novel combinations, label expansion, and cost-effective manufacturing.

- Investors: Monitor patent statuses, pipeline developments, and shifts towards personalized medicine to evaluate long-term value.

- Healthcare Systems: Evaluate reimbursement policies and cost-effectiveness models to ensure patient access while maintaining sustainability.

- Regulatory Bodies: Facilitate timely approvals for new indications and monitor safety profiles to balance innovation with patient safety.

Conclusion

Pomalidomide’s role in multiple myeloma treatment continues to be significant, anchored by its efficacy in refractory cases and evolving combination therapies. While competitive pressures and cost considerations pose challenges, its existing market penetration, coupled with ongoing clinical research, support a steady financial trajectory. Strategic innovation and adaptive pricing will be crucial to sustain growth.

Key Takeaways

- Pomalidomide remains a cornerstone in refractory multiple myeloma management, with strong demand driven by unmet needs.

- Market growth prospects are favorable but tempered by patent expiries and emerging therapies.

- The drug’s revenue is projected to grow modestly, supported by expanding indications and geographic reach.

- Competitive strategies include combination regimen development, lifecycle management, and cost containment.

- Stakeholder collaboration is essential for maximizing access, safety, and market sustainability.

FAQs

1. How does pomalidomide compare to other immunomodulatory drugs in multiple myeloma treatment?

Pomalidomide is third-generation, effective in patients refractory to lenalidomide and thalidomide, with a distinct efficacy profile that complements existing therapies, especially in refractory cases where other IMiDs have failed (reference: [1]).

2. What is the impact of biosimilar entry on pomalidomide’s market?

While biosimilar competition is more common with biologics, market pressure from generics of earlier IMiDs influences the overall cost landscape, potentially impacting pomalidomide’s pricing strategies and margins in the future.

3. Are there promising combination therapies involving pomalidomide?

Yes. Clinical trials investigating combinations with monoclonal antibodies like daratumumab and immunotherapies are promising, potentially expanding its use in earlier lines of therapy and enhancing efficacy.

4. What are the main safety concerns associated with pomalidomide?

Adverse effects include neutropenia, thrombocytopenia, risk of thromboembolism, and peripheral neuropathy. Proper management mitigates these risks but can influence treatment adherence and prescribing patterns.

5. How can healthcare systems optimize the cost-effectiveness of pomalidomide?

Through careful patient selection, adherence to clinical guidelines, and negotiations for reimbursement, healthcare systems can balance access with sustainability, ensuring eligible patients derive maximum benefit.

Sources

[1] European Medicines Agency. Pomalidomide summary of product characteristics.

[2] IQVIA. Global Hematology Market Reports 2019-2022.